Although 2004 is now behind us, the impact of a variety of economic, demographic, tax, and regulatory factors that affected gift planners in 2004 will continue to be felt this year. For this and other reasons, reviewing some of the events and issues that affected gift planning in 2004 may help set the stage for a more productive 2005. Fine-tuning your program plans and adjusting your strategies now may help maximize your fund-raising results in the coming year.

Impact of the estate tax

On January 1, 2004, the individual estate tax exemption equivalent increased by $500,000 to $1.5 million and the maximum gift or estate tax rate fell to 48%. This year the exemption equivalent remains at $1.5 million, but the maximum tax rate fell another 1% to 47%. In 2006 the exemption equivalent is scheduled to rise to $2 million. The net effect of these changes and talk of additional tax reform may well lead the wealthy to once again rethink their estate plans. Meanwhile, the number of estates affected by federal estate tax considerations, which fell in 2004, should actually increase in 2005 as a result of a generally improving economy and a corresponding growth in net worth. This will increase the need for gift, estate, and financial planning among the wealthy and near-wealthy. Additionally, the non-tax reasons for estate planning will continue unabated.

Consider alerting your constituents to the fact that they may need to review or revise their plans in light of various state and federal tax law changes that are currently scheduled or may be proposed during the year. Remember that the reduction in the estate tax means that many persons will have more to leave to family, friends, and charity. Individuals interested in maximizing tax benefits may find lifetime transfers more advantageous. For example, a 75-year-old widow who had been considering a $50,000 bequest may find the current benefits of a $75,000 gift annuity to be more attractive based on her circumstances.

Looking back

The economy began to improve in 2003 but then rocked back and forth for much of 2004. Higher interest rates and oil prices were counterbalanced by higher real estate and stock prices to create a mixed economic environment. While a post-election rally saw the Dow Jones Industrial average climb more than 1,000 points from pre-election lows, the Dow closed the year a scant 3% above 2003. This year may bring a similar pattern of fluctuating in the 10,000 to 11,000 range with no clear-cut direction.

The past year saw positive returns for real estate, but there were signs that growth was slowing. Fine art and other collectibles saw solid gains during this period. Net household wealth recovered with the economy and reached a record level in 2004. Unemployment figures have been improving, and the prospects for new college graduates look promising again. In spite of these gains, the economy continues to face a variety of challenges in 2005. The rising federal deficit, a falling dollar, and the challenge of fixing social security are likely to be hotly debated topics this year.

The outlook for gift planners

Overall, the number of wealthy and near-wealthy Americans grew in 2004, which should help major gift efforts in 2005. While the growth of income and assets should boost overall fund-raising totals, expect increased competition for current and campaign contributions.

Make giving to your organization more attractive by presenting a variety of giving opportunities in the hope that one or more may satisfy a donor’s particular needs. There may be special opportunities for philanthropically oriented donors to diversify their holdings and minimize taxes through a variety of split interest gifts as mergers and acquisitions continue to increase. Others may simply wish to convert highly appreciated low-yielding assets to an attractive income stream during retirement.

It may be possible to capitalize on economic concerns or uncertainty through planned gift strategies that deal with the particular issues that a donor may be facing. For example, a term of years charitable trust may allow a donor to “retire” early, while diversifying his or her investments. In other cases, a non-income-producing asset may be converted into a lifelong income stream. Still other donors may be interested in the special opportunities that a gift of life insurance may offer. See “Planning Matters” on page 2 for more on this topic.

That’s the law

The regulatory environment continues to be affected by congressional hearings and tax law changes designed to curtail abuses in the charitable sector. The American Jobs Creation Act of 2004 includes changes that will affect gifts of automobiles, patents, and other types of intellectual property. Charitable boards are likely to endorse stricter standards of accountability in light of Sarbanes-Oxley, the CAN-SPAM Act, and the Do Not Call Registry, in spite of the fact that the full impact of these changes does not apply to charities. In 2005, the charitable arena will likely face ongoing scrutiny. Those in the nonprofit sector should make every effort to avoid actions or transactions that could be categorized as abusive. They should also closely monitor potential problem areas and make sure that the others on staff are aware of them.

That being said, a broad range of gift planning opportunities have the time-tested stamp of congressional approval. Gifts via charitable remainder and lead trusts, pooled income funds, gift annuities, bequests, insurance, retirement plans, and others provide ample room for donors to meet multiple objectives. Sticking to the safe harbors provided by the IRS and Congress may be a better course of action than attempting the latest cutting-edge technique that has little or no proven track record.

Knowing your audience

On the demographic front, the “Greatest Generation” has remained the driving force behind the great wealth transfer. Their generosity will continue to provide for family, friends, and charities in 2005, but the number of those in this age group is rapidly shrinking. Persons who were 20 in 1940 or 1945 are now in the 80-85 age range. The majority of the surviving members of this generation will pass away over the next ten years. The World War II generation is followed by a smaller cohort group that is often referred to as the “Silent Generation.” The youngest members of this generation are now turning 60, and most of this group has already retired. The oldest Boomers are yet to turn 60 and the youngest are still in their forties.

Adjusting your planned and major gift strategies in light of these demographic changes should increase the likelihood that you will reach the right groups at the right time in their lives to consider various gifts. For example, a will currently drafted by a member of the World War II generation is much more likely to be a final will and testament than a will drafted by a member of the Boomer generation.

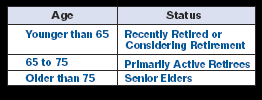

You may wish to consider sub-segmenting your constituency by age. Consider something like the following:

A few extra steps now to ensure that you are presenting appropriate gift planning information to each of these groups can greatly increase the efficacy of your funding efforts in the long run.

Looking ahead

At present, there is every reason to feel confident in the prospects for philanthropy for the remainder of 2005. The response of American donors to global disaster relief efforts in the wake of the Asian tsunami is an indication of the generosity of Americans when faced with a legitimate and compelling cause. It becomes ever more clear that donative intent is indeed the primary motivation for charitable gifts. Those who are involved in important social, religious, educational, environmental and other causes who communicate their needs to the appropriate constituents are likely to find that their needs will be met.