Encouraging Charitable IRA gifts may be one of the best ways to jumpstart your fundraising efforts early in 2019.

Most fundraising executives are aware of this special giving opportunity available to those age 70½ or older from traditional individual retirement accounts (IRAs). These donors can make gifts totaling up to $100,000 per year directly to qualified charitable interests on a tax-free basis. These direct IRA transfers can also count toward the donor’s annual required minimum distribution amount. This provides a powerful incentive to remind your donors about making Charitable IRA gifts early in the year, before they have taken any taxable distributions from their IRA.

Recent tax law changes that doubled the standard deduction and eliminated or cut back many other deductions will no doubt make IRA gifts increasingly popular for donors who want to support their charitable interests while also reducing their taxes. Additionally, the prospect pool for IRA gifts is growing rapidly as increasing numbers of Baby Boomers reach the age of 70½. Since 2016, nearly 10 million Boomers have qualified to make tax-free gifts from their IRAs, and that number will continue to grow by approximately 3.5 million people per year.

What a typical IRA gift looks like

A survey conducted by the National Association of Charitable Gift Planners shortly after the initial passage of the IRA gift legislation revealed that most IRA gifts were relatively small, but much of the dollar volume came from larger distributions. According to the survey, the average distribution was more than $16,000 even though the most common was $5,000. The second most common amount given was $100,000.

In addition, the study found that the 9% of Charitable IRA distributions greater than $50,000 to a single charitable recipient accounted for more than half of the total dollar value of IRA gifts. Almost 75% of the total amount of IRA gifts reported in this study came from the 17% of gifts that were greater than $25,000, very close to the 80/20 distribution of gift revenue sometimes cited by experts.

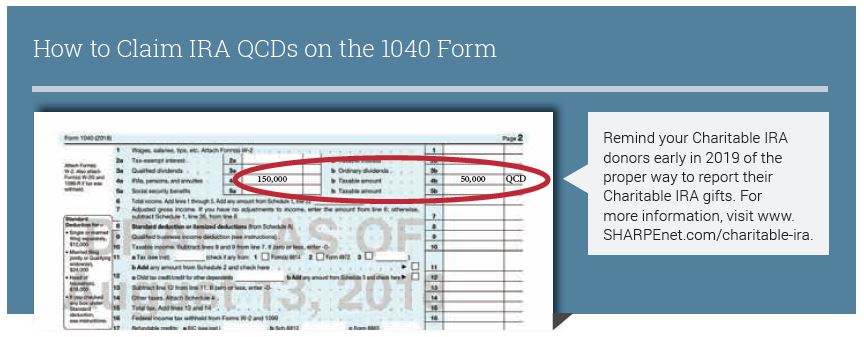

Based on the available data, the Charitable IRA provision seems to hold wide appeal for donors whether they are considering small, medium or larger charitable gifts. Where donor demographics are appropriate, fundraisers should consider developing a Charitable IRA marketing plan for 2019 that includes elements to attract gifts of all sizes but also features a special focus on those whom it is believed may have the capacity to make IRA gifts of $5,000, $10,000, $25,000, $50,000 or even the full $100,000. (See 2018 IRS Form 1040 below for an example of reporting a $100,000 IRA QCD as part of a total withdrawal of $150,000.)

SHARPE newkirk can help you with materials designed to encourage IRA gifts as well as identify your donors most likely to find Charitable IRA gifts attractive. To preview our latest Charitable IRA communication tools, click here. For more information, please contact us at info@SHARPEnet.com or 901.680.5300. ■