The National Committee on Planned Giving (NCPG) recently released the findings of a survey that asked about IRA distributions to charities as a result of the Pension Protection Act of 2006. As of January 10, 2007, NCPG had received information regarding 1,163 IRA gifts.

Value of IRA gifts

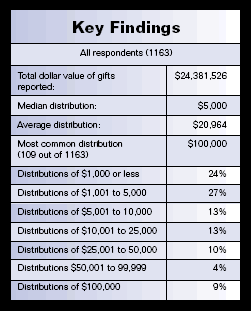

According to the survey, the value of IRA distributions as of January 10 totaled more than $24 million. While the median distribution is $5,000 and the average contribution was $20,964, the most common distribution amount was $100,000, with 109 out of 1,163 reporting gifts of this size. See the chart on the right for the breakdown of specific dollar values.

Profile of respondents

The majority of survey respondents came from public universities (30.4%), while 21.1% of respondents were from private universities and 11.7% from small colleges. Those identifying themselves as Religious Organizations and those in the “Other” category made up 7.5% and 7.8% of respondents, respectively.

Reason for the gift

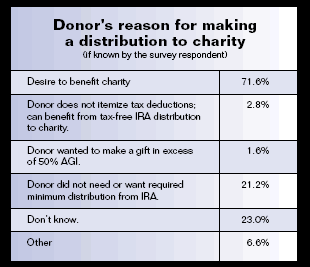

The NCPG survey asks why the donor decided to make an IRA distribution. Over 70% of respondents indicated that the donor’s main motivation was a desire to benefit the selected charity. Twenty-three percent did not know why the donor completed such a gift, and 21.2% reported that the donor did not need or want the required minimum distribution from the IRA.

2007 may see more IRA gifts

Because the IRA gift incentives did not become law until the late summer and the IRS has only recently issued detailed instructions on how to handle such gifts, many donors, their IRA administrators, and nonprofits did not have time to complete IRA gifts in 2006. The provision encouraging IRA gifts continues in effect for 2007 and many observers expect more gifts of this type in 2007 than 2006. Many will make their plans earlier in the year so it is important to inform donors about such gifts as soon as possible to receive a maximum share of the $100,000 each donor may give this way.

While these survey results are based on the 1,163 responses it has received so far from various nonprofit organizations, the NCPG encourages all charitable groups to continue using this survey to report their IRA gifts as well. You can access the survey online at https://websurveyor.net/wsb.dll/24399/hr4survey.htm.