One of the major lessons learned from KETRA legislation last fall is the importance of the 30% and 50% limitations on charitable deductions for federal income tax purposes. Every year, hundreds of thousands of individual taxpayers reach these limits and report many billions of dollars in carry-forward deductions. For instance, IRS reports for the 2003 tax year, the most recent year for which data are published, reveal that carry-forward charitable contribution deductions were reported by more than 500,000 taxpayers. These income tax returns include almost $26 billion of charitable gifts carried forward from one or more prior years when percentage limitations for charitable deductions were reached.

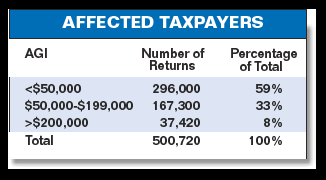

The IRS figures also provide important information about the adjusted gross income levels of those who encountered deduction limits. A simplified breakdown may be seen at right.

It may come as a surprise to many that the vast majority of taxpayers re-porting carry-forward contributions after exceeding AGI limits in prior years have moderate income levels. Many assume that only wealthy, high-income individuals encounter these limits. While it is true that those with the highest incomes report the largest dollar amount in carry-forward deduct-ions, those with more modest AGI levels were more likely to encounter the percentage limitations for charitable contributions.

Nuts and bolts

Understanding these limitations can help maximize both the tax savings and the satisfaction of donors making larger gifts. Gift development executives and marketing materials that imply that charitable gifts are fully deductible for federal income purposes may mislead an unsuspecting donor about the potential effect that a gift may have for tax purposes. Even guarded claims that “gifts are fully deductible up to the allowable limits” provide little guidance to donors who might be affected.

Therefore, it may be beneficial to review the 30% and 50% limits and carry-forward provisions. The amount allowed as a charitable deduction by individuals in any tax year is limited to a percentage of an individual’s contribution base, which is basically adjusted gross income computed without regard to any net operation loss carry-back. For most persons, this will be the same as their adjusted gross income, or AGI.

The percentage limit depends upon the type of donee organization and the donated property. For charitable organizations described in section 170 (b)(1)(A) (public charities, private operating foundations, and certain governmental entities), the maximum percentage limit is 50% of the individual contribution base. A 30% limit applies to contributions to non-operating foundations and certain other organizations. While gifts of cash may be deductible up to a 50% limit, gifts of long-term appreciated capital gain property are generally deductible up to 30% of the individual taxpayer’s contribution base (usually AGI). A taxpayer may elect to have all gifts of appreciated property deducted against the 50% limit by reducing the claimed contribution by the amount of the appreciation. Gifts subject to the 50% limit are considered first, followed by any gift falling into the 30% limitation. The combined deduction for contributions may not exceed the overall 50% limitation. Any contribution subject to either of these limits shall be carried forward for use in the next year. The maximum carry-forward period is five years, so it is possible for some gifts to provide income tax savings in as many as six years. Contributions of appreciated capital gain property to charities described in section 170(b)(1)(B) are deductible up to 20% of the individual’s contribution base.

While the basic tax rules are relatively straightforward, the application of the same rules can be very complex. Is the gift to a 50% charity or a 30% charity? Is the donor subject to a 50%, 30%, or 20% limit? Do the gifts include cash, capital gain property, or some combination? What is the individual’s contribution base this year? Does it fluctuate significantly? Are there carry-forward contributions to consider from prior years, or will this year’s gift create a carry-forward situation? In many cases, the donor’s accountant or other tax advisors will be the only ones capable of determining the answers to these questions with any degree of certainty.

However, it might be beneficial to consider a variety of donors that may encounter these limits. Many retirees are property rich, but their incomes may have fallen dramatically after they stopped earning a salary. Donors in this category could include those making large outright or split interest gifts. For example, a widow wishing to make a commemorative gift in memory of her spouse may hit the limit at a relatively low gift level regardless of whether it is funded with cash or appreciated property. Or consider a retired schoolteacher who funds a gift annuity or other life income arrangement with cash or appreciated property. Depending on her age and payment rates, the charitable deduction is often in the 25% to 66% range and likewise may approach either applicable limit.

For those still working, both affected gifts and incomes tend to be larger still. Relatively few persons with an AGI of $100,000 can afford to make gifts that are going to hit the limit because most of that income will be spent on living expenses, or needs to be saved for retirement or other purposes. Yet those with incomes four to five times that amount, or more, may have accumulated enough wealth that they can consider six- or seven-figure gifts. Donors that are key prospects for capital campaigns often fall into this category. A multimillionaire may have an income of $250,000-$500,000 and can easily have the ability to make a gift of $500,000 or $1 million from assets, not income. If the gift is given outright (instead of being broken into pledge installments), it may easily hit the limits.

The key to dealing with these limits is to understand them and to make sure that donors are fully informed before they make the gift. To learn more about these and other important issues, attend one of Sharpe’s popular seminars. See page 3 for more information.