Editor’s note: The feature article of the August issue of Give & Take, entitled “Where Do We Go From Here?,” offered a number of recommendations including helping donors make “balanced sales” of securities that enable donors to make gifts while minimizing taxes that would otherwise be due. A number of readers asked for more details regarding how this particular planning strategy is accomplished. In response, below we reprint an example from an article in the May 2002 issue of Give & Take entitled “Helping Donors Make the Most of Their Gifts in 2002.” This example may also be found in Sharpe’s year-end donor information booklet, “A Guide to Year-End Giving 2002.” See www.rfsco.com/donor. We also feature several other ideas to help boost giving this fall.

The balanced sale

Through the use of a little-understood but very effective technique known as a balanced sale, it is possible for a donor to make a gift while diversifying a portion of an investment position without incurring capital gains tax. Through a “balanced sale” a donor gives enough shares to generate the necessary tax savings to offset capital gains tax due on the sale of the remaining shares.

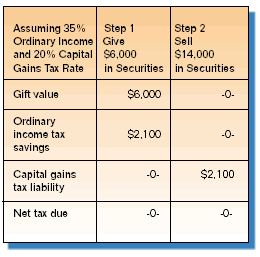

Example:

David Wilson owns stock worth $20,000. He invested just $5,000 in the stock ten years ago. He believes his investment is unlikely to increase in value in future years and would like to sell it. He does not, however, want to pay capital gains tax of as much as $3,000, which would leave him with net sale proceeds of no more than $17,000.

He is also interested in making a charitable gift of approximately $6,000 while enjoying the greatest possible tax savings in his 35% tax bracket.

Through a balanced sale, Mr. Wilson can accomplish both objectives by selling $14,000 worth of the security and donating the remainder, worth $6,000.

Note from the chart above that the $2,100 in tax savings he enjoys from his gift exactly offsets the $2,100 in capital gains tax due on the securities he sold.

His tax liability on the portion of the securities sold is thus “balanced” by the tax benefit for the charitable gift portion.

Mr. Wilson is able to enjoy cash proceeds of $14,000 along with the satisfaction of making a $6,000 gift—a total of $20,000 in value to him—while effectively bypassing the entire capital gains tax liability. Had he sold all of the securities, he would have netted just $17,000 after paying some $3,000 in taxes.

This case illustrates how it is possible to make a $6,000 gift at an after-tax “cost” of just $3,000 by utilizing incentives Congress has provided for those who choose to redirect a portion of their tax liability to fund charitable purposes.

A balanced sale can involve the sale of some shares of a particular investment and a gift of other shares, as described in the above example, or it can involve completely different assets given or sold at different times.

Beyond the balanced sale

Other ideas that may be attractive during these fiscally challenging times include gifts that will help to diversify investments or increase cash flow without triggering capital gains taxes. With proper planning, personal and philanthropic objectives may be reached harmoniously.

Consider the case of a donor who has recently suffered losses in the stock market. Her first inclination may be to rid herself of assets that have decreased in value by giving those assets to your organization. Instead, suggest that she may wish to consider selling the depreciated stocks and giving you the cash proceeds. You may thus keep her from “wasting” a loss for tax purposes that could offset other income. The donor may be pleasantly surprised and grateful to learn that the combined amount of the tax-deductible loss and the charitable deduction may be worth more than the current value of the investment.

Or consider the case of a wealthy donor who has recently experienced financial setbacks but still has substantial amounts of assets. Although he has contributed generously to your organization in the past, he does not feel comfortable making a gift at this point. How should you proceed? Consider highlighting his previous generosity and suggest he may wish to take advantage of record low discount rates and create a charitable lead trust to benefit his children or grandchildren while funding annual gifts for a number of years. At a 4.6% discount rate, a lead annuity trust paying 7% for 20 years results in a gift tax deduction of over 92% of the amount transferred to the trust.

Charitable organizations that help donors understand these concepts and use them to maximize the benefits of their gifts will likely be remembered favorably in more prosperous times. These strategies are contained in a number of Sharpe brochures and booklets designed to assist major contributors in light of today’s economic environment. Visit www.rfsco.com for a list of helpful brochures and booklets or call 1-800-238-3253 to speak with a Sharpe representative.