When considering one’s expectations for the future, the age old question, “is the glass half empty or half full?”, comes to mind. This is especially true when considering the future of income to nonprofits from bequests and other planned gifts. If expectations and goals are too low, the cup may seem to “run over.” If expectations are too high, on the other hand, planned gift revenues may be seen as the proverbial “drop in the bucket.”

In this vein, a recent article in The Chronicle of Philanthropy reporting on the much-heralded transfer of wealth in America is likely to spark heated debates and have an impact on the question of planned gift projections now and in coming years. The April 6, 2006 article, entitled “Much-Anticipated Transfer of Wealth Has Yet to Materialize, Nonprofit Experts Say,” (see www.sharpenet.com/resources) revisits the wealth transfer projections made by John J. Havens and Paul G. Schervish in their 1999 report “Millionaires and the New Millennium: New Estimates of the Forthcoming Wealth Transfer and the Prospects for a Golden Age of Philanthropy.”

In their report, Boston College professors Havens and Schervish predicted a wealth transfer totaling at least $41 trillion, including a minimum of $6 trillion in bequests to charity during a period beginning in 1998 and ending in 2053. The report is available at http://www.bc.edu/research/swri/features/wealth/. The researchers divided the 55-year estimate into two segments, the first being the 20-year period beginning in 1998 and ending in 2017. For the initial years of the wealth transfer, they predicted that charitable beneficiaries would receive at least $1.7 trillion in bequests. As noted in The Chronicle article, however, a close examination of the progress made to date towards the initial 20-year goal reveals what may be a classic “Good News, Bad News” story.

Bad news

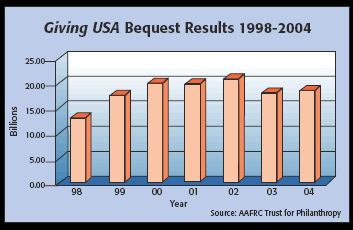

At first blush, the wealth transfer to charity appears to be getting off to a very slow start. Based on annual reports published in Giving USA, nonprofits received a total of $127.6 billion in bequest income from 1998 through 2004, the last year for which data is available. That total represents just 7.5% of the $1.7 trillion minimum Havens and Schervish projected for charitable bequests through 2017. This means that almost $1.6 trillion in charitable bequest income will be needed over the next 13 years just to meet the minimum 20-year bequest estimate.

In the wake of lackluster growth in investment assets, lower death rates than expected, and other factors, bequest revenue received by America’s charities has been flat in recent years:

At this point, it appears highly unlikely that nonprofits will realize anywhere near the amount of bequests that were projected to be received between 1998 and 2017. In order to reach the $1.7 trillion goal, charitable bequests would have to average over $120 billion per year for the next 13 years. The annual average would thus have to be some six times the amount received in 2002, which, at $20.1 billion, was the record year so far for charitable bequests.

Good news

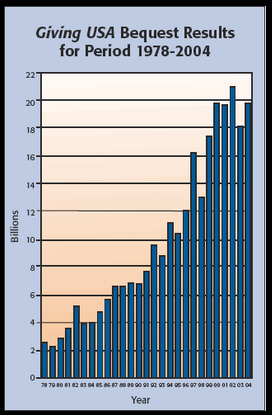

Is there any good news regarding the transfer of wealth to charity? Looking at longer-term trends, there is indeed good news. There has, in fact, been a tremendous growth in bequest receipts by nonprofits in recent years:

While there has been a lack of growth in bequests over the past two years, note that bequest receipts more than doubled between 1985 and 1995, and nearly doubled again between 1995 and 2004. Bequest income has been among the fastest growing sources of charitable support over the past 20 years.

Given that bequest income has been trending steadily upward over time, the key to successfully projecting bequest revenue may be to adjust expectations to a more reasonable level going forward. In order to reach the minimum wealth transfer numbers between now and 2017, an annual growth rate of 26% with a doubling of bequests every 2.8 years would be required. This is simply not going to happen. However, a continuation of growth rates over the past 20 years would result in more than doubling bequests to over $40 billion a year by 2017, not a bad showing given environmental factors underlying these trends.

Unraveling the mystery

Recall that the wealth transfer projections were for the 55-year period of time spanning the years 1998 through 2053. The authors of the Boston College wealth transfer projections maintain that, despite the aftermath of 9/11 and economic uncertainty in recent years, the wealth transfer is on track. A follow-up study was published in January 2003. The press release accompanying that report stated, “Following a thorough review of our 1999 report ‘Millionaires and the Millennium: New Estimates of the Forthcoming Wealth Transfer and the Prospects for a Golden Age of Philanthropy,’ we conclude in our new report ‘Why the $41 Trillion Wealth Transfer Estimate is Still Valid: A Review of Challenges and Questions,’ that its projections have not been significantly affected by recent and prevailing economic conditions.” (See http://www.bc.edu/research/swri/features/wealth/.) How is that possible?

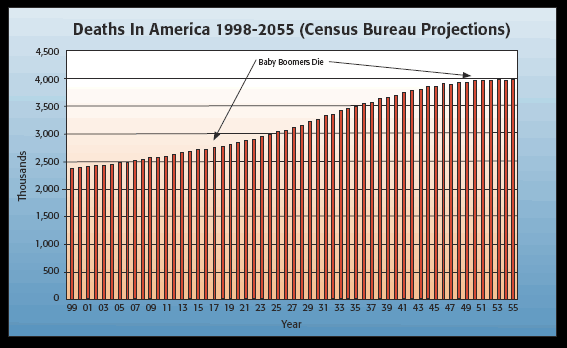

The death rates in America over the period 1998-2053 play an important role in the nature and timing of the wealth transfer. According to the authors of the study, much of the transfer was always expected to take place in the second phase from 2018-2053. That’s because the death rates in America will accelerate dramatically during that period of time.

Death rates increased by only 3.5% between 1998 and 2004. The number of deaths in 2017 will be just 11% higher than in 2004. On the other hand, the number of deaths in 2053 is projected to grow 44% over the number in 2017. As the last of the baby boomer generation passes away in the early 2050s, the predicted wealth transfer period will finally come to an end.

The good news is that the wealth transfer projected for the period 2018 to 2053 is still likely to occur. However, what many may have failed to appreciate is that for the transfer to occur, not only will the GI Generation and Silent Generation have to pass away, but almost the entire Baby Boom Generation must die as well. Suffice it to say that no one responsible for nonprofit fund development today is likely to see the bulk of the wealth transfer occur.

Resetting expectations

The failure of the much-anticipated wealth transfer to meet the 20-year projections now seems a foregone conclusion. If senior management, volunteers, advisors, and others in the nonprofit community remain unaware of this reality, those responsible for planned gift development may continue to be saddled with unreasonable expectations regarding bequest income in the near term, and could fail to be credited with what may be admirable performance under challenging circumstances.

Now may be the time to carefully examine your programs and re-evaluate your goals. You may discover that your planned gift potential is more or less than previously estimated. Shift your attention from the “macro” level of dealing with the entire wealth transfer to focusing on what is realistic given the age and other characteristics of the constituency that determine your “micro” level of potential.

For example, if a school was founded in the 1970s and has no graduates over age 60, it is highly unlikely that this institution will receive much of the wealth transfer in the near future. On the other hand, an organization with more than 50% of its donors beyond the age of 70 and few under age 60 may find that the coming decade will represent the bulk of the wealth transfer for them, followed by a period of potentially irreversible declines in bequest income.

Return to basics

In addition to sharing information regarding the reality of the wealth transfer with the appropriate persons and beginning to reset expectations, what else should development executives be doing?

Make sure that staff resources are properly allocated. This may, for example, mean cross-training existing staff instead of hiring additional planned giving specialists.

Review records to assure that existing bequest expectancies and those who have completed gift annuities and other planned gifts are being stewarded effectively and that these relationships are managed properly going forward. Profile bequest and other planned gift maturities and foster deeper relationships with active donors who share similar characteristics. Be sure to carefully maintain contact with your long-term donors and make plans to replace them.

Also begin considering strategies for working with the tens of millions of baby boomers who are entering a new phase of life. Remember that the oldest baby boomers are now turning 60 and bequests from this group will not be realized for a decade or more at the earliest. While it is important to emphasize bequests with this group, if costs are to be in line with revenue over the next 10 years, you must learn to structure gifts that meet baby boomers’ desire to give while maintaining their financial security in the years before they pass away.

Evaluate your results every year against previous years’ production and possibly that of your peer institutions. Depending upon your findings, revise your expectations and that of your leadership accordingly.

Editor’s note: For more in-depth analysis of strategies to deal with a stalled wealth transfer, economic uncertainty, and the upcoming aging of the baby boom generation, consider attending the Sharpe seminar “Philanthropy in Times of Change.” See page 3 for more information.