By Barlow Mann

By Barlow Mann

Understanding why people make charitable gifts is an important part of the gift development process.

Americans are traditionally among the most generous people in the world, and 2017 was no exception. This past December saw a surge of charitable gifts that is likely to propel total philanthropic giving to an all-time high. Watch for the Giving USA estimates for giving in 2017 to be released later this year.

Some of the surge in year-end giving was fueled by individuals who were spurred to make larger gifts by the pending Tax Cuts and Jobs Act of 2017 that was signed into law last December. Faced with the likelihood of lower tax rates and an increased standard deduction starting in 2018, many donors raced to make gifts that took full advantage of itemized deductions under last year’s higher tax rates.

The same phenomenon occurred more than 30 years ago when Congress passed the Tax Reform Act of 1986. At the time, Sharpe Group reported that many larger gifts were accelerated into 1986 before the new lower tax rates took effect the following year. The combination of accelerated giving and a steep stock market decline in the fall of 1987 resulted in a drop in individual giving that year. Yet, despite predictions to the contrary, giving subsequently resumed to echo long-term prior growth trends until the declines during the Great Recession more than 20 years later despite lower tax rates and reduced tax savings. History clearly reveals that tax and economic considerations are just part of the reason people choose to give.

Why people give

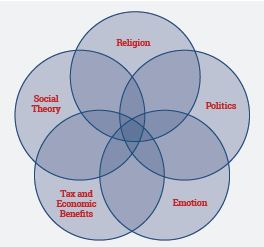

Understanding the many other reasons people make charitable gifts is an important part of the fundraising process. Some donors are driven by logical motivations and others by emotional and spiritual ones; many give because of some combination of the two. Additionally, some people are motivated to give by deeply held beliefs in politics or social theory. No two donors are alike. The reasons donors give are as complex and unique as individuals themselves. There are typically multiple motivations, sometimes conscious and other times not (see “Charitable Giving: Good for Charities, Good for Donors” in the December 2015 Give & Take).

Understanding the many other reasons people make charitable gifts is an important part of the fundraising process. Some donors are driven by logical motivations and others by emotional and spiritual ones; many give because of some combination of the two. Additionally, some people are motivated to give by deeply held beliefs in politics or social theory. No two donors are alike. The reasons donors give are as complex and unique as individuals themselves. There are typically multiple motivations, sometimes conscious and other times not (see “Charitable Giving: Good for Charities, Good for Donors” in the December 2015 Give & Take).

The National Association of Charitable Gift Planners (CGP)—formerly the Partnership for Philanthropic Planning—has conducted several nationwide surveys of donors to discover what motivates people to give to charity. For example, a 2006 survey found that the top two motivations for bequests, life income gifts and other planned gifts are a belief in the mission and work of the charity and a long-term relationship with the institution.

Do tax considerations matter?

It appears that most donors choose to support a charity because they are devoted to its mission and to the institution itself. That said, tax and financial considerations can be a major factor in determining the amount, timing and property used to complete a gift, as evidenced by the 2017 surge in year-end giving. The larger the gift, the more likely tax considerations are to play a significant role.

In reality, a person will normally decide to make a gift for non-tax reasons. They then decide how to structure the gift in the most efficient manner possible. Planned and major gift donors are more likely to be impacted by tax considerations than the majority of non-itemizing taxpayers who will continue to not itemize tax deductions under recent tax law changes. The relatively small group of itemizers will, however, as in the past, continue to provide the majority of the dollar value of all individual gifts. (See “Tax Reform,” Page 6.)

In short, it is a mistake to either over- or underemphasize the tax treatment of gifts. The best approach may be to focus on the primary motivators—who you are and the work you do—while providing ideas for the most effective types of gifts that people can make during life and through their estates.

With all the negative predictions about the possible impact of the new law on charitable giving, now is the time to inform your constituents that the new tax law preserved the special place that the charitable deduction has held in our tax code for more than 100 years. Assure them that their gifts will be put to good use, while also providing information on gift techniques and strategies they may find beneficial. A “stitch in time” may help prevent predictions of gloom and doom from becoming a self-fulling prophecy. ■