There has been much in the news of late about supposed abuses of the tax code by those trying to lower their personal or corporate tax bills. Some in Congress have made it clear that they intend to close loopholes that may have made possible deductions of real property and other noncash gifts at inflated value. Others, including many of those in the nonprofit sector, argue that imposing restrictions on the tax deductions all donors are allowed to take for noncash gifts would severely limit legitimate gifts and pose an undue hardship on America’s nonprofit community. They believe current law is adequate to address abuses and that the root of the problem is inadequate enforcement.

Gifts of noncash assets have increased significantly over the last several years as the value of securities and real estate have risen. In fact, recent IRS data show that almost one-quarter (24%) of all charitable gifts come in the form of noncash property. In 2002, the most recent year for which such data is available, noncash gifts totaled $34 billion—which explains why those on both sides of this issue are highly committed to their positions.

Crunching the numbers

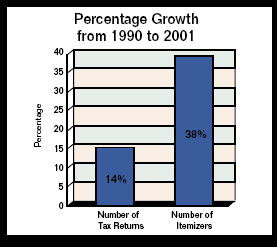

The increase of deductions for noncash gifts is part of an overall rise in the number of persons claiming itemized income tax deductions in recent years. In the 12-year period from 1990 to 2001, the number of taxpayers who itemize rose by 38.5% from just over 32 million to almost 45 million. By comparison, the total number of tax returns over this period grew by 14.2%. While only 28% of taxpayers in 1990 itemized deductions, over 34% of 2001 taxpayers chose to itemize.

The amount of itemized deductions also nearly doubled from 1990 to 2001, rising from $458.5 billion to $884.5 billion. Charitable contributions were the third most common itemized deduction, following deductions for interest and taxes.

Gifts to charity

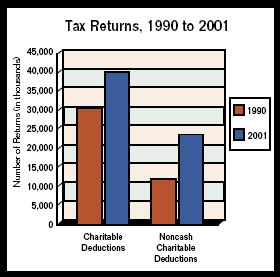

The number of those itemizing charitable deductions rose at an average annual rate of 2.7% from 1990 to 2001. The amount of these deductions grew at a much higher rate of 5.5% (in constant 1990 dollars), even considering 2001, which saw a sharp drop in noncash gifts after investment market declines in the wake of 9/11. Compare these figures to those for noncash charitable deductions. Both the number and amount of noncash deductions grew at an average annual rate of more than twice that for all charitable gifts (including noncash gifts).

Preliminary IRS data for 2002 reveal a continuation of prior trends. The total number of tax returns claiming any sort of itemized deduction exceeded 45 million. The total dollar amount de-ducted by itemizers approached $900 billion. Over 88% of those who itemized deductions, some 40.4 million persons, claimed a charitable deduction, with a dollar amount for these deductions of over $140 billion. Of those returns, almost 60% included noncash contributions, with 24% of the total amount deducted for charitable contributions coming from noncash gifts.

The future of noncash gifts

Most noncash gifts are gifts of publicly traded securities, the value of which is readily ascertain-able. The value of other noncash property, such as real estate, art, and vehicles, is necessarily more subjective. It is the subjective nature of those values that worries some in Congress and explains why some legislators would like to strictly limit deductions for gifts of property other than publicly traded securities. Charities that rely heavily on gifts of real estate would be most affected by these proposals.

As can be seen above, the value of noncash gifts to the nonprofit community is significant and may become increasingly so as real estate values continue to rise in many parts of the country. The fate of noncash gifts currently lies in the hands of Congress. While Congress debates this issue, however, those in the nonprofit community can continue to enjoy and seek out gifts of cash and noncash assets from the loyal donors who form the backbone of American philanthropy.