Over the years, we have observed a wide range of approaches to the use of planned giving techniques in capital campaigns.

In some cases, for example, campaigns are conducted with well-defined goals for outright contributions over a specified period of time. In these instances, campaign guidelines have traditionally credited only outright gifts or near-term pledges received during the period of the campaign. On the other end of the spectrum, campaign totals sometimes include not only all outright contributions and pledges to the institution during the campaign, but also include all deferred gifts completed, bequests received from estates, and future bequest commitments made during the campaign.

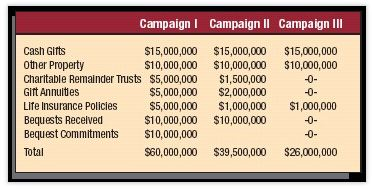

Note the chart at right that depicts the outcome of three campaigns with very different policies regarding the role of planned giving.

Broad crediting policies were adopted in Campaign I, with trusts and other deferred gifts counted toward the campaign goal at full value along with bequests received during the campaign and commitments for future bequests.

With somewhat more conservative policies in Campaign II, deferred gifts were counted at present value and estate distributions were counted at full value. No recognition was given for future bequest commitments.

Campaign III was the most traditional in its approach, with no credit for planned gifts with the exception of the cash surrender value of life insurance policies as of the end of the campaign, as those funds were vested and available to the institution at that time.

Which campaign raised the most money? From a long-term perspective, most would agree that Campaign I raised the most money. As far as spendable funds available during the campaign, however, there is really no difference in the three campaigns. All three received outright gifts of $25 million. All three received $10 million in bequest distributions. Two of the campaigns chose to count deferred gifts and bequest receipts, while the other did not credit deferred gifts and decided the bequest receipts had been influenced in previous years as a result of other fund developments, had already been recognized as part of donor stewardship efforts, and were thus not “new” funds raised as a result of the campaign. Campaign II decided to include realized be-quests from earlier efforts, but decided not to count new bequest expectancies discovered during the campaign, as it was decided they were too uncertain to be credited to the campaign. The opposite approach would be to count new bequest commitments received during a campaign as new gifts, but not to count the bequest receipts that had already been credited to previous efforts, as it might be considered “double counting” to count them again when received. All three campaigns were entitled to $1 million in cash value in life insurance policies, but Campaign I chose to instead count the face value of the policies in order to reflect the full extent of the donor’s commitment.

What is the lesson to be learned from these variations? First, this is one of the most complicated areas of nonprofit fund development. There are any number of ways to count bequests and other planned gifts in a capital campaign and most would agree there is really no “right” or “wrong” way to do it. The Council for Advancement and Support of Education (CASE), the Association of Fundraising Professionals (AFP), the Internal Revenue Service (IRS), the Financial Accounting Standards Board (FASB), and other groups provide various guidelines and methodologies designed to provide answers to how planned gifts should be counted in campaigns. Because they all address the subject from different perspectives, however, there are considerable differences in their approaches.

First things first

It is important to realize at the outset the significant differences crediting policies can make in the amount reported in a campaign, and for that reason it is a good idea to determine gift crediting policies BEFORE setting the goal of a campaign. In today’s environment, before taking the “anything they can do we can do better” approach to setting campaign goals, it may be wise to explore what “they” counted to make their goal!

In our experience, competent campaign counsel are aware of the pros and cons of counting planned gifts toward goals and will consider this issue in depth when conducting a feasibility study and recommending goals. On the other hand, as we see more institutions attempting to conduct campaigns without the benefit of specialized counsel, the role of planned giving is an area that may not receive adequate attention until circumstances demand it, too often in the advanced stages of a campaign.

Why bother?

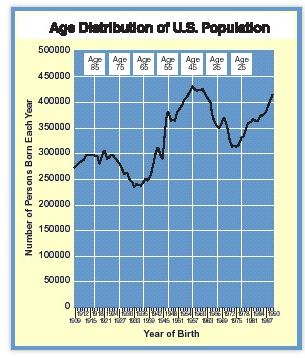

We sometimes hear development executives and volunteer leadership who are about to begin a capital fund development effort make statements like, “We don’t need planned gift crediting policies because we would never count something like a bequest commitment toward a campaign goal.” While many might agree with this statement at first, consider how you would respond to an 85-year-old former board chair when he hands you a binding testamentary pledge agreement prepared by his attorney along with a copy of a recently revised will that names your institution to receive $5 million, and it is clear that he expects this to be recognized as his gift to your campaign. Recall that over 70 million Americans will pass the age of 65 during the next 20 years, some 25% of the U.S. population. (See chart at right).

Because of this demographic reality, the issue of crediting planned gifts in campaigns, especially those from older individuals, is not going away. It is only going to take on greater and greater importance.

The importance of terminology

The process of determining how planned gifts will be incorporated into a capital campaign can be simplified somewhat if one begins with definitions of terms. It is helpful at the outset to consider the meaning of the term “capital campaign.” In the past, this term was used to describe periodic campaigns designed to raise outright gifts designated for buildings, equipment, and other capital needs. Annual giving and planned giving efforts were, of necessity, conducted simultaneously in order to meet other ongoing needs. The term “planned giving” can mean many things, but most would agree it is essentially a set of methodologies that can result in funds for current, capital, or endowment purposes.

In recent years, the term capital campaign has, in some cases, taken on a different meaning than in the past. “Comprehensive campaigns” have emerged that count dollars received from a variety of sources during a campaign in an effort to help counter unwanted “diversion” of gifts from current and future funding programs to capital needs. Once that concept is embraced, the “capital campaign” can quickly become an effort to enhance all funding efforts. In that case, it would then seem to make sense to set goals for the annual giving, planned giving, and capital giving components of the comprehensive campaign.

The issue of “crediting gifts” then becomes somewhat easier to deal with, as it is no longer necessary to try to “convert” a deferred gift to its “capital gift” equivalent value. That conversion is at the root of efforts to determine the “present value” of a gift to be received in the future, so there can be equivalence with current gift commitments to the campaign.

After it is decided there will be a goal determined for each funding unit that feeds into the totals of the comprehensive campaign, it becomes clear that the “campaign” in reality represents a general ramping up of overall development efforts for a period of time. The essence of the campaign then becomes an effort to encourage an environment that is conducive to better case development, while providing a sense of camaraderie and urgency that may be lacking during non-campaign periods. The end result is more gifts of all types and sizes and the achievement of a total fund-raising goal for a particular year.

If one thinks about it, once a program is “ramped up” and capable of generating more funds from annual commitments, capital fund transfers, and planned gifts each year, why would such a campaign ever end? The only component that might logically end would be the continual push for large outright commitments restricted to specific capital purposes. At that point, then, we would have come full circle back to the traditional definition of a “capital campaign” as a period of emphasis on capital fund commitments in the context of a professionally managed, productive, development effort. Some institutions have, in fact, decided to never end their “comprehensive campaign” efforts. They instead continue those efforts in the form of a well-managed development program. Shifts in emphasis and institutional funding priorities are then reflected in periodic capital fundraising efforts, thereby preserving the benefits of the energy generated from greater focus and compression of effort during a campaign of relatively limited duration, without burning out staff, volunteers, and donors with perpetual campaigns.

Where does planned giving fit?

If it is decided to include a goal for planned gifts as part of an overall campaign, regardless of its scope, here are some ideas to consider:

1. Focus on irrevocable gifts that provide useable resources in the shortest period of time. For gifts that last for the life of one or more persons, that might indicate an emphasis on gifts completed by the oldest persons among the constituency. The combined life expectancy of a 65-year-old couple is 25 years, so gifts for the lifetime of one or more donors will have little present value where younger persons are concerned.

2. For younger persons, focus on gifts that provide funds in the near term such as charitable lead trusts or charitable remainder trusts for a term of years. Special attention should also be given to younger persons who have accumulated large amounts of capital held in ways that require special planning to result in a viable campaign commitment.

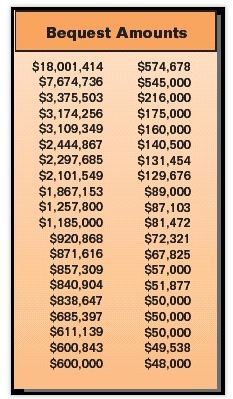

3. It may not be wise to encourage bequests of particular amounts as gifts to a campaign. See the chart at right that represents 60 recent bequests totaling over $80 million received by a client with a very effective planned gift development effort.

Note that few of the bequests appear to be of specific amounts. Only two bequests over $500,000 were for even amounts. The remainder were residuary bequests. Encouraging specific sums may simply serve to cause a donor to guess at an amount, and for a number of understandable reasons many donors will arrive at a smaller amount. It is not surprising, therefore, that bequests of specific amounts received each year nationwide are usually for amounts less than $50,000.

4. At some point in the campaign, consider sweeping the entire constituency looking for those who have already, or indicate they would consider, leaving a bequest or other planned gift as part of their long-range planning. These persons must have significant donative intent in order to come to this decision, or even seriously consider it. The fact they have already made a bequest commitment, or are considering doing so, says volumes about donative intent. Carefully working with these persons may help discover viable prospective bequest donors, along with younger persons who are not necessarily prospects for bequests during the next few decades, but who may be giving at lower levels than they might be able to achieve and thus be prospects for significant outright gifts to a campaign. The latter group could also be a significant source of committed and effective volunteers.

5. When pursuing the strategy outlined in the previous paragraph, as well as other planned gift communications efforts during a capital campaign, it may be advisable to carefully target communications concerning deferred gifts, and intentionally omit persons who are scheduled to be solicited for major outright gifts. This is especially true during the early stages of a campaign. If information is available on Web sites, for example, be sensitive to ways to discourage younger persons from using interactive features to structure gifts of large amounts that may qualify for significant tax and other financial benefits while yielding no funds for charitable use for what may be many years.

6. When working with elderly donors making large outright commitments to a campaign, it may be advisable to encourage a bequest or other estate gift to back up the pledge in the event the donor should die before completing their gift. Where younger donors are concerned, some institutions will purchase term life insurance to insure the pledge.

7. Charitable trusts, bequests, and other planned gifts are rarely concluded solely as a result of the efforts of volunteers and advisors. Because bequests and similar expectancies may be legally and/or practically revocable, dedicated staff resources on an ongoing basis during and following the campaign are required to maintain the gift commitment.

Planning is key

As we can see, there are many ways to effectively and productively include planned gifts in a capital campaign. The most important thing is to decide as part of the earliest planning stages whether the campaign is truly an effort in the spirit of a “barn raising” that is designed to quickly solicit funding for specific capital needs, or a more generalized ramping up of all development efforts for a period of time. Planned giving tools can serve both campaign types very well.

With planned gifts often accounting for 20% to 50% of major campaigns totaling upwards of a billion dollars or more, it is critical that this component be carefully considered and coordinated with other dimensions of the campaign. Careful attention by leadership to ways planned giving can be integrated in campaigns can help maximize results by providing valuable alternatives for those who say “yes, but” when asked for a gift.

Objections to making larger gifts from persons who enjoy significant assets can arise from natural financial considerations that compete with a heartfelt desire to give. Planned gift vehicles have been created over the centuries to help people resolve these conflicts, and will continue to be the key to helping some people make meaningful gift commitments during a campaign. Learning how to match the proper gift methodology with the right property in ways that fulfill the program interest of a particular donor will thus play an increasingly important role in fund development efforts in the future, as in the past.

In today’s world of rapid social, demo-graphic, economic, cultural, and political change, the ability to successfully incorporate planned giving in development efforts before, during, and after a period of capital fund emphasis will be one of the keys to unleashing the levels of giving that will be necessary to fund the activities that are beyond the scope of government and business that are vital to the continued success of the American experiment.

The preceding article is based on Session VII of the Sharpe seminar “Major Gift Planning I.” www.sharpenet.com/seminars for upcoming dates and locations.