The American Taxpayer Relief Act of 2012 (ATRA), enacted by Congress Jan.1, contains a number of provisions that are favorable for charitable giving.

Charitable deduction remains intact

The legislation as passed did not directly limit the tax deductibility of charitable gifts. There is, however, speculation that this issue will resurface in the next round of fiscal negotiations most expect to begin soon.

Pease Amendment returns

The Pease Amendment, which expired in 2010, was reinstated in the tax code. Those who work with higher income donors should be aware of this and be prepared to discuss it if the issue is raised.

Some have commented on the possible negative impact of the return of this provision. In 1991 when the amendment was first enacted, the Sharpe Group predicted little or no effect on giving. Over the subsequent 18-year period the Pease Amendment was in effect, this proved to be the case.

The Charitable IRA returns

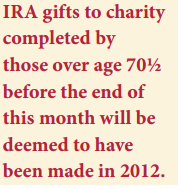

Congress extended the ability to make IRA Rollover gifts in 2013 subject to the same dollar limit ($100,000) and other restrictions in place since 2006, and announced a “January Sale” on gifts made from traditional or Roth IRAs. IRA gifts to charity completed by those over age 70½ before the end of this month will be deemed to have been made in 2012. This means it is possible for those who act quickly to make IRA Rollover gifts of up to $200,000 in 2013.

Higher Income and Capital Gains Tax Rates

ATRA raised tax rates for couples earning $450,000, heads of household earning $425,000 and single filers earning $400,000. Those earning more than these threshold amounts will see additional income taxed at the pre-2001 maximum rate of 39.6 percent.

In the case of capital gains and qualified dividend income, income tax rates increase from 15 percent to 20 percent at the same income threshold amounts that trigger the new 39.6 percent tax bracket. A Medicare contribution tax of 3.8 percent on capital gains, dividends, interest and other unearned income passed in 2010 health care legislation will also come into play in 2013 for those with adjusted gross income over $250,000 ($200,000 for singles and heads of household).

Charitable gifts for this group will be deductible against the higher rates and not limited to 28 percent or 35 percent as had been proposed.

The Medicare contribution tax should not, however, be added on top of income tax to determine the after-tax cost of a gift as the Medicare tax is an excise tax that is paid on affected income and no deductions can be taken against that income.

Taking stock and giving it

With ordinary tax rates as high as 39.6 percent and capital gains tax rates increased to a maximum of 20 percent, the total savings for gifts of appreciated property can be just under 60 percent, a reduction in cost of as much as 20 percent, compared to an 8 percent reduction in the cost of cash gifts.

In addition, for those subject to the 3.8 percent Medicare contribution tax, a gift of appreciated property will permanently bypass that tax as well as the capital gains tax, as no sale takes place that would cause gain to be reportable. The effective tax on capital gain income at the federal level could in this case be as much as 23.8 percent and the total tax savings from a gift could be more than 63 percent. As in the case of cash gifts, state capital gains tax could further increase the savings from appreciated property gifts rather than cash.

Life income gifts

With investment values in many cases having recovered from recession declines and interest rates at record low levels, many donors are choosing to fund charitable gift annuities, charitable remainder trusts and other life income plans. Higher income and capital gains tax rates will make the tax savings available from these plans even more attractive than in the past.

In addition, those who encourage gift annuities, charitable remainder trusts and other split-interest gifts should keep in mind that capital gains and qualified dividend rates remain significantly lower than taxes on other sources of income. Gift annuities funded with appreciated stock and other gifts that result in payments partially in the form of capital gains or qualified dividends will remain attractive to donors who are interested in a predictable source of tax-favored income.

AMT permanently patched

For years, Congress has periodically patched provisions of the Alternative Minimum Tax (AMT) that would otherwise serve to ensnare millions of middle-income tax-payers for whom the AMT was never meant to apply. The AMT effectively eliminates many itemized deductions as part of a recalculation of taxes at a lower minimum rate. Congress acted to permanently raise the income level at which the AMT begins to apply and indexed that level for future inflation.

Some higher income taxpayers will continue to be affected by the AMT. Gift planners should know that charitable gifts have, contrary to what some believe, always been deductible against both the regular and the Alternative Minimum Tax. The difference is that the AMT rate is lower and the tax savings are thus somewhat less. In no case, however, does a taxpayer subject to AMT wind up paying tax on their gifts.

Estate tax changes

ATRA maintains the exemption for both estate and gift tax purposes at $5 million, indexed for inflation ($5.12 million for 2012 and expected to be in the range of $5.25 million for 2013), and raises the maximum rate to 40 percent.

Those who work with donors with substantial estates should continue to emphasize charitable lead trusts and other vehicles that can help charitably minded individuals make gifts while minimizing estate and gift taxes.

Donors who are no longer subject to estate taxes will find they have more discretionary estate dollars newly available to make charitable gifts as they no longer must pay tax on amounts left to non-charitable recipients.

In other cases, older donors who may have planned for charitable bequests as part of their estate distributions and can now expect no estate tax savings may wish to accelerate the bequest and make it in the form of a gift annuity or other life income gift. This will give them immediate income tax savings while increasing spendable income in times of lower interest and other investment returns.

Miscellaneous provisions

Special rules for real property contributed for conservation easements are extended, as is the enhanced charitable deduction for contributions of food inventory and the basis adjustment to stock of S Corporations making charitable contributions of property.

The law also reinstates phase-outs of personal exemptions for higher income taxpayers. This should have little impact on charitable giving except to the extent that the loss of personal exemptions results in somewhat less discretionary income from which to make gifts. The same can be said for the end of reduced payroll tax deductions that for the past two years have resulted in additional discretionary income for millions of donors. The loss of that benefit could also impact smaller charitable gifts by some donors.

A “bird in the hand?”

In the wake of the new legislation, the president and others have mentioned the need to broaden the tax base by limiting or eliminating various deductions. Whatever the case may be, it is likely that further changes in the amount of deductions available, or their value, could be in the offing.

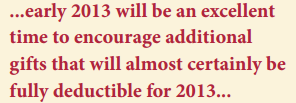

When coupled with the January 31, 2013, deadline for IRA Rollover gifts and the prospect for future limitations of the amount deductible for charitable gifts, early 2013 could be an excellent time to encourage additional gifts that will almost certainly be fully deductible for 2013, if not in future years after the next round of changes.

Because almost every donor will be affected by one or more of the provisions of the new legislation, those who enjoy supporting charitable interests will, as noted at the outset, be relieved to find that a variety of proposed changes that could have negatively affected charitable giving were not included in the 2012 tax act. Now is the time to share the good news with your donors and reap maximum results from this welcome period of certainty, however brief.