As the economy continues to recover, the outlook on charitable gifts continues to improve.

The latest U.S. Census figures indicate that inflation-adjusted median household income increased by 5.2 percent between 2014 and 2015. At the same time, the number of people living in poverty decreased slightly by 1.2 percent.

In 2015, median household income rose to $56,516 from $53,718 in 2014. The findings of the report “Income and Poverty in the United States: 2015” may signal a rise in overall giving from individuals as median income levels increase and the number of people below the official poverty rate falls. The spike in income was the largest increase in the past 17 years.

Household Income by Selected Percentile

20th: up to $22,800

20th: up to $22,800

40th: up to $43,511

60th: up to $72,001

80th: up to $117,002

Top 10 percent: over $162,180

Top 5 percent: over $214,462

What does this mean for fundraising?

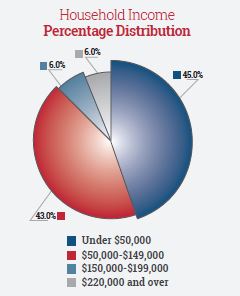

Fundraisers may wish to structure solicitation strategies around factors such as donor income and age. For example, higher-income, wealthy donors aged 70½ or older may respond well to a special appeal concerning the Charitable IRA featuring gifts in amounts up to $100,000. For those in the middle income ranges, suggesting an IRA gift in the $1,000 to $10,000 range may be more appropriate. Those with lower incomes, who are less likely to itemize their deductions, should be advised of the benefit of tax-free IRA gifts as opposed to gifts in after-tax dollars.

Wealthy upper-income individuals aged 55 and older account for the vast majority of gifts of stock; so consider sending that group a special appeal highlighting the advantages of noncash gifts. Finally, if possible include all of your donors in the highest income ranges in an appeal asking for an additional gift at year’s end during the crucial period for charitable giving between Thanksgiving and December 31. ■

Note: Sharpe Donor Data Enhancement Services can help you market more effectively by enhancing your donor records with actionable information such as age, wealth, marital status and more. For more information about Sharpe Donor Data Enhancement Services or other services, contact us at 901.680.5300 or info@SHARPEnet.com.