Gifts of stock and mutual funds outpaced charitable bequests in 2006, according to the summer 2009 Statistics of Income Bulletin. The IRS report focuses on individual non-cash contributions in 2006, the most recent year for which complete data is available. The study is available in its entirety at www.irs.gov.

In that year, the almost 25 million taxpayers who itemized deductions claimed over $50 billion in non-cash charitable gifts. Almost $47 billion of this total was reported by 6.2 million taxpayers on IRS Form 8283, which is used for claiming non-cash gifts greater than $500.

For purposes of the IRS, non-cash charitable gifts include gifts of stock, mutual funds, and other investments as well as items such as real estate, clothing, food, and household goods.

In 2006, gifts of corporate stock accounted for almost $23 billion, just under half of the total for larger non-cash gifts. This figure represents a 40% increase over tax year 2005, when just over $16 billion was donated. When gifts from mutual funds are added to the mix, the total for 2006 surpasses $24 billion.

In the same year, gifts from charitable bequests generated $21.6 billion. In what may be surprising to some, gifts of publicly traded stocks and mutual funds actually exceeded charitable bequest income in 2006.

Additionally, the $26 billion total of stock, mutual fund, and other investment giving greatly surpassed the total given in other types of property. For instance, the $26 billion figure was seven times greater than the total of gifts of real estate and land ($3.6 billion).

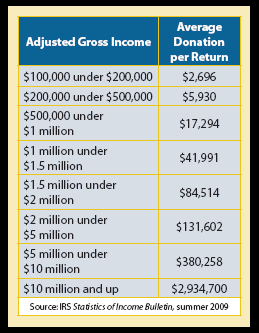

As may be expected, the number of returns reporting non-cash gifts of all types of property increased with the taxpayer’s reported income. The greatest number of returns reporting non-cash gifts fell into the $75,000-$199,999 income range. With just over 3 million returns, this group accounted for over half of the 6 million returns reporting non-cash gifts.

The amount of non-cash gifts also rose with income level. Those with incomes greater than $200,000 gave over half of the total non-cash gifts reported on the 8283 form.

What the numbers mean

Fundraisers will be especially interested in how these figures could and should impact their efforts going forward. In the latter part of 2009, donors finally saw a much-anticipated upturn in the stock market. In mid-October, the stock market reached 10,000, a figure many feared they would not see this year. This high-water mark represents an over 3,000 point gain since the market reached its low of under 7,000 in March. Donors may finally be ready to again consider gifts of securities after a long and prudent wait.

As donors begin to contemplate such gifts, fundraisers must know how to advise them. Of special importance is knowing how best to direct limited budget dollars for greatest impact.

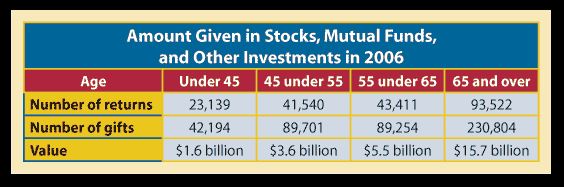

The following breakdown by age of the 201,613 returns reporting 451,953 gifts of stock, mutual funds, and other investments valued at $26 billion will give some idea of who is likely to give appreciated securities.

Note that approximately 60% of the total amount of securities gifts were made by persons age 65 and older. Some 71% of the number of gifts were made by persons age 55 and older. In 2005, IRS reports reveal some 51% of stock, mutual fund, and other investment gifts came from persons 65 and older, with 72% coming from those 55 and older. The August 2008 issue of Give & Take contains more details of 2005 giving.

Turn to the matrix

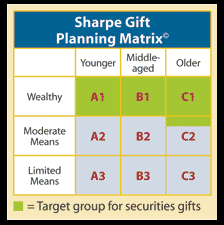

Once again, age and wealth appear to be important factors to consider in marketing non-cash gifts generally and gifts of appreciated securities in particular. In developing your strategy for non-cash major gifts, it may be useful to consider the Sharpe Gift Planning Matrix©.

The IRS study indicates that the A1, B1, and C1 groups are the primary prospects for larger non-cash gifts, particularly gifts of stocks and mutual funds. Of all the segments of the matrix, the C1 box (containing older and wealthier donors) is the source of the greatest number and amount of securities gifts.

When designing your communication plans to encourage non-cash gifts, age and wealth criteria may not always be available. In such cases, the size of previous gifts may be substituted for selection purposes. Consider promoting gifts of securities with all donors of more than $500, $1,000, or some other amount you deem appropriate. In doing so, you will naturally pick up many in the A1, B1, and C1 groups. For donors over 65, you could lower gift amount criteria to $100 or $250 to include some in the C2 category.

Consider the focus that many organizations rightly place on gifts of bequests, gift annuities, and other life income plans. Given the fact that gifts of appreciated securities appear to be producing income in amounts similar to if not greater than bequests and that the majority of those gifts are coming from those age 65 and older, perhaps additional emphasis should be placed on encouraging such gifts.

As fundraisers know, if you do not ask, you will not receive. With the recent rally in the stock market, now is the time to reach out to your most loyal constituents to make the case for gifts of securities before the year—and the opportunity for year-end gifts—come to an end.