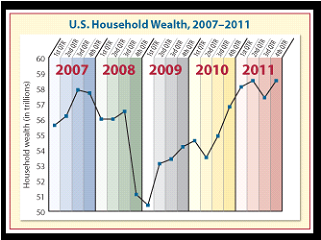

According to figures released by the Federal Reserve last month, household wealth rose to the highest levels seen since the Great Recession began in 2007. Household wealth in the fourth quarter of 2011 reached $58.5 trillion, exceeding the pre-recession high of $57.7 trillion in the fourth quarter of 2007. The 2011 figure was the highest reported in four years.

Note the steady and dramatic increases since the first quarter of 2009 (see chart below). Much of the gain occurred in the final quarter of 2011. Even though housing continues to be a drag on the economy, better employment figures and rising stock market values in the first quarter of 2012 are likely to continue to fuel growth in household wealth in the near term, and it is likely that the next figures released by the Federal Reserve will reveal continued growth.

Approximately half of U.S. households own stocks or mutual funds. Wealthier Americans are more likely to own securities and use them to fund charitable gifts. Government figures indicate that the wealthiest 10 percent of Americans own about 80 percent of the securities held by individuals. IRS figures indicate that approximately 60 percent of gifts of securities come from persons 65 and older and that 98 percent of stock gifts come from people over 45.

People give from discretionary income and assets. If current trends continue, 2012 could be the best year for charitable giving in America since the beginning of the Great Recession. Targeted gift development efforts to those who are likely to have benefited from the rebound in household wealth and can make maximum use of current tax incentives could be a beneficial strategy to consider for the remainder of this year.

As a final planning note, a number of scheduled and proposed changes to the current favorable tax environment for charitable gifts may provide an additional incentive for donors to complete gifts before the end of 2012.