As reported in Giving USA, the Fundraising Effectiveness Project and other studies, total charitable giving in America was down in 2022. The most recent Fundraising Effectiveness Project report for the first quarter of 2023 indicates that many of the conditions impacting charitable giving last year continued into 2023. As fundraisers, this news is probably not what you want to hear.

If your charitable giving year-to-date is down or flat, there are steps to take now to improve the odds of meeting or exceeding your fundraising goals for calendar year 2023. For 60 years, Sharpe Group has been studying trends and practices to improve fundraising results and providing strategies to help nonprofits and their donors in the good times, the bad times and, of course, the uncertain times.

Mid-Year Corrections

Today, we remain in uncertain times, but many of the economic trends that impact giving seem to be improving since last year and the beginning of 2023. Consider a few things that have changed for the positive as the year has progressed:

- The stock market has largely recovered from the dip it experienced in 2022, as has the household net worth, which reached $154 trillion in the second quarter of 2023.

- Unemployment continues to be very low (around 3.6% in June), and salaries have been increasing because of demand.

- The likelihood of a recession has been falling in 2023, with many economists now expressing greater confidence in the economy as inflation cools and the prospect of regular interest rate hikes diminish.

While economic uncertainty remains, many factors are significantly more positive than a year ago, which should provide a boost to philanthropic activity in the second half of the year.

Plans for All Donors

Experienced fundraisers plan for both the expected and the unexpected and recognize that diversified donor/gift mix is essential. Small, medium and large gifts traditionally come from individuals, foundations, bequests and corporations, and most nonprofits have specific plans to secure gifts from all of these sources.

At Sharpe, we focus primarily on gifts from individuals and their estates and have a variation of the traditional donor giving pyramid that may be useful in your planning.

At Sharpe, we focus primarily on gifts from individuals and their estates and have a variation of the traditional donor giving pyramid that may be useful in your planning.

As the mass of small gifts grows through donor acquisition and retention activities, some donors have the capacity to make medium or larger gifts and move up the donor pyramid. Most gifts are made with cash, but larger gifts and planned gifts often come in the form of noncash assets like stock or real estate. As the donor base grows, more people will move up to larger gifts as their interest and ability to give increases along with their relationship with your organization.

Who are your best prospects?

Consider using the recency, frequency and monetary signs of gifts to analyze and track, then broaden that list to include additional data points that allow more targeted fundraising approaches. These might include current age, wealth, income estimates as well as other demographic and list hygiene items.

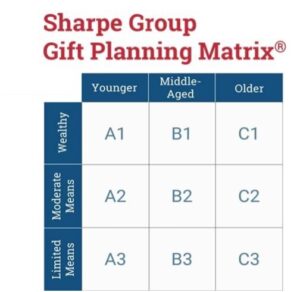

The Sharpe Age and Wealth Matrix is another tool that allows fundraisers to better communicate with cohorts of like-minded donors at specific stages of life based on their capacity and propensity for giving.

The major gift donors run across the top of the pyramid, and the planned gift donors are mainly 65 or 70 and older and run down the right side of the pyramid. Large numbers of small- and medium-size donors who are middle-aged or younger make up the remaining boxes of the marketing matrix. The top-of-the-matrix donors are likely to receive the most complex marketing mix, with personal contacts, direct mail, etc., to increase special or major gifts.

The major gift donors run across the top of the pyramid, and the planned gift donors are mainly 65 or 70 and older and run down the right side of the pyramid. Large numbers of small- and medium-size donors who are middle-aged or younger make up the remaining boxes of the marketing matrix. The top-of-the-matrix donors are likely to receive the most complex marketing mix, with personal contacts, direct mail, etc., to increase special or major gifts.

In addition to the regular appeals, loyal older donors should also receive special communications on planned giving subjects such as bequests, beneficiary designations, QCDs and in the case of C1 donors, a mix of communications about larger gifts now and in the future. You may want to consider “investing” in special communications to across-the-top-of-the-matrix and down-the-right-side-of-the-matrix donors.

As can be seen to the left, specific strategies and communication tactics may be devised to reach different donor groups for different types of gifts at different stages of their life and place on the donor lifecycle.

Here to Help

Sharpe consultants can assist with CRM hygiene, data appends, marketing and communications recommendations and staff training. Contact us for more information or to speak directly to a Sharpe Consultant about making the most of the year-end giving season in 2023. ■

Barlow Mann has more than three decades of experience in charitable gift planning and serves as general counsel for Sharpe Group. He is a member of the American and Tennessee Bar Associations and has authored articles on gift planning for many publications.