Gifts of appreciated securities and other assets have been a mainstay of many development programs. During the boom times of the 1990s, significant gifts were often made from the portfolios of those who had benefited from markets that could only seem to go up. The message to donors was simple—give appreciated assets. Why? To make gifts while avoiding capital gains tax, the bane of every investor’s existence, and in so doing to give away so-called “paper profits.” This message had a certain appeal to many who had experienced large gains in hot investment markets, and many charities thus benefited from the “wealth effect” that also helped fuel growth in other sectors of the economy.

Back to basics

Now, however, given the different environment we live and work in, we may need to consider adjusting our thinking, as well as the information we provide our donors about gifts of appreciated assets. As donors are increasingly taking a hard look at what they can afford to give, we must show them how to make gifts in the most economical ways. All too often we focus on tax avoidance and the desire to reduce tax bills alone when perhaps we should be emphasizing how tax savings actually help reduce the cost of gifts donors would like to make.

For example, if a donor is in the 38.6% tax bracket for federal tax purposes and gives $1,000 in cash, the “after-tax” cost of the gift is $614, yielding tax savings of $386. On the other hand, suppose the same donor owns securities worth $1,000 that cost only $250 six years ago. If the securities are given, the donor will save $386 in federal taxes, the same amount saved with the cash gift. But the donor also avoids payment of capital gains tax on the $750 increase in value, thereby saving as much as $150 in the 20% capital gains tax bracket. The total tax savings would then be up to $536, reducing the net cost by nearly 25%, to $464.

While the above math may be obvious to experienced development officers, how many donors really understand this? I once met a wealthy entrepreneur who had sold stock in his company to generate cash to make significant gifts for many years before a representative of one of his charitable interests finally asked him why he was giving cash instead of securities. The donor was understandably annoyed about the huge sums he had paid in unnecessary capital gains taxes over the years. The moral of the story is this: Don’t assume that donors are experienced gift planners. They may need help in choosing the best asset to use to fulfill their gifts.

It is hard to imagine a case in which a donor would be better served by making a gift of $10,000 in cash instead of $10,000 in appreciated securities. Donors are sometimes reluctant to make a gift of the stock, however, because they think it may further increase in value. Other donors are heavily invested in the stock of companies that employ them and are afraid that a gift of their stock may imply they have lost confidence in the future of the company and trigger sales by others. This is an especially important consideration today when many companies are urging employees to “keep the faith.”

There is a simple solution to the above concerns. In either case, donors should make their gifts in the form of stock and then use cash they might otherwise have given to repurchase shares of the same stock. That way, they realize additional savings from a gift of securities by avoiding capital gains tax, but when the dust settles they still own the security and enjoy a new, higher cost basis. If the security goes up in value from that point, the donors would have less gain to report if they sold it. If the value of the investment declines, they would realize a loss for tax purposes at sale, instead of perhaps just less gain if they had held the security and sold it after it had declined in value.

The strategy outlined above is not widely understood by donors for one important reason: Charities and/or their advisors too often fail to tell them about it. Now is the time to share this idea with your donors. There has not been a time in recent memory when more persons have held more appreciated investments but have also been so uncertain about the future direction of the market! Charitable organizations and institutions that take the initiative today by informing their donors may be surprised how much donors will appreciate the advice—and how much they may give.

The balanced sale

There is another little-understood technique for a donor who would like to make a gift while diversifying a portion of an investment position, all without incurring capital gains tax. Through a “balanced sale” a donor gives enough shares to generate the necessary tax savings to offset capital gains tax due on the sale of the remaining shares.

Example:

David Williams owns stock worth $20,000. He invested just $5,000 in the stock ten years ago. He believes his investment is unlikely to increase in value in future years and would like to sell it. He does not, however, want to pay capital gains tax of as much as $3,000, which would leave him with net sale proceeds of no more than $17,000.

He is also interested in making a charitable gift of approximately $6,000 while enjoying the greatest possible tax savings in his 35% tax bracket.

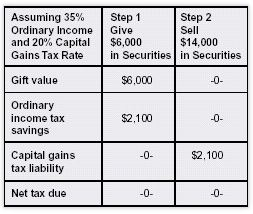

Through a balanced sale, Mr. Williams can accomplish both objectives by selling $14,000 worth of the security and donating the remainder, worth $6,000.

Note from the chart below that the $2,100 in tax savings he enjoys from his gift exactly offsets the $2,100 in capital gains tax due on the securities he sold.

His tax liability on the portion of the securities sold is thus “balanced” by the tax benefit for the charitable gift portion.

Mr. Williams is able to enjoy cash proceeds of $14,000 along with the satisfaction of making a $6,000 gift—a total of $20,000 in value to him—while effectively bypassing the entire capital gains tax liability. Had he sold all of the securities, he would have netted just $17,000 after paying some $3,000 in taxes.

This case illustrates how it is possible to make a $6,000 gift at an after-tax “cost” of just $3,000 by utilizing incentives Congress has provided for those who choose to redirect a portion of their tax liability to fund charitable purposes.

How to communicate

The best way for donors to learn how to make their gifts more effectively this year is for you to tell them. You may want to target the appropriate information to a select group of persons who have made cash gifts above a certain amount. You should also include persons who have made stock gifts in past years.

But how do you find stock donors if your record systems don’t record the nature of property used to make gifts? If possible, search donor records for all gifts of odd amounts. For example, a gift of $3,567.34 was in all likelihood a gift of securities, as one would only write a check in this amount in very unusual circumstances.

You may also want to share information with your donors in person or via the telephone. If systems permit, consider holding all larger checks for an extra day while you call and personally thank the donors. While you are talking with them, ask them if they have considered making their gift in the form of securities. Most donors will still want you to cash the check, but some may actually give you a larger gift in the form of securities once they understand the benefit. Either way, you have made a very positive contact with your donors and shown that in challenging times you are going the extra mile to help them make their gifts in ways that are most beneficial to them.

This year can be an excellent year for charitable giving. The assets still exist, though their growth in value in many cases may be stalled. The economy may be in a “pause” mode, but don’t let that affect your efforts. Go the extra mile for your donors and you may find they will do the same for you.

Editor’s note: The Williams example featured in this article is reprinted from the new Sharpe publication, “A Guide To Year-End Giving 2002.” Call 1-800-238-3253 for a copy or visit www.sharpenet.com/yearendguide.