Individual Retirement Accounts (IRAs) have evolved considerably since their creation in the 1970s. Over the years, eligibility for individual retirement plans has expanded and changed to include variations on both the traditional IRA and the newer Roth IRA so that the IRA has now become an important part of the retirement portfolios of tens of millions of people and accounts for the ownership of trillions of dollars. It is critical for gift planners to have an adequate understanding of IRAs in order to benefit from the role they can play in fund development efforts. This is especially true in light of charitable incentives included in the recently enacted Pension Protection Act of 2006. The charitable IRA rollover provision could prove to be a significant source of funding over the next 16 months.

A short history of IRAs

The first provisions for IRAs were included in 1974 under the Employee Retirement Income Security Act of 1974 (ERISA) as a plan limited to workers who did not have access to employment-based plans. In the early 1980s, the IRA was extended to all workers under provisions of the Economic Recovery Tax Act of 1981 (ERTA). IRA contributions increased over 500% during this period.

However, after taking strides to make the IRA more accessible, Congress then restricted the tax deductibility of certain IRA contributions and created non-deductible IRAs as part of the Tax Reform Act of 1986. (Note that even though the contributions were not deductible, the funds could grow on a tax-deferred basis.)

The Taxpayer Relief Act of 1997 expanded the nondeductible IRA through the creation of the Roth IRA, under which after-tax dollars could grow on a tax-deferred basis and eventually be withdrawn tax free. Although the Roth IRA is derived from the traditional IRA, the tax treatment of withdrawals dictates that traditional IRA funds will continue to be the preferred choice for inter vivos, or testamentary, charitable gifts.

The 2001 Tax Act increased the contribution limits for IRAs. The Pension Protection Act of 2006 includes provisions to simplify and encourage the use of IRA assets for charitable purposes for persons over age 70½.

Value of retirement plans

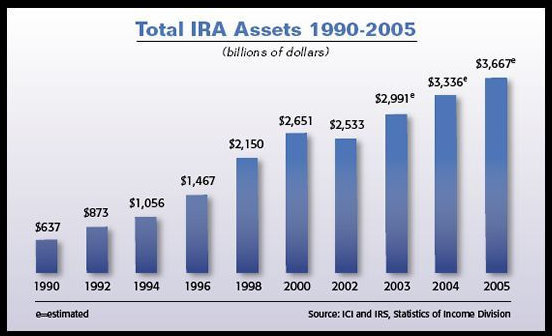

The value of assets held in IRAs grew steadily from 1981 to 1999 before experiencing declines during the 2000-2002 time period as a result of investment market declines. Since then, account values have recovered and grown to record levels.

IRA asset values reached over $2.5 trillion before declining to around $2.4 trillion in 2001. IRA assets grew to some $3.7 trillion at year-end 2005. An estimated 46.8 million households have some type of IRA, of which 37.6 million included traditional IRAs. Approximately 10% of this number is required to take distributions. In 2001, some 3.5 million individuals reported IRA withdrawals on their income tax returns.

Of the 3,448,457 individuals in 2001 reporting IRA withdrawals, 836,593 had an adjusted gross income (AGI) of under $30,000. Another 895,335 persons had an AGI in the $30,000 to $49,999 range, and 1,114,172 fell into the $50,000 to $99,999 range. In the highest income group, 496,167 returns revealed an AGI in the $100,000 to $200,000 range. Some 106,189 returns fell in the over $200,000 category.

Implications for gift planners

With the passage of legislation to encourage charitable gifts from IRAs, gift planners need to be aware of potential IRA gift opportunities. To do so, it is critical to understand the makeup of the IRA market. For upper, middle, and upper-lower income IRA holders who are at least 70½ and support charitable causes, IRA assets may represent a convenient, tax-efficient source for making charitable gifts while conserving non-IRA assets.

The charitable IRA rollover provisions of the Pension Protection Act of 2006 provide a significant but limited opportunity to tap this important asset source for charitable purposes. The law provides for an exclusion from income for certain direct distributions to charitable organizations. Donors must be at least 70½ and have a traditional or Roth IRA. The funds must go directly from the IRA to a qualified charity. The provision does not apply for gifts to donor advised funds, support organizations, gift annuities, charitable remainder trusts, or other planned gifts. A maximum of $100,000 may be transferred in this fashion in both 2006 and 2007, for a potential gift of as much as $200,000 per individual. In some cases a couple may be able to transfer as much as $400,000 to charity if they both have IRAs.

Many believe that the nation’s nonprofits will greatly benefit as a result of simplifying rules and encouraging charitably motivated persons to consider these assets as an additional source for funding outright gifts in retirement years.

If you would like more information about how the federal tax legislation may affect gifts of retirement plan assets, visit www.sharpenet.com/irarollover. See page 3 for upcoming training opportunities that feature the use of retirement plan assets in charitable planning.