The charitable gift annuity is among the oldest of the charitable gift planning tools. Its use dates to the Middle Ages in Europe, and American charities have been utilizing it in their fund development efforts since the 1840s if not earlier. For example, one of our clients is now commemorating the one-hundredth anniversary of its gift annuity program.

Until recently, the gift annuity primarily appealed to persons of moderate means, typically 75 to 85 years old, who were attracted by the prospect of generous fixed payments for life. In the past, gift annuities normally averaged in the $5,000 to $50,000 range, and most organizations that issued them rarely saw gift annuities much larger than those amounts.

Historically, cost effectiveness has depended on volume

Because of the cost of administering a gift annuity program, it has been important in the past to have a volume of annuities, as the recommended rates assume a relatively low cost of administration per annuity. This means that the typical program requires a large number of average-size annuities for the program to “work.” If the cost of administration of a gift annuity program were $7,500 annually, for example, then an organization would have to have $1 million in its annuity fund in order to cover the .75% cost of administration that is assumed by the American Council on Gift Annuities in the process of setting recommended gift annuity rates. If the average annuity contract were $10,000, then an organization would have to have one hundred annuity contracts in force at any given time in order to fall within the cost of administration assumptions underlying the rates.

For this reason, organizations that do not have the potential for a significant number of gift annuity contracts have in the past been well advised to forego the implementation of a gift annuity program.

The emergence of the “megannuity”

Recently, however, there have been significant changes in the way many organizations and institutions approach their gift annuity programs. Due to recent economic trends and tax law changes, we are now seeing many more large gift annuities than in past years. Six-figure gift annuities are increasingly more common and it is no longer unusual to see annuities of $1 million or more. One healthcare organization recently completed a gift annuity in excess of $5 million for a couple in their late 70s and early 80s. There are a number of reasons for this phenomenon.

First, after many years of low inflation and interest rates, more older Americans are now willing to commit larger sums in fixed payment arrangements without fear of significant erosion of spending power or losing the opportunity to possibly enjoy the benefits of higher interest rates in the future. As the stock markets have reached new highs for several years, many older investors are also concerned that they are not enjoying adequate spendable income from their investments, and they are concerned that a significant market correction could dramatically reduce the value of their holdings, while still leaving them liable for capital gains taxes on any remaining gain.

A love/hate relationship with capital gains?

Another important factor to be considered is the impact of lower capital gains taxes on charitable gift plans. When a person funds a gift annuity, he or she avoids capital gains tax entirely at the time the gift is funded. The capital gains tax attributable to the value of the life income element of the gift must, however, generally be reported over his or her life expectancy. As a result, when an older person uses highly appreciated assets to fund a gift annuity, a large portion of the annuitant’s annual payment will typically be taxed at capital gains rates no higher than 20%. This is welcome news to persons who would otherwise be paying tax at the rate of 40% or more on the entire amount of many alternative sources of income. Changes contained in the recently passed IRS reform legislation make it possible to enjoy the maximum capital gains tax of 20% after a holding period of just 12 months and a day rather than the 18-month period originally required by the Taxpayer Relief Act of 1997. This development will make it possible for persons who have had a rapid run up in the value of an investment to quickly convert gains to a source of income in a tax-favored manner.

A case in point

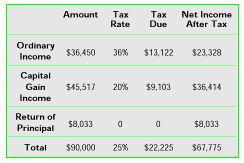

For example, consider the case of Mr. Braun, age 79. He has $1 million worth of a particular security with a cost basis of $150,000. The security pays no dividends. He is worried that his funds will not grow at the rate they have in the past, and he is also concerned that he may have too much exposure in the event of a downturn in the price of the stock. He would, however, be liable for up to $170,000 in capital gains tax were he to sell this asset. If he earned 8% on the remaining $830,000 and half were taxed as capital gain at 20% and half taxed at an ordinary income rate of 36%, he would have net spendable income of $47,808 following a sale. If he enters into a gift annuity paying 9%, here are the financial consequences:

Note that Mr. Braun avoids the $170,000 in capital gains tax at the time of his gift that would be due were he to sell the stock. That is good news. But for Mr. Braun, even better news is that for the first ten years that he receives payments, nearly 10% of the amount received will be free of tax. Of the amount that is taxable, over half will be taxed at a maximum capital gains tax rate of 20%, which is significantly lower than the 36% rate he pays on his ordinary income. This results in after-tax income of $67,775, some 42% more than he would have enjoyed had he sold the stock and reinvested the proceeds in the manner described above. As an added benefit, he enjoys an income tax deduction of over $491,000 that will save him nearly $177,000 in income tax when deducted against his tax rate of 36%. Invested at 8%, this savings will net him over $10,000 more in spendable income each year. While similar results can be achieved under the tier structure of income reporting that applies to charitable remainder annuity trusts, the gift annuity will typically yield a more favorable outcome when funded with highly appreciated property, further explaining its newfound popularity among wealthier donors and their advisors.

New math for annuity programs

As a result of the developments outlined above, some organizations are finding they can have a cost-effective gift annuity program with relatively few annuities in force at any given time. Returning to our earlier illustration of administrative costs, only two annuities of $500,000 each are necessary to cover a $7,500 assumed cost of administration ($1 million X .75%). For this reason, some charities are now deciding they can enter into an occasional large gift annuity in lieu of a charitable remainder trust without mounting a broad scale marketing– and administration–effort. However, the registration requirements of some states where your donors and prospects reside can be costly and can also affect the number of annuities required to make a gift annuity program “work.”

One must also remember that from the standpoint of a charitable entity entering into a gift annuity contract, this plan represents a general obligation on the part of the charity and thus presents more risk than a charitable remainder trust, as the organization must guarantee the payments to the donor with all of the otherwise unencumbered assets of the organization. In some cases, the donor may share that concern and prefer to have the payments backed by a separately managed charitable remainder trust even if the tax consequences of a gift annuity may be slightly more favorable.

Conclusion

For many organizations the gift annuity may now be “coming into its own” from a major gift planning perspective. We will undoubtedly see more of the “megannuity,” to coin a term. As a result, if your organization counts among its constituency a significant number of older, wealthier persons, it may be well worth your time to brush up on your knowledge of the tax consequences of gift annuities, as they may increasingly be the gift of choice for such persons. For organizations that have been maintaining a small gift annuity program that may be less than cost effective, the current environment may offer an opportunity to add a small number of larger, non-traditional gift annuities that will put a program on a solid footing from an administrative cost standpoint.

Capital Gains Holding Period Altered

On July 9 the Senate passed the IRS Overhaul Bill which, among other matters, contains a provision to alter the capital gains holding period structure. For properties held over one year, the maximum tax rate will now be 20%. The mid-term rate of 28% for properties held between one year and 18 months created by last year’s Taxpayer Relief Act has been eliminated. This change is retroactive to January 1, 1998. The rate for property held less than one year remains 39.6%. Tangible personal property such as artwork, antiques, and other “collectibles” will still be subject to a 28% tax rate after being held for more than 12 months, and the 25% rate applicable to recapture of straight-line depreciation of real estate remains in force.

This change in the capital gains tax structure is good news for donors and gift planners alike. Gifts of appreciated assets will continue to be deductible for the full fair market value of the property and will still result in the avoidance of capital gains tax. Perhaps the best news is that there will now be much less confusion over which property to give because the “mid-term” category no longer exists. Now all properties held over one year will once again be considered “long-term.”