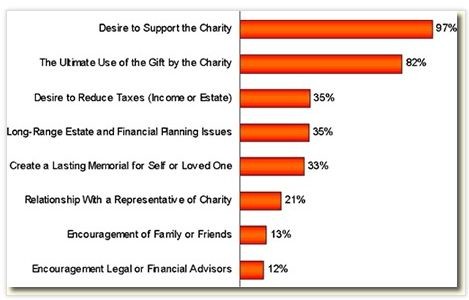

A survey conducted under the auspices of the National Committee on Planned Giving (NCPG) in 2000 revealed that the desire to create a lasting memorial for oneself or a loved one motivated almost as many charitable bequest donors as tax and financial considerations. The wish to memorialize a loved one was listed as a motivation for bequests in one-third of the cases.

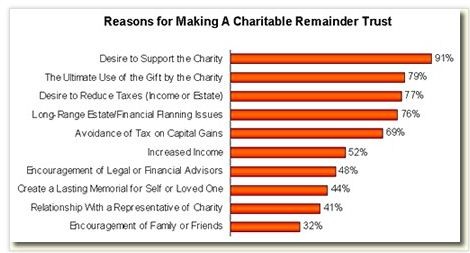

The same report revealed an even greater role for memorial gift motivations in persons who had established charitable remainder trusts.

Countless colleges, universities, museums, and other organizations offer prominent examples of memorial gifts. Harvard University was named in honor of its first benefactor, John Harvard, who donated his personal library and half of his estate in a bequest to the emerging university. Leland and Jane Stanford established Stanford University for “California’s children” in memory of their only child, who died at the age of 16.

In light of this and other evidence of the role memorial considerations can play in the decision to give, fundraisers should make every effort to capture this potential to increase funding from bequests and other planned gifts while also providing an additional source of current gift income.

Yet programs designed to encourage gifts in memory of or in tribute to others are often overlooked and/or underutilized.

Missing the mark

Memorial gift programs often revolve largely around the process of receiving, receipting, and acknowledging memorial gifts sent “in lieu of flowers” at the time of someone’s death. These gifts typically come as a result of a donor’s decision to honor a family’s wishes and may or may not be an indication of any donative intent on the part of the donor.

While an efficiently run program of this nature can produce a significant stream of small current gifts, these gifts represent only a portion of the funding that can be derived from efforts to serve a donor constituency through a more comprehensive memorial and tribute gift program.

In addition to welcoming gifts made in memory of a decedent soon after their death, consider including a line on regular gift appeal response devices that allows a donor to make a gift in memory or honor of a loved one. Experience shows that persons who make gifts in memory of the same person on more than one occasion are much more likely to leave a bequest to the same organization, whether or not the bequest is specifically designated in the will as a memorial gift. A number of studies of wills that contain gifts for charitable purposes have revealed that bequests to an organization from the estates of persons who had made one or more gifts to that organization in memory of a loved one during their lifetime tend to be two to three times larger than bequests left by others.

Strengthening your memorial gifts program

To fully realize the potential for memorial gifts to your organization or institution, consider the following steps or activities:

1. Make certain that existing programs for encouraging, receiving, receipting, and acknowledging memorial gifts are running smoothly. It is especially important that memorial gifts of any size be quickly processed and acknowledged to donors and the survivors of those who have been commemorated.

2. At the end of a period of time after all those persons who have made a gift following the passing of a friend or loved one have been acknowledged, consider presenting a list of the names of donors in a framed certificate or perhaps a scroll that can be delivered to the closest surviving loved one. This piece will act as a constant reminder of the importance of your organization in the life of the deceased and their surviving family members and could well lead to the decision to make additional gifts during lifetime and as part of a surviving loved one’s estate.

3. Once it is determined that all memorial gift donors have been properly acknowledged, make certain their names are included to receive future information on charitable gift planning along with others who may have been selected to receive this information on account of age, longevity of giving, or other factors.

4. Consider adding an honorary or tribute component to other development programs designed to encourage outright gifts, bequests, and other planned gifts. This may be accomplished by including a special insert with regular acknowledgment letters or by following up with special communications focused on memorial and tribute gifts.

5. Make sure that you have a readily available list of commemorative naming opportunities, including named funds, buildings, rooms, and programs, with appropriate minimum donations and funding options.

6. If appropriate, consider sending information on a periodic basis encouraging additional memorial gifts to all prior donors regardless of whether they have made memorial gifts in the past. This communication may be structured around anniversaries, birthdays, times of religious significance, Mother’s Day, Father’s Day, or Memorial Day.

7. Examine major and planned gift proposals currently under consideration and determine the appropriateness of adding a memorial element. Special attention should be paid in determining the proper person to be recognized, whether it be the donor, another family member, or a close friend or mentor. A suitable and tastefully presented opportunity to honor a loved one in a special way may make the difference in a donor’s decision to fund a gift in one instance over another.

8. Always remember to contemplate the gift from the donor’s perspective and identify ways to increase the donor’s satisfaction through suitable recognition, whether public or private. In some cases it may be appropriate to volunteer to give recognition to donors who did not seek it for themselves. Be sure, however, always to seek the donor’s approval before bestowing this recognition. Donors may be recognized in this manner through inclusion in gift clubs, societies, walls of honor, or other appropriate programs. Remember that a listing in a permanent bequest recognition society is tantamount to creating a lasting memorial in memory of that donor, something some persons may desire though they would never initiate a request for this recognition on their own.

In challenging economic times, it is important that all possible motivations for the completion of larger gifts be considered. The desire to give in honor or memory of others is among the most powerful and timeless of motivators—and facilitating such gifts can be a welcome way to provide additional service to your constituency.