The Internal Revenue Service recently proposed new regulations for the ordering of income and other distributions from charitable remainder trusts. These regulations reflect changes made to various tax rates as a result of the 2001 and 2003 Tax Acts, including the rates that apply to capital gains and most dividends. A public hearing is scheduled for March 9 to discuss the proposals—proposals that may result in lower taxes on CRT distributions in the future.

The Internal Revenue Code and Regulations have for years provided guidance on determining the tax treatment of payment distributions to beneficiaries from charitable remainder trusts. Known in the field as the “Tier System,” such distributions are treated as follows:

- First: As ordinary income to the extent that the trust has such income that year, and undistributed ordinary income from prior years. This “tier” of income can be taxed at the federal level at rates as high as 35%.

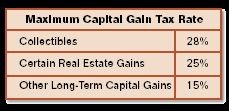

- Second: As capital gain to the extent that the trust has capital gain for the trust’s taxable year and any undistributed capital gain from prior years, including gain “trapped” in the trust at the time appreciated property used to fund the trust was sold. This tier of income is taxed at federal tax rates as low as 15%.

- Third: As other income which is characterized as tax exempt for the trust’s taxable year and undistributed tax-exempt income for prior years.

- Fourth: As a distribution of trust corpus which would also be tax free.

These rules are guided by the general principle that income subject to the highest tax rates should be distributed first. The proposed regulations extend and apply this general principle to different classes and types of income that may exist as “subsets” within some of the previously mentioned four tiers.

This change is in response to the fact that different types of long-term capital gains are now subject to different federal income tax rates. See the chart to the right.

Qualified dividend income is also to be taxed at a maximum rate of 15% applicable to most long-term capital gains.

What this means for gift planners

As a practical matter, this means that the first- and second-tier distributions may now contain income that is subject to multiple maximum tax rates. The first tier (ordinary income) may contain qualified dividend income, which is taxed at a maximum rate of 15%, and all other ordinary income, subject to a maximum income tax rate for ordinary income tax purposes of 35%.

The spread between most capital gains (and dividends) and other ordinary income can be quite substantial and is likely to influence how charitable trusts will be invested and administered. Even if the income recipient is not in the 35% income tax bracket, the savings will still be significant for those in the 25%, 28%, and 33% brackets.

Consider the difference in tax due based upon a $10,000 distribution at the various rates:

Trustees and money managers will undoubtedly see the tax savings opportunities involved and prudently manage these trusts for the advantage of the income beneficiary and charitable remaindermen. This increased emphasis on capital gains and dividends should benefit both groups, even while investing in accordance with the trustee’s fiduciary responsibilities.

All gift planners and professional advisors should closely follow the progress of the IRS’s proposed regulations and then adjust their marketing and asset management strategies accordingly. Whatever the outcome, the role of gift planners remains to find the most productive and beneficial way for donors to make gifts to the organizations and institutions whose causes they support.