According to a recent Pew Research Center study, most people don’t feel as old as younger people perceive them to be. The average respondent to the Pew survey considers 68 the beginning of old age, yet just 21 percent of those 65-74 consider themselves old. Even among those 75 and older, only 35 percent consider themselves old.

According to a recent Pew Research Center study, most people don’t feel as old as younger people perceive them to be. The average respondent to the Pew survey considers 68 the beginning of old age, yet just 21 percent of those 65-74 consider themselves old. Even among those 75 and older, only 35 percent consider themselves old.

Perceptions of old age have changed as improvements in health and lifestyle have boosted the average life expectancy in the United States. In 1910, the average American life expectancy at birth was 50 and those aged 70 had a life expectancy of 9 years. By 2010, the average life expectancy at birth was 78 and the average 70-year-old could expect to live 15 additional years. Even an 80-year-old in 2010 could expect to live another 9 years.

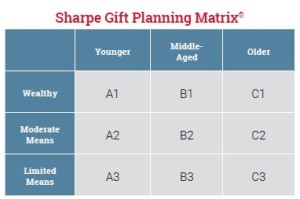

Beginning in 2016, the oldest baby boomers will be turning 70. While most won’t want to admit it, they will be in what has normally been thought of as the “older” age bracket beginning at age 65, the traditional age of retirement. (See Sharpe Gift Planning Matrix at right.) According to a 2014 Gallup poll, most Americans age 70 and older have retired or will soon be retiring from the workforce. In fact, Gallup reports the most popular retirement age in America is just 62. After retirement, many boomers will be moving on to a new phase of life, during which they expect to have more time for hobbies and other pursuits, including volunteering and otherwise becoming engaged in charitable endeavors.

Beginning in 2016, the oldest baby boomers will be turning 70. While most won’t want to admit it, they will be in what has normally been thought of as the “older” age bracket beginning at age 65, the traditional age of retirement. (See Sharpe Gift Planning Matrix at right.) According to a 2014 Gallup poll, most Americans age 70 and older have retired or will soon be retiring from the workforce. In fact, Gallup reports the most popular retirement age in America is just 62. After retirement, many boomers will be moving on to a new phase of life, during which they expect to have more time for hobbies and other pursuits, including volunteering and otherwise becoming engaged in charitable endeavors.

The next generation of givers

Those over 65 have traditionally been a reliable source of charitable giving, through both outright and planned gifts. As the bulk of them move into this age range, the baby boomers are replacing the Silent and GI Generations as America’s most generous generation. In spite of all the talk about acquiring younger donors, IRS data and other stud-ies reveal that baby boomers contribute more total money to charity than any other generational group. According to a recent survey, boomers represent 43 percent of total U.S. giving with 51 million donors. Some 72 percent of baby boomers give to charity.

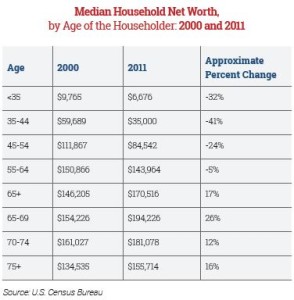

With many at the peak of their earning potential and others newly retired, boomers have reached the prime age for charitable giving. Both household income and wealth tend to increase with age, and income and wealth traditionally peak between age 50 and 70. Since 2000, the 65+ age group has seen its average wealth levels increase rather dramatically, while every other age group under that range has suffered a decrease. According to the U.S. Census Bureau, those 65 and older enjoyed a 17 percent increase in average net worth between 2000 and 2011, with the 65-69 age range seeing an even more dramatic 26 percent rise. By contrast, younger age ranges suffered anywhere from a 5 percent loss to a 41 percent loss in household wealth during that period. See chart on the following page.

With many at the peak of their earning potential and others newly retired, boomers have reached the prime age for charitable giving. Both household income and wealth tend to increase with age, and income and wealth traditionally peak between age 50 and 70. Since 2000, the 65+ age group has seen its average wealth levels increase rather dramatically, while every other age group under that range has suffered a decrease. According to the U.S. Census Bureau, those 65 and older enjoyed a 17 percent increase in average net worth between 2000 and 2011, with the 65-69 age range seeing an even more dramatic 26 percent rise. By contrast, younger age ranges suffered anywhere from a 5 percent loss to a 41 percent loss in household wealth during that period. See chart on the following page.

The lifecycle of a typical donor

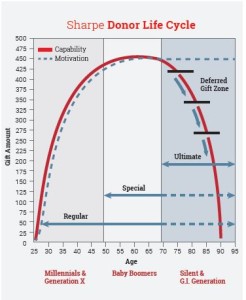

As the older members of the Silent and remaining members of the G.I. Generation approach extreme old age, most will gradually stop making regular current gifts. Many will, however, be finalizing their estate plans and fueling the majority of estate gifts over the coming decade. Keep in mind that the life expectancies for baby boomers range from 14 years for a 70-year-old male to 31 years for a 52-year-old female, and couples of those ages might be expected to live even longer.

Younger donors, such as Gen Xers and Millennials, will begin to support more charitable organizations in greater numbers and with greater amounts as their wages increase and time and resources allow, based on their stage of life.

Younger donors, such as Gen Xers and Millennials, will begin to support more charitable organizations in greater numbers and with greater amounts as their wages increase and time and resources allow, based on their stage of life.

Boomers, however, are currently in the sweet spot for major outright giving. Now is the time to educate your donors about charitable gifts that will help them fulfill their personal, financial and charitable goals. Consider using a multichannel approach to reach donors in this demographic. Planned gifts that will hold special appeal to wealthier members of this age group include outright gifts of noncash properties, charitable trusts for terms of years, charitable lead trusts and deferred gift annuities. It is also time to begin encouraging them to include charitable interests in their estate plans as well.

Make sure you have the most complete age and wealth information available about your donors so you can identify which marketing appeals will be most appropriate for them at their particular stage in life. This is your chance to help your boomer donors give in ways that will lead to maximum impact on your organization and maximum satisfaction for them.

To learn more about how to help your donors choose the best ways to give at their stage in life, contact a Sharpe representative at 901.680.5300 or info@sharpenet.com. You may also wish to attend one of Sharpe’s popular seminars. Click here for more information. ■