This spring the stock market sprang to record-high levels. As a result, those involved in planned and major gift development may discover that gifts of appreciated securities are not just a year-end giving phenomenon. A number of Sharpe clients have reported increased levels of stock gifts earlier in the year than normal.

While the February 2007 Give & Take cover story “Appreciating Gifts of Securities” reviewed general stock market history from a philanthropic perspective, this month we will examine some emerging trends specifically in equity ownership and how they may affect the planned and major gift development efforts of all types of nonprofits this year and beyond.

Trends in equity ownership

According to recent studies conducted by the Investment Company Institute and the Securities Industry Association, there have been significant shifts in equity ownership in recent years. The number of households owning individual stocks and mutual funds has increased more than three-fold over the past 25 years. Today, half of all U.S. households own these securities. In 2005, this included more than 91 million people and 56.9 million households. In fact, the number of households owning equities increased by over 7 million since 1999! These numbers continued to grow in spite of the 2000-2002 stock market contraction.

To summarize, major trends include:

- Half of all U.S. households own equities.

- 90% of these households own mutual funds.

- Approximately half own individual securities.

- Overall, the values of these investments have recovered from the bear markets of a few years ago, with net household wealth at an all-time high.

- Nearly 75% of households that own equities hold stock or mutual funds individually, outside of retirement accounts.

Dealing with change

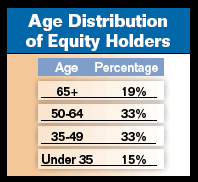

Fundraisers who understand and account for the impact of changes in equity ownership stand to benefit the most. A broad range of demographic groups own stock and mutual funds. Younger persons are more likely to own mutual funds as part of some type of retirement account. In fact, the majority of equity investors under age 50 own stocks and mutual funds in retirement accounts. Older donors, however, often purchased their first equity investments individually, outside of retirement accounts. Only 27% of investors age 65 and older own equities in employer-sponsored retirement plans or IRAs. Of investors in the 50-64 age range, only 41% own equities in tax-deferred retirement accounts.

The mean and median age of an equity investor is 51. As that number indicates, a slight majority of stock owners are over 50. In fact, 52% are 50 and older, with 48% age 49 or younger. While most younger investors hold equities in retirement accounts, most older investors own securities both individually and in retirement accounts. For the most part, the younger investors will not access these funds because of the tax liability and penalty they would incur for doing so. Those IRA holders over age 70½, however, may enjoy tax-free charitable giving resulting from increases in equity values inside their IRAs up to a $100,000 maximum in 2007.

Not just for year-end

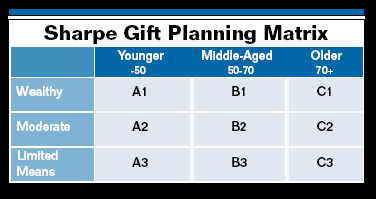

In years past, not-for-profits received most, if not all, gifts of appreciated securities during the final month or two of the year. Over the past few years, those gifts tended to come from a relatively narrow segment of an organization’s donor base. With one out of three Americans now owning equities, development professionals would be wise to educate their constituents about the possibilities and benefits of funding their charitable gifts with investment funds. The Sharpe Gift Planning Matrix may be helpful in identifying a variety of prospects from donors of assorted ages and wealth levels.

Most younger prospects for gifts of equities will be found in the A1 box. They are likely to be college-educated corporate executives and professionals who have investments in addition to tax-deferred retirement plans. This group may also include some who have inherited wealth from their parents, grandparents, or other relatives.

To find the wealthier, middle-aged prospects for equity gifts, look to the B1 box. This group, traditionally courted by major gift officers, is comprised of older members of the Baby Boom Generation and the younger segment of the Silent Generation. Most people in this group are still working and in their peak earning years. In many cases, their net worth has never been higher.

In addition to enjoying the income and capital gains tax benefits of a gift of securities, this group may also be able to utilize such gifts to minimize or eliminate alternative minimum taxes. That is because charitable gifts are deductible against both regular and alternative minimum tax liabilities. Larger outright and deferred gifts create charitable deductions that, when itemized, can reduce the difference between the regular and alternative tax liability. Strategically planned gifts of securities can also help with an individual’s asset allocation and diversification issues. In addition, certain gift plans can provide professional asset management and can help restructure a donor’s finances prior to retirement. Look beyond the obviously wealthy for those who fit the profile of the “millionaire next door.” Many members of the upper half of the B2 box can also benefit from these strategies.

Those in the C1 box—wealthy retired, or semi-retired, individuals and couples should also be educated about equity gifts. Their net worth is likely higher than ever and, in many cases, their disposable income also remains quite high because they are required to take distributions from retirement plans whether they need them or not. This year is an ideal time to ask members of this group to direct gifts to charity of up to $100,000 from Individual Retirement Accounts before December 31. This may also be a good time to encourage them and others to include charitable beneficiaries for remainders of their IRAs and other tax-favored retirement accounts at their death.

According to data from 2006, the single most popular amount of IRA gifts under the Pension Protection Act of 2006 (PPA) was the maximum of $100,000. Members of the C1 box are among those most likely to have IRA assets that they will not need. Others in the C1 box may find themselves cash poor and property rich. In this case, they may be able to “give out of the stock market” to fund a gift annuity or charitable remainder trust designed to provide a fixed or variable income for life, which may also result in multiple years of income tax savings from the charitable deduction.

The C2 box may hold the largest number of charitable gift annuity prospects. You may find that others in this group would prefer to conserve cash and fund charitable gifts with appreciated securities. If a donor cannot itemize larger gifts, “bunching deductions” into alternate years may provide some tax savings. This C2 group, as well as those in the C3 box, should also consider making charitable gifts from IRAs under provisions of the PPA before December 31. They may also choose to designate charitable organizations beneficiaries of their retirement plans.

The time is right

While recent months have seen the Dow and many other stock market indexes increase to record levels, nobody knows where the markets will be in December. Those who are prepared to help donors take full advantage of the current financial markets will reap the benefits both now and, possibly, in the future.