In late June, Giving USA Foundation reported record levels of giving for 2007. While nonprofit management and volunteers welcomed this announcement, the sobering realities of 2008 now draw our attention. Whenever the word “recession” hangs in the air, commentators inevitably begin predicting lean times for fund raising. History shows that these predictions often come from those experiencing their first recession, whether as journalist, nonprofit manager, or volunteer.

In the fall of 1981, I first began working with nonprofits in the area of charitable gift planning. The country had just entered its second recessionary period in as many years. The prime rate was 20%, inflation had hit 10%, mortgage rates were 15%, and the unemployment rate was over 9%. To many, the economy had not looked as bad since the Great Depression, and there were dire predictions that fund raising would suffer dramatic setbacks. Surprisingly, in that year giving in America grew 13% over 1980, some 3% when adjusted for inflation.

Since that time, fund raising has weathered two more recessions—in 1990 and 2001. However, as noted in July’s Give & Take, giving in America is extremely resilient, dropping just 1% on average, adjusted for inflation, during recessionary periods over the past 50 years.

Nonetheless, The Sharpe Group has observed that the fund development efforts of different organizations seem to be affected in different ways during recessionary periods. Some experience declines, while others show continued, even remarkable, growth. Contemporary reports in the 1930s at the end of the Great Depression announced that a number of educational institutions actually raised more funds during the Depression than they did during the boom years of the 1920s. How can this be possible?

Many factors in play

The way a particular organization fares in tough times depends on a number of factors, not the least of which is their reaction to the first signs of a recession. Inexperienced managers may understandably err on the side of caution and begin cutting costs across the board. They ask themselves, “Is that donor visit trip really necessary?” “Should we mail that appeal?” “Should we postpone that campaign?” “Can we let that position remain vacant a few more months?”

More seasoned fundraisers carefully fine-tune their plans based on the knowledge that opportunities for funding ebb and flow and affect different donors, organizations, and areas of the country in different ways. For example, in recent months some regions have been hit harder by declines in real estate values and other challenges while those parts of the country involved in energy production have seen little, if any, economic downturn.

Urban areas in colder parts of the country where workers have longer commutes on average and consumers pay more to heat their homes this winter will obviously be affected to a greater extent by higher energy prices than smaller communities in more temperate parts of the U.S.

Other points to consider

Despite regional differences, why do we not see large declines in giving during recessionary periods? There are many reasons this is the case.

First, charitable giving is high on the priority list for many donors and is by no means the first thing they cut in times of economic slowdown. Other discretionary spending will normally be cut first. Historically, as long as people remain employed, most will continue to give. If a couple decides to postpone a vacation or a home addition, they may have more discretionary funds to save, spend on other needs, or give.

Ironically, some donors may actually increase their giving during downturns as they cut back on other spending. Many will think long and hard before they cut a pledge to their religious affiliation or tell a peer they can’t afford their regular gift to their alma mater’s annual giving program.

The beneficiaries of increased giving may be those entities donors are already supporting. Experience reveals that it can be harder to start new donor relationships during difficult economic times, because donors tend to focus on pre-existing relationships.

Several factors should be considered where major donors are concerned. When companies lay off workers during slower periods, it is not normally self-proprietors and senior management who feel the brunt of the job reductions. Major donors may enjoy more job security and some may feel a responsibility to increase their giving if they are untouched by factors hurting the ability of others to give.

Major donors may, however, pay more attention to the form and timing of their gifts. Now could be a good time to inform them about the importance of carefully deciding what property to give. For example, some have seen the value of securities fall in recent months but still enjoy significant gains. They may be wise to give those securities and use the cash they might have otherwise donated to instead diversify their holdings through the purchase of a broader group of stocks at lower current market prices.

Many older donors who are comfortably retired and no longer in the workforce may be among those least affected by the current economic conditions. They obviously can’t lose their jobs. Many seniors have long ago retired their mortgages and were not caught up in the subprime lending excesses of recent years.

Retired persons may also be less affected by increased fuel costs because they are no longer commuting and may drive little, if at all.

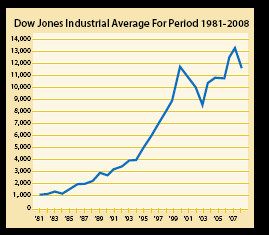

Also concerning stock values, keep in mind that people in their 60s and older have likely been investing over a longer term and still enjoy significant gains. See the following chart for long-term trends in the Dow:

Persons over 65 account for over 50% of total giving of appreciated securities, and it is important to keep information about giving non-cash property in front of them. Some may find this to be an excellent time to use securities that have increased in value but yield little income to fund gift annuities and other gifts that provide additional income to help pay for higher medical expenses and other costs.

Remember also that the factors that lead people to consider their final estate plans in their 70s and beyond continue regardless of the prevailing economic climate. A certain percentage of donors are making or revising wills and other plans every week and it is therefore important to keep providing information on ways to make gifts as part of their estate planning.

Keep in mind, though, that 65-year-olds have a life expectancy of 20 years or more and there is plenty of time to influence their behavior later. Cutting back on planned gift marketing to persons under 65 may thus be a relatively safe place to reduce costs in ways that will not have an appreciable impact.

Importance of stewardship

During economic downturns, businesses of all types take steps to make sure they maintain close relationships with those who use their services. Now more than ever it is important to cultivate donor relationships and not take them for granted. Time spent thanking donors, reporting back on how their gifts have been used, and involving them in other appropriate ways will be rewarded.

Giving in America overall has proven to be resilient during recessions, but individual organizations can’t afford to take this for granted. Take time now to pause, reflect, and regroup before approaching donors this fall with a renewed sense of purpose and confidence in your organization and its case for support.