Updated July 18, 2018 for new tax form.

Now that the provision allowing qualified charitable distributions up to $100,000 per year from an IRA is permanent, donors, gift planners and other advisors need to ensure everyone involved in an IRA gift understands the tax reporting requirements that apply to gifts of this nature. Can you imagine how unhappy a donor might be to learn, after an IRA gift is completed, that her charitable gift ended up being fully taxable? Even worse, what if her gift resulted in other adverse effects on her tax situation?

Know the IRS rules

In order to receive favorable treatment under the Charitable IRA (CIRA) provision, the taxpayer must follow the IRS rules. According to the IRS, the donor:

- Must be 70½ or older at the time of the gift.

- Must have a traditional or other eligible IRA account.

- Must have the funds transferred directly from the IRA to a qualified charitable entity.

- Must not receive any benefits of value in return for the gift.

- Must not exceed a total of $100,000 in qualified charitable distributions to all charities combined in a single tax year.

- Must properly report an IRA distribution to charity on his or her tax return.

It is this last item that could represent a pitfall for your Charitable IRA donors. Even if they meet all of the other requirements, the donors will lose anticipated benefits if the gift is not reported properly for tax purposes.

How to report IRA gifts

Each year, the IRA plan administrator or trustee should provide the IRA account holder with a 1099-R form outlining the total distributions. It is important to note that the 1099-R will NOT indicate the amount that was NOT taxable.

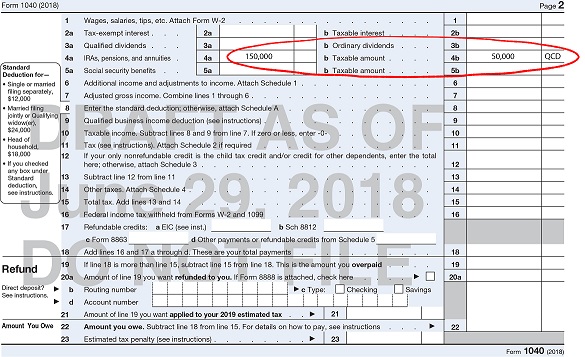

As a next step, the taxpayer should report the entire IRA distribution on line 4a of IRS Form 1040. Then, it is essential that the taxpayer or tax preparer use line 4b to reflect the qualified charitable distribution. Line 15a reports the gross distribution, and line 4b reports the taxable distribution. If all of the IRA distributions were directed to eligible charities, $0 would be entered as the taxable amount on line 4b. In addition, the taxpayer should write “QCD” next to line 4b to indicate the amount is a qualified charitable distribution.

If the distributions were partially taxable and partially tax-free, lines 4a and 4b would need to clarify that. For example, if a donor’s required minimum distribution (RMD) was $150,000 and he directed $100,000 of that amount as a gift to charity, the full $150,000 would be shown on his 1099-R and reported on line 4a of the 1040. Line 4b would be used to record that the $50,000 of the distribution that was not given to charity is taxable, and “QCD” would be noted next to that line.

The nonprofit’s role

Even though it is the taxpayer’s responsibility to report these transfers, charitable recipients may wish to make sure they remind donors to make certain their advisors are aware of the distribution and report the nontaxable portion properly under IRS rules. Such reminders may be done in various gift acknowledgments and via other donor communication channels.

You might want to consider sending Charitable IRA information to all IRA donors and perhaps also other affluent older donors during the first quarter of the calendar year. This information could serve both as a reminder of this gift option before they have used their $100,000 IRA gift amount for the year and as information to share with tax preparers to make certain their gifts for 2018 are reported correctly on their 2018 return. Such action could keep some donors from being taxed on the IRA funds they distributed under the assumption that these funds would not be included as part of their taxable income.

Sharpe Group offers a number of resources and communications tools to help you educate your donors about the benefits of making a gift from an IRA, including a strategic marketing guide, a Charitable IRA brochure and royalty-free downloadable postcard art. Visit www.SHARPEnet.com/give-take/ira for more information. ■