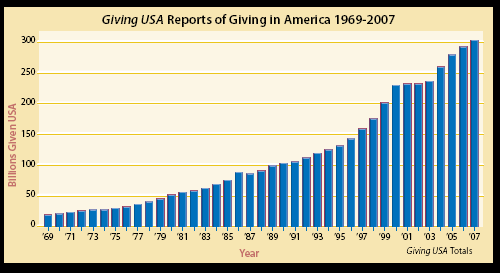

Newly released Giving USA 2008 figures for calendar year 2007 indicate that total giving in the United States grew by 3.9% and reached an estimated $306.39 billion. This figure represents a new record for philanthropic giving, exceeding $300 billion for the first time in history despite what now appears to have been the beginning of an economic downturn at the end of last year. See the chart below summarizing giving since 1969.

Across the board increases

According to Giving USA estimates based on tax data and other information, every type of public charity experienced an increase in giving for 2007. The last time every subsector saw an increase in giving was 2001.

When asked what current economic conditions may mean for giving this year and beyond, Melissa Brown, editor of Giving USA, responded: “If I had to estimate it right now, I would say giving is historically tied to stock prices and growth in personal income. We all know what is happening with stock prices right now, and I don’t think personal income is going up very much. I can’t predict what will happen with these figures the rest of the year. I can say that giving is closely tied with the economy. Watching the stock market and personal income figures from the Bureau of Economic Analysis is probably the best way to get a handle on what may happen this year and beyond. We have looked at recessions going back to 1955, and in a recession year, giving on average falls just 1% adjusted for inflation. And it appears some types of donors deliberately decide to give more because they see a greater need in a recession.”

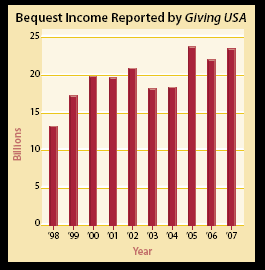

Bequests show increase

Of particular interest to some is the estimated $23.15 billion in bequest giving for 2007, an increase of 6.7% over 2006. Bequest giving grew at 2.5 times the rate of individual giving, which increased by 2.7%. Giving by bequests has now grown three out of the last four years:

As in the past, it is clear that bequests and other planned gifts are relatively immune to economic cycles, as they are more closely tied to the lifecycle of donors than the winds of economic change. Bequest income now accounts for some 7.6% of giving in America, compared to 74.8% from living individuals, 12.6% from foundations, and 5.1% from corporations.

It is not unusual for organizations that have long emphasized the importance of planned giving to receive upwards of 25% or more of their philanthropic support in the form of bequests. Over the past five years, for example, according to the Council for Aid to Education (CAE), matured bequests combined with the present value of trusts and other deferred gifts have accounted for an average of some 27% of individual gift income to higher education.

Bequest income is expected to remain stable in coming years with more moderate growth depending on the value of stocks, real estate, and other investments. The level of bequests is also tied somewhat to the number of deaths in America. Mortality rates have fallen slightly in recent years.

There is not expected to be a significant increase in the number of deaths until the first Baby Boomers begin to pass away a decade or more from now, when the bulk of the coming intergenerational wealth transfer will begin to occur.