The fall months have always been the time when a large percentage of gift income is received. This is true for a number of reasons:

1. The final months of the year are traditionally the “season of giving” when many peoples’ thoughts turn to sharing with others.

2. Many individuals receive work-related bonuses at the end of the year and they wait to see how much they will have to give to others.

3. Those who own their own businesses often do not know how they fared for the year until the final months.

4. Investors often “balance” their portfolios toward the end of the year and find that charitable gifts can be used to offset taxes due on gains they may have realized earlier in the year.

5. The deadline for making tax deductible gifts is December 31, another reason many choose to make gifts later in the year.

Year-end 2000 is shaping up to be one of best ever for giving to America’s charitable community as economic and other conditions are favorable in terms of all of the factors listed above.

Mood of the country

In this election year there has been a tremendous amount of discussion about unprecedented prosperity in America. History reveals that while the philanthropic spirit in America is quite resilient, Americans give more in times of broad-based prosperity.

Workers earning more

Reports indicate that once again the real wages of Americans will rise more than inflation. After long periods of declines in real wages, many donors are finding that their discretionary income is steadily rising. Americans give about 2% of discretionary income to charity so this is good news for charitable giving.

Market fluctuations

This year has seen a great deal of fluctuation in investment markets. As we go to press, the markets are once again hovering at or near the record levels they reached in January. In the spring, however, during a period of downturn, many individual investors sold stocks before profits eroded further and in so doing generated significant amounts of capital gain. This was also true of mutual fund managers, leaving many investors with capital gains to report due to sales inside funds, even though they did not receive the cash proceeds. Many donors will find, therefore, that gifts of other appreciated securities before the end of the year may be the best way to offset capital gains that would otherwise give rise to tax liability next April.

In other cases, donors are sitting on the sidelines with large amounts of cash and may decide to use those funds to make gifts before the end of the year.

For these and other reasons, market conditions may make charitable gifts especially attractive to many donors this fall.

Tax climate is favorable

In an election year there is typically much talk of tax change—and this year has been no exception. Both major candidates are promising tax cuts as part of the benefits of projected budget surpluses in coming years.

As the savings from charitable and other tax deductions are greater when taxes are higher, lower taxes in the future may result in slightly less savings as a result of making charitable gifts. If properly informed, many donors may decide to complete gifts this year in order to take advantage of tax rates that are now higher than they may be in future years.

There has also been discussion of reducing and/or eliminating the federal gift and estate tax in coming years. While there has been much speculation on the impact of estate tax reductions on charitable giving, consider the following:

1. The vast majority of bequests, gift annuities, and many other types of planned gifts are made by persons who are not subject to estate taxes. Of approximately 2.5 million persons who died in 1997, only 90,000, or just under 4%, died with taxable estates. Of that group, only 16%, or 15,000, made use of the charitable deduction. These persons gave large amounts to charity, but indications are that approximately 185,000 other persons left charitable bequests with no estate tax benefits.

2. The minimum cost of a charitable gift via estates to a family is now 45% per dollar left to charity. In simple terms, if a person leaves $10 million to charity, it now costs their heirs the approximately $4.5 million they would have had if the charitable bequest had not been made and the $5.5 million in taxes had been paid. For persons who are not now subject to estate taxes, the cost of making a charitable bequest is 100% per dollar bequeathed, as their heirs would have received their entire estate had charitable interests not been included. It is clear, therefore, that many people now make charitable bequests when the cost is 100% of the amount donated to charity and there is no reason to believe that wealthy people who give generously during their lifetime will decide to give less through their estates when it will cost their heirs even less than under today’s system.

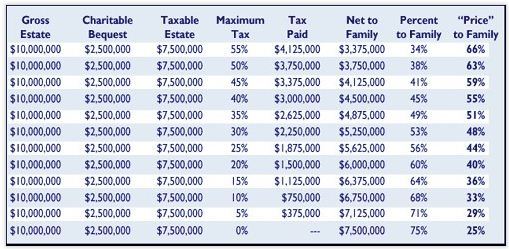

Example: Mr. Donor has amassed an estate of $10 million. His estate will pay taxes at the rate of 55% of amounts over $3 million. As part of a capital gift development effort, he made a commitment of $2.5 million via his estate and a gift in this amount was announced. Mr. Donor has two children, and he decided he wanted them to share the balance of his estate amounting to approximately $1.7 million each under current law. If the estate tax were repealed tomorrow, the children’s share would increase to $3.75 million each, or more than twice the inheritance that was originally anticipated when Mr. Donor planned his bequest.

Note the approximate “cost” of this gift to his family net of the combination of estate taxes and the gift assuming various estate tax rates.

Upon learning of the proposed repeal of estate taxes and the impact of that on his children’s inheritance, he decided that he would rewrite his will in such a way that the bequest would remain in his will following estate tax repeal and actually be increased somewhat if estate taxes are reduced, as he would then be able to “afford” to leave more while his children would actually receive more…a classic “win-win” situation.

3. If there are major changes in estate taxes there will be tremendous opportunities to emphasize the importance of charitable giving via estates. Untold numbers of donors will review and possibly revise their estate plans on the heels of estate tax changes. The older and wealthier they are, the more quickly they can be expected to make these changes. It will be imperative, therefore, that the charitable community get its message out as quickly as possible following any such changes.

4. Repeal of estate taxes may lead to increased gifts during lifetime, both outright and in the form of trusts, annuities, life estates, and other “split interest” gifts. If there is no tax advantage to making gifts at death, then many donors will decide to make the gifts while they are alive and can realize income tax savings. For those who are contemplating bequests, they may decide to fund gift annuities, charitable trusts, and other gifts that allow them to unlock income from appreciated assets while also enjoying income and capital gains tax savings. Repeal of the estate tax would also bring repeal of the gift tax, removing an obstacle that currently blocks the completion of many charitable trusts, gift annuities, and other plans that would otherwise be created to provide income for loved ones other than a spouse before making an ultimate distribution for charitable purposes.

Act now for maximum advantage

These are exciting times for fundraisers. As always, those who assess their environment and adapt accordingly will not only survive, they will prosper. There are wonderful opportunities for those organizations and institutions that serve needs in our society not met by the business and government sector. Meeting those needs through voluntary transfers of wealth has always set America apart from much of the rest of the world. There are more funds available to be raised than ever before. Show your donors the best ways to give those funds and make 2000 your best year ever!