A number of factors can affect which gift plans a donor finds most appealing, including the type of assets the donor owns. This article will examine some of the gift planning considerations for donors whose assets include marketable securities.

Gifts of securities typically make up a sizeable portion of all charitable gifts each year. In recent years, gifts of securities for charitable purposes as reported on itemized deductions have ranged from roughly $12 billion to $26 billion per year. Gifts of corporate stock, mutual funds and marketable securities usually account for the largest share of such non-cash contributions. In some years, outright gifts of stock exceed the totals for charitable bequests.

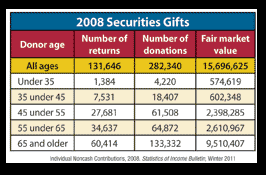

The likelihood that a donor will make a gift of stock or other marketable securities such as mutual funds increases with both the donor’s age and income level. According to IRS figures, the vast majority of such donations come from individuals age 45 and older, with the 65+ age group giving the most. In fact, the fair market value of stock gifts from those 65 and older is almost twice the combined totals from the under 45 and the 55 to 64 age groups.

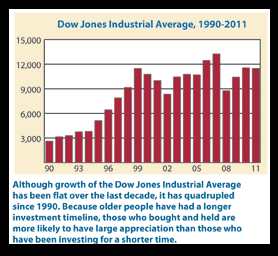

These figures seem to run contrary to the conventional wisdom that stock gifts are most likely to come from persons in the peak earning years of 45 to 65. Gifts of non-cash assets, however, are a function not only of the donor’s stage in life but also the number of years the donor has been active in the market.

People over 65 are more likely than younger people to have invested in securities for a substantial period of time. Stocks held for longer time periods often reflect the historical increase in value in the markets. Additionally, older donors who have accumulated significant wealth over time and who are no longer in their peak earning years may simply prefer to make gifts in the form of stock instead of cash, which may be in relatively short supply.

Based on this background and today’s volatile financial markets, astute planners and donors may find gifts of appreciated securities a particularly smart way to give.

Working with market swings

Donors can time these gifts with market swings to lock in high values with the “paper profit” used to fund gifts. For stocks held longer than a year, the gift will be deductible at its full value.

Donors can conserve cash and use stock they believe may soon decrease in value to make gifts without incurring the capital gains taxes they would have owed if they had sold the stock.

They can give the stock and use the cash that would otherwise have been given to acquire a brand-new “cost basis” for their stock. If it later decreases in value, they will have created a loss for tax purposes. If it goes up in value, they will have less gain to report.

Highly appreciated low-yielding stock can also be an ideal asset to fund a gift annuity or charitable trust. The donor receives a current income tax deduction based on the calculated value of the gift and future income that may be fixed or variable.

Accelerating a planned bequest with an outright or income-generating gift can provide donors with tax benefits and increased cash flow that would not be available with a bequest.

Unfortunately, many donors simply do not understand the multiple benefits that can flow from a gift of securities. Those responsible for major or planned gifts should be sure to communicate the benefits of giving stock to appropriate prospects in person, by telephone, by mail and via other communication channels.