Using a Wholistic approach, we know how to structure a planned giving program and develop strategies based on our more than 50 years’ experience that help organizations raise large gifts.

If you are beginning a planned giving program or your existing program needs a check-up, talk to us about a planned giving program audit. Our consultants will perform a comprehensive review of your organization’s strengths and weaknesses. Audits are a way of discovering valuable information that can help drive your current and future marketing and donor cultivation efforts.

Sharpe’s Planned Giving Program Audits are scalable, depending on your organization’s size and needs and may include:

- Interviewing staff and senior management.

- Comparing the organizational experience with industry norms, paying special attention to realistic income potential that would help determine the appropriate scope of planned gift development efforts.

- Evaluating marketing materials and communication strategies to determine if they are appropriate and effective for donors.

- Analyzing a series of multi-dimensional database reports to determine if gifts and estates are being handled systematically and proactively.

- Studying estate administration and gift acceptance policies and suggesting improvements where appropriate.

- Examining age and demographics of current and deceased members of a donor recognition society to determine effective stewarding practices.

- Reviewing and analyzing an appropriate number of realized bequests to determine important metrics, such as how many other charities are named in estates, whether any appear repeatedly and the ratio of residual to specific bequests.

- Making a projection of reasonable gift planning potential.

Click here to learn more about how a planned giving assessment can benefit your organization. ■

STRATEGY & TACTICS: Create Your Plan & Implement Your Plan

STRATEGY & TACTICS: Create Your Plan & Implement Your Plan

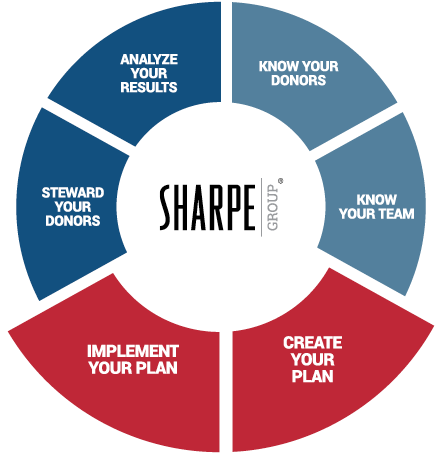

An important part of charting any journey is knowing where you’ve been, where you are now and where you want to go. Because we know every organization will answer those questions differently, we recommend starting with a planned giving program audit. (See “Timing Is Everything: The Planned Giving Program Audit and Review.”) From there, the strategies and tactics your organization needs will become clear.

Sharpe Group will help you create a strategic marketing plan and can coach and mentor you and your team throughout the process to help secure large gifts, including drafting gift acceptance policies. And when it’s time to implement your plan, we offer:

Ongoing technical support.

Customized training for staff and board.

Charitable Giving Tax Service and The Advisor eNewsletter.

For more information contact us. ■