This June marks the one-year anniversary of the reversal in the Federal Reserve Bank’s monetary policy. The 0.25% increase in the benchmark interest rate charged to banks in June 2004 was the first such increase in four years. Over the past year, the rate has risen several more times, yet many popular interest rates have remained basically unchanged. The interest rates on savings accounts and CDs have risen noticeably in recent months, yet mortgages and long-term bond rates have stayed at roughly the same level.

One interest rate important to gift planners is the discount rate used in the calculation process to determine the charitable deduction of various split interest gifts. This month’s “Planning Matters” will address many key questions and issues concerning the discount rate and its impact on gift planning in today’s economic environment.

Question: What does the term “discount rate” mean?

Answer: There are several types of discount rates. One is the interest rate that the Federal Reserve charges banks. This rate effectively provides a floor for interest rates. A “discount rate” is also the interest rate used to determine present value, or time value, of money. For charitable gift calculation purposes, the applicable discount rate is pegged to a specific set of government interest rates.

Question: Where did the federal discount rate come from? How is it used in the gift planning arena?

Answer: Until the late 1980s, the federal government published tables that utilized a fixed discount rate for gift calculation purposes. The fact that the rate was artificially fixed made it possible to take advantage of periodic interest rate fluctuations when planning charitable gifts. In 1989, however, a switch was made to a floating discount rate based upon 120% of the “applicable federal midterm rate” (AFMR), the rate of interest the government pays on the intermediate term debt obligations. Today, as a result, the discount rate used in the charitable gift calculation process changes monthly and, with the exception of pooled income fund calculations, a donor may elect to use the current month’s discount rate or the rate from either of the two previous months.

Question: How do fluctuations in the discount rate affect split interest gifts?

Answer: The attractiveness of various gift options is affected in different ways. For example, lower discount rates make charitable lead trusts and gifts of remainder interests in homes more attractive. A higher discount rate would, on the other hand, increase the size of the charitable deduction for other types of gifts such as gift annuities and charitable remainder annuity trusts. Gift planners who understand the interplay of rising interest rates on donors and gift plans may thus be more effective than others in the coming months.

Question: Does the discount rate really fluctuate enough to make a difference?

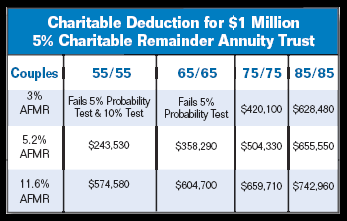

Answer: The rate has fluctuated dramatically over the years, ranging from a high of 11.6% in 1989 to a low of 3% in 2003. From May 2004 to May 2005 it has ranged from 3.8% to 5.2%.

Consider the impact on the amount that donors could deduct for identical gifts made to a charity over the course of time.

Question: Does a change in the discount rate affect all split interest gifts in the same way?

Answer: No. While the effect is similar for gift annuities and annuity trusts, the discount rate has less impact on the unitrust because of the way the gift is structured. As noted above, charitable lead trusts and life estate arrangements are generally more attractive with a lower discount rate. For example, an 8% charitable lead annuity trust could erase the transfer tax in just 15 years with a 3% AFMR. With an 11.6% AFMR and an 8% payment, the same lead trust could run for 100 years and only generate a 72% offset. Low discount rates cause some gifts to fail the charitable gift tests that ensure that at least 10% of the corpus will remain and that there is less than a 5% probability that the corpus will be exhausted by the end of the payout period (see chart above).

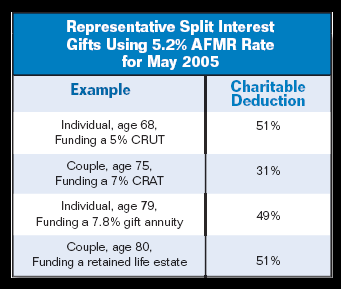

Question: What about the current discount rate?

Answer: When the discount rate is in the 5% range as it is now, most gift arrangements remain attractive. With moderate payout rates and typical time frames, a broad area of gift planning options is appealing. For example, using the May 2005 discount rate of 5.2%, an 8% lead annuity trust can generate a 99% gift and estate tax deduction in just 20 years. Gift annuities, life estate agreements, unitrusts, and annuity trusts can also be completed on a favorable basis at this rate.

Question: What should a gift planner do in this environment?

Answer: Now may be an ideal time to review older or currently pending proposals that may be interest rate sensitive. Prospects for lead trusts and retained life estate agreements should be reminded that these plans are more attractive during times of lower interest rates. Those who had been considering charitable gift annuities or charitable trusts should be sent new proposals showing how the charitable deduction has increased. Some donors who had been considering a charitable bequest may find the additional benefits of a split interest gift more attractive and wish to make a current gift instead or in addition. As almost all planned gifts are affected by an increasing discount rate, the change in the direction of the discount rates provides an opportunity to review gift proposals, renew conversations with donors, and reach out to all of your planned giving prospects.