With the roller coaster activity sustained by the stock market in the past several months, one might expect some investors, especially those at or near retirement age, to be reconsidering their level of commitment to a market experiencing this kind of volatility. But news reports indicate that the ups and downs of the market have yet to shake the confidence level of most investors. Apparently both long-term and novice investors recognize that markets will invariably go up and down. In addition, many investors recognize that short-term downward fluctuations may even provide opportunities to buy additional stocks at a discount.

Stocks fuel record giving

According to the Giving USA report on charitable giving in America in 1997, gifts of appreciated securities were one of the prime reasons that charitable giving reached an all-time high last year. If the current atmosphere of uncertainty and volatility surrounding equity markets continues this fall, what impact might we expect on charitable giving, and what strategies may be beneficial to planned and major gift prospects in the coming months?

Cashing out of the market

First, those who decide to reduce their exposure in the stock market this fall may well find that they have significant amounts of cash on hand as they take their profits, and in some cases losses, in the market. Some will reinvest in other securities, but many will place their cash “on the side-lines.” For these persons, 1998 may be an excellent time to use some of their gains from the long bull market to complete outstanding pledges and otherwise make larger than usual charitable gifts in 1998.

For the higher income donor, selling off a portion of his or her portfolio may also make it possible to give more this year from a tax standpoint. Because percentage limitations (50% for cash and 30% for securities) are based on AGI (adjusted gross income), as securities are sold and more AGI is generated, it becomes possible to deduct larger amounts that might otherwise have needed to be carried over to future years.

There are, however, much more efficient ways to combine charitable giving with the realignment of investment portfolios.

Three alternatives

We start with the fact that there are really only three possible scenarios for the investment markets–they can go up, go down, or trade at current levels. Each of these different scenarios provides planning strategies that can help your donors meet both personal and philanthropic objectives with gifts of appreciated securities.

If a donor believes that the market is headed downward, one strategy would be to make charitable gifts with appreciated securities and to conserve cash. This strategy would allow the donor to fulfill charitable obligations with “paper profits” that the donor thinks could be eroded by a decrease in the market while, at the same time, preserving cash for other purposes. The donor enjoys a federal, and perhaps state, income tax deduction based on the full value of the donated property, and capital gains tax is bypassed entirely.

If your donor is uncertain as to whether the market will continue to go up or down, you might suggest that, instead of giving cash, he or she consider making outright gifts using appreciated securities. Then the donor can use the cash that might otherwise have been donated to repurchase additional shares of the same stock at today’s value. That way, if investments lose value in a market correction, the donor will have a capital loss to declare for tax purposes. On the other hand, if the markets go up, the donor will enjoy a new, higher cost basis in the stock that “replaced” the donated stock.

If your donor would simply like to reduce his or her position in the market, the donor may want to consider a combination of giving some shares of a stock and selling the remaining shares. This is called a “balanced sale” of the stock.

Take a closer look

Let’s examine how a balanced sale works. Suppose George White owns stock worth $20,000. He invested just $5,000 ten years ago. He believes that the stock is unlikely to increase in value in future years and he would like to sell it. He does not, however, wish to pay capital gains tax of as much as $3,000, leaving him with net sale proceeds of no more than $17,000.

Mr. White is also interested in making a charitable gift of approximately $6,000 while enjoying the greatest tax savings in his 36% tax bracket.

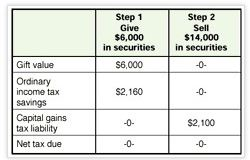

Here is how a balanced sale would help him accomplish both of his objectives.

Let’s examine the chart above.

Note that the $2,160 in tax savings from the gift more than offsets the $2,100 in capital gains tax due on the securities he sold. The tax liability on the portion of the securities that are sold is thus “balanced” by the tax benefit for the charitable gift portion.

Mr. White is able to enjoy cash proceeds of $14,000 and the satisfaction of making a $6,000 gift, a total of $20,000 in value to him, while effectively bypassing capital gains tax liability. Had he sold all of the securities, he would have netted just $17,000 after paying some $3,000 in taxes. Mr. White has thus been able to make a $6,000 gift at an after-tax “cost” of just $3,000.

Converting gains to income

In today’s environment, many donors may wish to use securities that have increased in value in recent years to fund gift annuities, pooled income funds, charitable remainder trusts, and gifts that provide additional income for themselves and/or loved ones for life or other period of time. This can be an excellent way to unlock value from appreciated securities while reducing tax liabilities and providing an additional source of income for the future.

Communication is the key

While these strategies may seem obvious to charitable gift planners, it is doubtful that many of your donors have seriously considered the possibility of combining their personal and philanthropic planning. To help offset the potential negatives of stock market uncertainty and show donors the many positive alternatives that present themselves in today’s environment, it is essential to communicate with key donors and prospective donors this fall about gift strategies that may benefit them. Charitable organizations and institutions that are prepared to assist donors and their advisors with tips about the most effective ways to give securities in today’s economic environment, whatever that may be, will reap benefits in the future.

(Portions of this article are excerpted from the updated booklets “Taking Stock…and Giving It” and “Your Guide to Effective Giving in 1998.” A copy of “Your Guide” is enclosed with this issue of Give & Take. For more information on these booklets, click here or please call 1-800-238-3253)