by Barlow T. Mann

A new study suggests the long-promised transfer of wealth may now be upon us.

The Chronicle of Philanthropy has recently collaborated with the Center for Rural Entrepreneurship/LOCUS (Center) to create a new study, $9 Trillion and Counting: How Charities Can Tap Into the Transfer of Wealth.

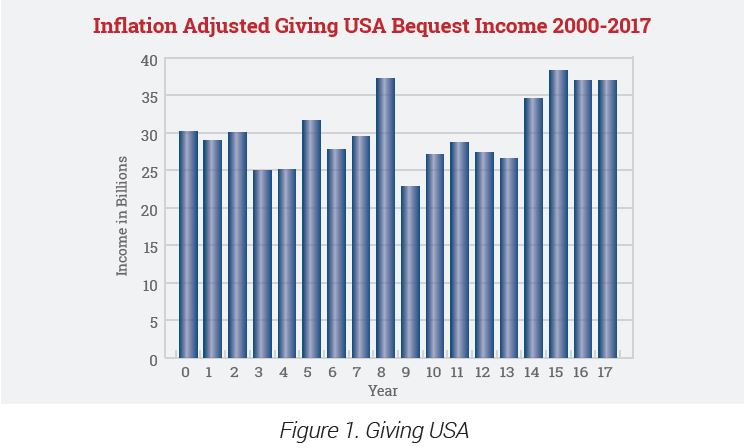

While recent Giving USA reports estimate that charitable bequests are again on the rise, charitable bequests were flat from 2000 through 2013 and actually declined over that period in real dollars (see figure 1).

Using updated data and analysis by LOCUS in a partnership with the Center, The Chronicle of Philanthropy report offers a more focused look into the near-term transfer of wealth between now and 2027. It does not project how much of the total wealth transfer will actually flow to charity but points out that the growth in wealth transfer overall will create an opportunity for the nonprofit sector to benefit.

Using updated data and analysis by LOCUS in a partnership with the Center, The Chronicle of Philanthropy report offers a more focused look into the near-term transfer of wealth between now and 2027. It does not project how much of the total wealth transfer will actually flow to charity but points out that the growth in wealth transfer overall will create an opportunity for the nonprofit sector to benefit.

Why now?

With household net worth at an all-time record high and the number of deaths in America growing from 2.4 to 2.5 million per year in the 2000s to over 2.8 million in 2017, the transfer of wealth from older generations is finally starting to accelerate.

The total amount in assets transferred set a new record for 2017. It is unclear if this increase will result in a “bequest boom” for every charity, but it is likely that charitable organizations and institutions that actively encourage gifts through estates and offer appropriate stewardship to estate gift donors will enjoy a greater share of the new rising tide of bequest transfers.

During the next 15 to 20 years, the bulk of gifts through estate transfers will continue to come from America’s most senior generations—the remaining members of the G.I. Generation and the Silent Generation—because the most common age at death of those leaving charitable bequests is the late 80s to early 90s. Most Baby Boomers are still decades away from being a significant source of realized bequest gifts.

“We’re not even through the Silent Generation yet. We’re about six years out from realizing the beginning of the Baby Boom curve,” explains Robert F. Sharpe, Jr., Sharpe’s Chief Consultant, who was quoted in the study.

Cautious optimism

It is important to keep in mind that there are major unknowns looming on the economic, social and political horizons that may influence the actual wealth transfer numbers over the coming decade. Medical advances that lead to longer life expectancies, combined with reforms to federal and state entitlement programs, may result in greater consumption of capital during the final years of life, resulting in a reduction in assets remaining at death.

The fact that much of the wealth of the Baby Boomers is held in the form of tax-deferred retirement accounts is another factor to be considered. In the past, seniors may have paid lower capital gains taxes when converting appreciated assets to spendable funds. Today, that same appreciation in value will be taxed at regular income rates, consuming more of the asset’s worth in taxes—and those taxes will be assessed because of mandatory retirement plan withdrawals whether or not there was a need to convert those assets to income.

Of course, the wealth transfer will still occur under these circumstances, but more of it will actually be “transferred” in the form of taxes to governmental entities rather than loved ones and philanthropic interests. Time will tell.

Worth reading

The report includes comments from academic researchers, consultants and experienced fundraisers, as well as estimated amounts of the distribution of wealth by age and the type of assets owned by wealth range based on research in the Federal Reserve Study of Consumer Finances and other sources.

Planned gift case studies include The Nature Conservancy, American Heart Association and Southwest Initiative Foundation. Additionally, the report includes a section on tips to improve planned gift development efforts, stages of giving based on age including how to broach planned giving topics with donors. See “Trends in Giving” in this issue for suggestions to help increase giving to your organization this fall.

For the full report and information on bulk orders of $9 Trillion and Counting, click here. ■

Barlow Mann is Sharpe’s Executive Vice President and Chief Operating Officer.