During times of rapid change, both donors and the charities they support are searching for certainty. Despite Benjamin Franklin’s assurance that “in this world, nothing is certain but death and taxes,” planned gifts can provide a degree of much needed certainty for an organization’s fund-raising programs. While current events may or may not have impact on the success of an annual appeal, a special event, a capital campaign, or a major gift solicitation, planned gifts tend to proceed on their own path, relatively undisturbed by current conditions.

In today’s environment gift annuities, life estate agreements, charitable lead trusts, charitable bequests, and many other gift plans continue to appeal to a growing number of donors. For mature fund-raising programs, such gifts can provide a stable source of funding, even in trying economic times.

The bedrock of fund-raising programs

Bequests have historically provided a reliable and growing source of income for America’s nonprofit community. An examination of federal estate tax returns, Giving USA estimates, and the Council for Aid to Education (CAE) reports confirms this.

Over the most recently reported 20-year period from 1982 through 2001, after adjusting for inflation, Giving USA reported that bequests grew at an average rate of 5.7% per year, a rate some 57% higher than the inflation-adjusted growth of gifts from living individuals.

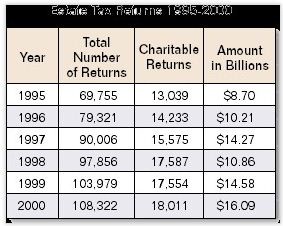

Federal estate tax returns reveal a steady increase in the total number and value of charitable deductions reported. An average of 18% of taxable estates left gifts to charity that grew in amount each year an average of 16% between 1995 and 2000.

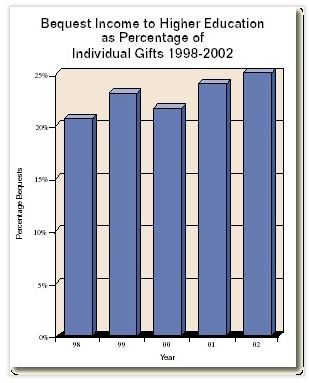

Newly released figures from the CAE/Rand Foundation confirm the consistent growth of charitable bequests to higher education over time. The annual report, “Voluntary Support of Education,” indicates that in the 2001-2002 fiscal year, approximately 25% of giving by individuals to America’s colleges and universities come in the form of gifts received via charitable bequests, the largest percentage in a number of years.

When the value of assets contributed to gift annuities, charitable remainder trusts, and other irrevocable deferred gifts is included, the total donated to higher education in the form of planned gifts approaches 40% of individual gifts.

As donors and charities continue to cope with ongoing economic uncertainty along with reductions in estate and gift tax rates, planned gifts that offer income and tax advantages are likely to appeal to an even broader group.

Charitable entities that are equipped to recognize, acknowledge, understand, and accommodate the varied concerns that compete with donors’ desire to give will continue to be successful, even in the most challenging of times.