How much do you know about charitable bequests? Find out by taking this quiz about one of the most popular ways to make “gifts of a lifetime.”

1. Donors receive income tax benefits when they make a charitable bequest provision.

¤ True ¤ False

FALSE. Because bequests are revocable until death, no income tax benefits are available at the time they are made. For this reason, bequest development programs need not be affected by various income tax reform proposals after the elections.

2. Donors enjoy increased income following the decision to make a bequest by will.

¤ True ¤ False

FALSE. When a donor makes a provision in his or her will, no property changes hands and no changes are made in the way the donor’s assets are invested. There is thus no effect on the current income flow to the donor.

3. Most charitable bequest donors are wealthy persons who are acting out of a desire to reduce or eliminate estate taxes.

¤ True ¤ False

FALSE. Recent IRS studies show that of some 2,400,000 people who die each year, only about 32,000, or less than 1½%, die with estates of $2 million or more which require the filing of a federal estate tax return. Of this group approximately 20% use the charitable deduction. Publicly reported statistics on overall bequest giving would indicate that there are around 180,000 other charitable estates each year that are providing a very large portion of charitable bequest dollars. It appears, therefore, that 97% or more of charitable bequests and a large percentage of bequest dollars are realized from the estates of lower and middle income persons who are seeking to make their “gift of a lifetime” for motivations that are not driven in any way by estate tax planning considerations.

4. The typical bequest donor is seeking recognition and will notify a charitable beneficiary of a bequest in advance in order to assure that he or she is thanked, enjoys membership in a bequest recognition society, and is otherwise appropriately acknowledged.

¤ True ¤ False

FALSE. Programs that track advance notifications of bequest intentions typically find that prior to active bequest development efforts, perhaps only one in six to ten bequest donors will notify charitable recipients in advance of a bequest. After a number of years of active communications efforts, this figure can sometimes be raised to as many as one in four or five. It is vitally important, however, to discover the relatively small percentage of persons who will notify charitable beneficiaries of their estates in advance, as these persons often prove to be both desirous and appreciative of efforts to thank and recognize them in appropriate ways.

5. Bequest dollars cannot really be influenced as they just come in “over the transom.”

¤ True ¤ False

FALSE. Virtually all organizations occasionally benefit from charitable bequests whether or not they have been actively encouraged. This can lead to the belief that this source of income is inevitable and cannot, in fact, be influenced. Nothing could be farther from the truth. In most cases, as noted above, the charitable bequest is motivated almost entirely by charitable intent. A certain number of very charitable persons among your constituency will decide to leave assets at death to an average of four to seven charitable interests. They will have typically given to many more organizations and institutions during their lifetime, but only a special few are singled out for what in many cases will be the “gift of a lifetime.”

Through systematic efforts, it is possible to dramatically increase the number of persons who decide to include your organization or institution in their will. In this respect, the process of encouraging charitable bequests is not unlike other types of fund-raising activity. Those entities that ask most often and most effectively enjoy the greatest success over time.

6. It usually takes many years to see results from proactive bequest development efforts.

¤ True ¤ False

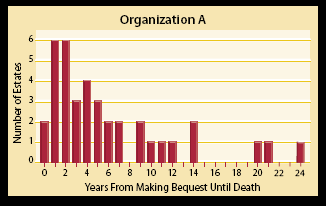

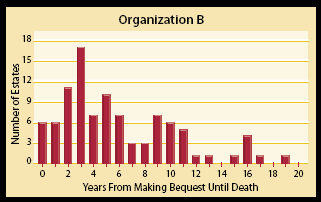

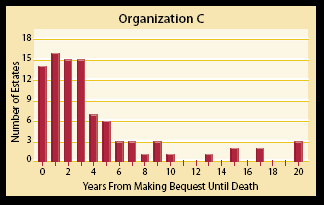

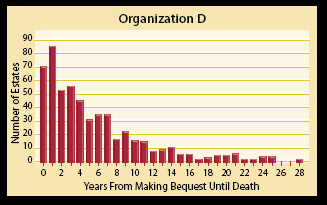

FALSE. Studies show that wills including charitable bequests are most often completed by persons in their mid to late 70s who execute their wills some three to five years prior to death on average. These funds can actually be influenced and received in a shorter period of time than the pledge payment periods allowed in some campaigns for current gifts. Note on the graphs below the number of years that passed from the time people finalized their wills until death. These statistics are based on bequests received by four organizations with entirely different missions. Because of the short period of time between the completion of wills and the receipt of bequests, it is possible to influence bequest income in a relatively short period of time, usually 2 to 5 years.

7. The most sophisticated planned giving programs realize most of their results from charitable trusts and other irrevocable plans while bequests are a relatively unimportant component in their programs.

¤ True ¤ False

FALSE. It is rare for charitable bequests to comprise less than two-thirds of total planned gift receipts for even the most long-term, sophisticated programs. For many programs, bequests will consistently generate 80 to 90% or more of planned gift income received in a given year.