The most recent figures available from the Internal Revenue Service feature good news for gift planners: Despite a weakened economy, planned giving activity has continued to reach record levels in recent years. IRS analysis of estate tax returns filed for 2001 reveals that charitable deductions totaling approximately $16.15 billion were claimed on 18,711 estate tax returns, an all-time record for both dollar amount and number of estates with charitable dispositions. This occurred in spite of the fact that fewer estates were required to file returns after the filing threshold increased from $600,000 to $675,000 between 1997 and 2001. The number of estate tax returns filed in 2002 can be expected to decrease further as a result of the estate tax threshold increase to $1 million in 2002.

As illustrated in the table to the right, the amount deducted for charitable distributions from the estates of the relatively wealthy grew by nearly 50% over the three-year period from 1998 to 2001, despite the combination of filing threshold increases and economic fluctuations. During the same period, according to Giving USA reports, gifts from living individuals increased by 31%.

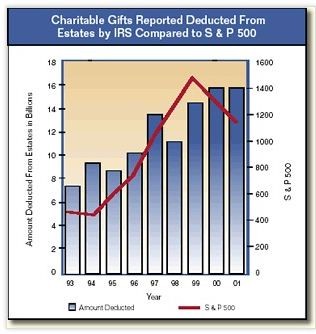

Despite contrary speculation in the press, it is interesting to note that charitable distributions from the estates of the wealthy have continued to achieve record levels even after the stock market peaked and began to decline in the late 1990s. See the chart below comparing charitable bequests reported on federal estate tax returns to the Standard and Poor’s stock market index.

This seeming anomaly may be partially explained by the nature of assets owned by decedents for these years. Most of those leaving charitable bequests die in their later years (IRS reports indicate more die in their eighties than in any other decade of life), and their investments may have been allocated more conservatively than those held by younger persons. The value of fixed income investments, for example, increased substantially during the time period covered by this report.

Looking back over a longer period of time, the aggregate amount deducted from estates filing returns more than doubled in an eight-year period from $7.2 billion in 1993 to $16.1 billion in 2001, and the number of estates taking deductions increased by 68% over the same time period. These figures provide ample evidence that the wealth transfer originally predicted by a number of commentators in recent years is well underway.

Beyond bequests

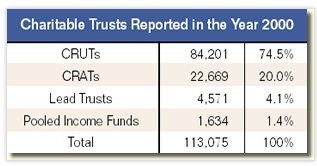

Newly released data from the IRS also shows a steady increase in other planned giving activity as evidenced by the growth in the numbers of various types of charitable trusts. Returns filed for calendar year 2000 (the most recent statistics released) reported information on 113,075 charitable trusts with a year-end book value of approximately $94 billion. Charitable remainder unitrusts were the most common type of split-interest trust, comprising 74.5% of the total. Charitable remainder annuity trusts accounted for another 20%, while charitable lead trusts and pooled income funds accounted for 4% and 1.4% of the totals respectively. See Planning Matters on page 2 for more information on trusts.

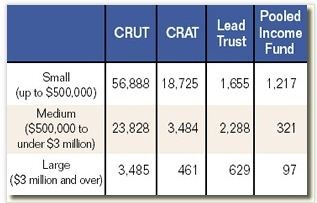

The report categorized charitable remainder trusts as small (assets totaling less than $500,000), medium ($500,000 to under $3,000,000), or large ($3,000,000 and over). The vast majority of charitable trusts fell into the small category.

Over three-quarters of the charitable trusts reported asset values totaling less than $500,000. Fewer than 5,000 of the trusts had asset values $3 million or greater. Annuity trusts and unitrusts held 11.2% and 75.6% of the $94 billion of year-end book value assets. Lead trusts held 11.5% of the book value of the assets, and pooled income funds 1.7%.

The number of annuity trusts reported increased by almost 5% from 21,630 in 1999 to 22,669 in 2000. Unitrusts grew in number by 8% from 78,239 in 1999 to 84,201 for calendar year 2000. The ratio of unitrusts to annuity trusts held steady at just under 80% of trusts in the form of variable income unitrusts. There were 4,571 charitable lead trusts and 1,634 pooled income funds for the same year. Figures for year-by-year number changes were not available for lead trusts or pooled income funds.

Making use of the data

The overall importance of charitable bequests as a percentage of total gift planning activity becomes readily apparent upon examining these figures. Charitable bequests from estates filing returns in a given year typically number two to three times the number of newly reported split-interest gifts. IRS data from 2000, for example, reports 18,711 estates with charitable deductions versus slightly more than 7,000 new split-interest trusts. The revenue from charitable bequests also far exceeds that sup-plied by split-interest trusts. For example, estate tax deductions for the period from 1994 to 2001 ($100.1 billion) exceeds the total asset value of all of the split-interest trusts reported by the IRS to be in existence in the year 2000 ($94 billion). This $100 billion does not take into account the substantial numbers and amount of bequests from the 95% of decedents whose accumulated assets placed them below the newly increased threshold for filing an estate tax return.

It should be noted, however, that while the charitable deductions claimed on estate tax returns are primarily bequests, those figures also include testamentary split-interest gift arrangements. Gifts completed during lifetime that give rise to individual income tax deductions are reflected in total income tax charitable deductions claimed by taxpayers or carried over from prior years by those who itemize their income tax deductions. Thus, it is not possible to statistically account for the substantial increases in gift annuities completed during lifetime now being experienced by many charitable entities, as these funds are not reflected in estate tax deduction figures or in the number and amount of charitable trusts being reported. In fact, because many older persons who fund gift annuities do not itemize their income tax deductions, it is possible that a large number of gift annuities never show up on any public “radar screen.” The message here for charitable gift planners is that that it is important to emphasize both bequests and life income gifts in order to assure continued growth in both gift categories.

The big picture

Despite doom-and-gloom predictions by the popular press for charitable giving in general, and relatively anemic figures on giving reported by Giving USA and others, planned gifts thus far seem to be largely immune from the current economic downturn, as has been the case during past periods of economic dislocation. Charitable gifts completed as part of long-range financial planning tend to proceed on the timetable of individual donors, are to a large extent influenced by events in their lives, and are thus not as dependent on short-term fluctuations in asset values, interest rates, and other economic influences.

History shows that organizations and institutions that continue to build strong gift planning programs year in and year out can count on bequests, split-interest trusts, and other planned gifts to help them continue to achieve funding success during periods of economic stagnation.