There was much discussion last summer and fall of the possibility that major tax law changes affecting charitable giving could be included as part of a compromise budget reduction plan submitted by the Congressional supercommittee. On Nov. 23, however, the committee announced that it had failed to reach a bipartisan solution to the nation’s budget crisis.

It now appears there will be no major tax law changes in 2012 and we will be operating under the Bush tax cut extensions until their planned expiration this Dec. 31.

What does this mean for the nonprofit community? Among other things, there may be an opportunity to encourage significant charitable gifts this year.

Understanding motivations

Let’s start with the premise that donors do not give primarily to gain tax savings. Even if they did, it is nearly always a mistake for any nonprofit to promote charitable gifts as simply a way to reduce or eliminate taxes.

That’s because the tax benefits of charitable gifts are the same regardless of which charitable entity ultimately receives the gift. With that in mind, we must recognize the primacy of donative intent.

While it is nearly always a mistake to overemphasize the tax benefits associated with charitable gifts, it can also be a costly misstep to ignore them or underestimate their influence on donor behavior.

Every development officer who works with those considering making a major gift should at a minimum understand the impact of tax considerations on the size and timing of gifts. They should also be aware of how proposed reductions or eliminations in the tax treatment of charitable gifts could affect future giving.

Impact of proposed changes

Let’s consider the case of a donor in the 28 percent tax bracket who wants to make a $1,000 charitable gift. Under current law, if that amount is fully deductible from income that would otherwise be taxed, the donor owes no tax on the donated amount and needs just $1,000 in pretax income to make the gift.

If the charitable deduction were to be eliminated, as some in Congress have proposed, that $1,000 charitable donation would be taxable. A donor who wished to make a gift of $1,000 under those circumstances would have to earn $1,389, pay $389 in tax owed on the income and donate the $1,000 remaining after tax. Note that because tax would then be due on the gross amount of income required to make the gift, the cost of the gift would increase by 39 percent.

If the charitable deduction were to be eliminated, as some in Congress have proposed, that $1,000 charitable donation would be taxable. A donor who wished to make a gift of $1,000 under those circumstances would have to earn $1,389, pay $389 in tax owed on the income and donate the $1,000 remaining after tax. Note that because tax would then be due on the gross amount of income required to make the gift, the cost of the gift would increase by 39 percent.

The political debate that will soon unfold will bring to the forefront the question of whether this “price increase” for donors who itemize deductions would cause them to decrease their giving. No one knows the answer to this question, but it is of vital importance to the nation’s nonprofit sector. Keep in mind that donors who itemized tax deductions gave $156 billion in 2010, some 69 percent of all individual giving reported by Giving USA.

To tax or not to tax

The stage has thus been set for debate in Congress and perhaps on the Presidential campaign trail about the advisability of either fully or partially subjecting to income tax funds that are voluntarily devoted to charitable purposes.

When negotiations resume on ways to bring the federal deficit under control, one of the most appealing solutions will be to leave tax rates the same, while quietly eliminating as many deductions and credits as possible.

This approach would avoid the drama that would surround a formal tax increase yet would achieve a similar result by applying existing rates to more income. It could be made more palatable to taxpayers by describing it as a “reduction in tax expenditures,” not a tax hike.

A tax increase implemented through limiting deductions would affect millions of Americans, including those who have borrowed to purchase homes and those who make significant charitable gifts.

Persons who do not need a mortgage to own a home and/or who don’t support charities would see no increase in their taxes. It remains to be seen how this plan would play out in the court of public opinion.

What to do now

In any event, it appears that charities have a period of time this year to do two things that can help preserve favorable tax treatment for donated funds and may also lead to increased giving.

One of the reasons tax incentives for charitable gifts are now under attack may be that many charities have not done an effective job in recent years of educating donors about the importance of these benefits.

The nonprofit community should take time now to explain that the elimination of these tax benefits would result in a significant increase in the cost of giving and the amount of income it could take to fund their gifts. It is unlikely that current and prospective donors will learn about the removal of these tax benefits from sources other than the charities that could suffer from their elimination.

In the absence of a cohesive lobbying effort based on a united nonprofit coalition, many charities may find it most effective to appeal directly to their donors.

As part of this process, it should become apparent to donors/voters why it is important to maintain the status quo for the tax treatment of charitable gifts. As a consequence, more of them may become motivated to contact their representatives to protest the proposed tax increases based in part on taxing charitable gifts.

Do not neglect the opportunity to remind donors of charitable tax benefits when thanking them for gifts of larger amounts. This is also a good time to furnish them with information about the best ways to make additional gifts.

Given the increase in stock market valuations in recent months and years, be sure to point out to donors that by making gifts of appreciated securities, they can deduct the full value of the security, not just its cost.

Reports published by the IRS indicate that in some years charitable organizations and institutions receive more gifts in the form of appreciated securities than the total of all bequests realized. How many programs spend as much time educating donors about the benefits of giving securities as they do encouraging charitable bequests? Take this opportunity to set your fundraising efforts apart.

Be aware of estate tax issues

Another area that is under exploration by Congress as a way to close the deficit is an increase in estate and gift taxes.

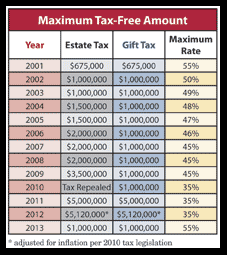

Under current law, the amount that can be given to heirs during lifetime or at death free of gift and estate tax is $5,120,000.

If Congress doesn’t act in 2012, that amount is scheduled to drop from $5,120,000 to $1 million, and the maximum estate tax rate will rise from 35 percent to 55 percent. (See chart below.) As a result of this possible increase, many among the wealthy will be taking steps during the remainder of this year to transfer significant amounts of wealth to their heirs.

These transfers may compete with plans to make larger gifts, but they don’t have to. In fact, through the use of planning tools such as the charitable lead trust, it can be possible to make major gifts while also transferring assets free of tax. See Page 1 of the November 2011 issue of Give & Take for more on these possibilities.

Bottom line

It now appears that 2012 will be a year of much debate and uncertainty. But the fact that changes in tax laws are certain to happen in 2013 whether through Congressional action or inaction means there will be a great incentive for donors to act this year to make their gifts while valuable tax incentives remain in place.

Those who understand this possibility and encourage their donors to act may find that this year could be one of the best ever for charitable giving.