In recent months, we have observed a disturbing trend with the potential to negatively impact the overall fund-raising results of organizations seeking to encourage bequests and other planned gifts. One commentator after another has pronounced that “age doesn’t matter” when it comes to encouraging bequests and certain other types of planned gifts.

The message typically goes like this: “There is no pattern to who leaves bequests. The size of past gifts doesn’t matter, age doesn’t matter and, in fact, many bequests come from those who have never even made a current gift.” Perhaps, then, we should send e-mail or even “snail mail” to everyone in America encouraging them to leave a bequest to our organizations. In fact, one supplier of planned gift marketing materials once joked that their brochures should be “air-dropped over major population centers.”

Since you probably cannot market indiscriminately to everyone in America, most programs are generally confined to a donor base or other natural constituency. Depending on your mission, you may periodically receive bequests from non-donors, but there is little you can do to encourage those bequests other than continuing to be the solid organization you are.

In some cases, those with a relatively small constituency may be correctly advised to market bequests to all of their donors because “you can never tell who will leave a bequest.” For a smaller program with a one- or two-person staff and little division of labor, this approach can be relatively cost effective and create few, if any, problems.

The story is much different for larger, more sophisticated programs with multiple staff members charged with raising funds through direct mail, membership, annual fund, “major” and “capital” gifts, as well as encouraging gifts through wills and other planned gifts. In this case, plans to market bequests to all donors may understandably meet some resistance.

Who should we target?

Let’s talk about age. If nothing else, even those new to planned giving intuitively understand that bequests do not normally come from young people.

Marketing bequests to all donors over a certain age, say 55, might help solve the problem of overlapping with the efforts of those in your organization working with younger donors. But what if the majority of donors are over the age of 55, which is often the norm for many 0rganizations involved in healthcare, social services, the arts, and similar missions? In that case, such an approach can be tantamount to marketing bequests to all donors. Predictable conflicts can then arise as “territorial boundaries” are inevitably crossed.

In other instances, there may be relatively few donors over 55, but they may tend to be the “better” donors. Where major gift efforts or capital campaigns are relying heavily on the 55-70 age range, issues of priority for contact are especially common. For these and other reasons, age alone may not be the only factor to consider.

How can gift history guide us?

So should also we target efforts based on size of current gifts? It may be surprising, but there is generally little or no correlation between the size of lifetime gifts and/or the amount of cumulative giving and the likelihood of leaving a bequest. In fact, in some cases, larger lifetime gifts can actually be contra-indicators of who may leave a bequest as some, especially the wealthy, may be able to completely satisfy their donative intent during lifetime.

The number of gifts and frequency of giving combined with age factors can be better indicators of whether a person is likely to leave a bequest. Once a person meets requisite age requirements, the longer that person has given and the more times they have made a gift of any size, the more likely they are to leave a bequest.

In the case of premium-based fund-raising programs, however, a long giving history can yield “false positives” as persons without sufficient donative intent to make a bequest may have “bought” labels or cards on numerous occasions but have little awareness of, or commitment to, your organization. That same person may also still be in their 50s, with a 30-year or longer life expectancy.

In still other cases it can be a mistake to assume that a long gift history will necessarily precede a bequest. The mission of some organizations attracts donors very late in life when only one or two gifts may precede including that organization in their final will and passing away relatively shortly thereafter.

Is 80 the new 70?

Internal Revenue Service reports and other data indicate a definite pattern underlying the timing of both the decision to include charities as part of a donor’s estate plan and the realization of a bequest. (See “Studying Charitable Estates” on page 1 of the March 2008 Give & Take.) According to the IRS, most donors who leave bequests from taxable estates pass away in their 80s, with more dying in their 90s than their 70s.

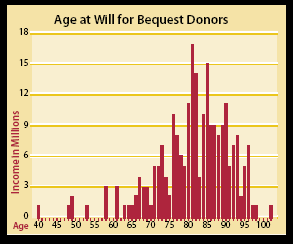

Many recent studies indicate that bequest donors are not only living longer, they are also making their final wills at an older age. Some programs are, in fact, beginning to find that 80 may be the new 70! See the chart below for one leading program that received more than $50 million in bequests in a recent year.

Note that 64% of bequests came from donors who made their final wills after the age of 80. Some 61% of the total bequest dollars—over $30 million—came from that group. In only 10% of cases was the final will executed before the age of 70. For many years this organization had been marketing bequests to donors as young as 60 and was thus very surprised to learn how old their donors were when they actually made the decision that was “operative.” While it can be important to address younger donors, this organization has over 30 million reasons a year to pay attention to the age of its donors when focusing their limited resources on bequest development efforts.

The best way to market bequests for many organizations comes down to a “calculus.” The elements of the equation include size of budget, the importance of avoiding conflict with other funding programs, the age of the donor base, the nature of the mission of the organization, and various other factors.

FLAGging your file

For those who want a reliable and relatively simple way to determine a reasonable target market for bequests for their organization or institution, the acronym FLAG™ may be useful. Created by Sharpe in the 1980s, this approach looks for [F]requency, [L]ongevity, [A]ge, and [G]ender. Where age is known, many programs choose 70 as a minimum age. Some may dip as low as 65. Keep in mind, though, that a 65-year-old woman has just under a 20-year life expectancy, and that very few donors make final bequest decisions younger than age 75. Some have found they don’t even acquire most of the donors who finally leave bequests until they are beyond the age of 70. If budget doesn’t allow targeting all donors beyond a certain age, then introducing frequency and longevity factors can help reduce the file further. You may want to target those who have given two or more times over a period of a few years or longer. Remember, few donors will give for the first time in November and then decide to include a bequest the following February!

Where gender is concerned, remember that for many organizations, 70% or more of bequests will come from women who are typically the second to die of a couple. When targeting men, you may want to lower whatever age is used for females by at least five years to account for shorter life expectancies.

Less may be more

Some may say this is all well and good, but they don’t need to target in this manner because they have enough budget to market bequests to all of their donors over 55 who have given more than once. That is not necessarily wrong, and those who supply publications and other marketing tools aimed at younger persons will certainly be more than willing to accommodate (or even recommend) such a plan. Before pursuing this approach, however, be sure to consider the impact on other funding programs. Remember that others on staff are normally encouraging current gifts from donors in their 50s and 60s who may have been recently acquired and may be decades away from making their final bequest decisions.

In addition, if we overexpose donors in their 50s and 60s, we may find that they are “numbed” to the message by the time they are finally of the age to consider and act on charitable estate planning concerns.

One size does not fit all, but suffice it to say that bequest marketing is not “ageless.” In times of tighter budgets and increased competition for our donors’ attention, we should make sure that we give careful thought to how, when, and to whom the bequest message is communicated.