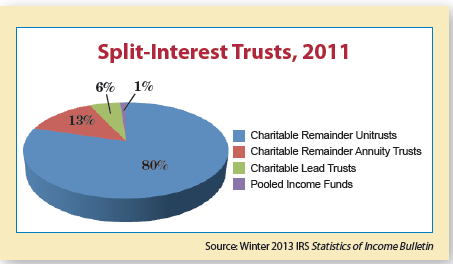

Under the provisions of the Internal Revenue Code and Regulations, several types of so-called “split-interest” trusts can provide tax benefits to charitable donors. Two of the most popular are charitable remainder annuity trusts and charitable remainder unitrusts, often referred to as CRATs, CRUTs or collectively as CRTs. These trusts were incorporated into federal tax law as part of the Tax Reform Act of 1969. While annuity trusts and unitrusts are similar in many respects, fundraisers need to be aware of the unique properties of each so they can ensure donors select the trust that best suits their needs.

Coming to terms

Both annuity trusts and unitrusts may be established to last for one or more lives, for a term of years not to exceed 20 years or for a permissible combination of a life or lives and a term of years. For example, a trust for one or more lifetimes plus 20 years is not per-mitted, but a trust arrangement for one or more lives or 20 years, whichever is longer or shorter, is allowed.

Payout rates

Both annuity trusts and unitrusts have a mini-mum payout rate of 5 percent and a maximum payout restriction of 50 percent. They typically pay between 5 and 8 percent unless they are set to run for a relatively short term of years.

An annuity trust must distribute a fixed amount from the trust at least annually with no fluctuations from year to year based on its actual earnings. The payout from a unitrust is, on the other hand, a fixed percentage of the value of the trust principal as determined each year. As a result, the actual amount a donor receives from a unitrust can change from year to year with underlying investment performance.

There are several types of unitrusts—a straight payment unitrust, a net-income unitrust that pays the set percentage or the actual income (whichever is less), a net-income unitrust with a provision to make up any annual payment amounts less than the set percentage in future years when the trust may earn more than that amount, and the so-called “flip” unitrust. A flip trust begins as a net-income-payment unitrust and then converts to a straight-payment unitrust after the occurrence of a provision stated in the trust document. Examples of flip provisions include the birth of a child, a death or a change in marital status.

Taxation tiers

The payments from charitable remainder trusts are governed by the IRS code and treasury regulations and are generally taxed based on a series of four tiers. Payments are taxed in the same manner as they were earned by the trust. The nature of the income is not prorated. For example, payments are taxed first to the extent they represent interest and other ordinary income earned by the trust, second as capital gains income, third as tax-exempt income and fourth as a tax-free return of principal. As a practical matter, most charitable remainder trust payouts are categorized as coming from tier I (ordinary income) or tier II (capital gains income).

It is important to note that charitable remainder trusts are often funded with securities and certain other assets that have increased in value since they were acquired because a gift to a charitable remainder trust is not considered a sale for tax purposes. The tax-exempt trust can subsequently sell the asset free of capital gains tax, and the entire amount is available to produce payments. As noted above, however, capital gains tax is due to the extent a beneficiary receives payments that were funded from capital gains realized by the trust. That can be a good thing, however, as capital gains tax rates are generally lower than the rate paid on interest and other ordinary income.

Deducing deductions

When a charitable trust is established, a calculation is performed in accordance with IRS rules and regulations to determine the amount that qualifies as a charitable income tax deduction for tax purposes. Depending on the circumstances, there may also be gift and estate tax considerations.

To qualify as a charitable remainder trust under IRS rules, the amount of the charitable deduction must be at least 10 percent of the amount transferred to the trust. As a general rule, the higher the trust payout and the longer the anticipated term of the trust, the smaller the charitable deduction. The gift calculation also uses the Applicable Federal Midterm Rate (AFMR), a “discount” rate that is tied to federal interest rates, which fluctuate monthly. Gift planners may use the current month’s rate or elect to use the rate from either of the two previous months. The low AFMR in recent years has generally resulted in lower charitable deductions for charitable remainder trusts, particularly annuity trusts. Other rules require that there cannot be more than a 5 percent chance that an annuity trust will exhaust its funds prior to termination.

Donor benefits

By combining their personal and philanthropic objectives, donors who establish charitable remainder trusts can enjoy these benefits:

- Donors receive a current income tax deduction for a portion of the amount used to fund the trust.

- Donors may receive payments based on the full proceeds of the sale of appreciated assets without realizing capital gains tax at the time of the gift to produce income for the trust term.

- Trust payments may be reported for income tax purposes more favorably than ordinary income. Some payments that are categorized as capital gains may be taxed at the recipient’s current rate, which is often lower in retirement.

- Charitable trusts are tax exempt, so sales within the trust are not taxable until distributed to a taxpayer.

CRT crystal ball

The recovery of wealth levels for affluent Americans, particularly those with highly appreciated stock, the return of higher tax rates on upper income individuals and the swelling ranks of retirees (10,000 baby boomers are retiring every day) are all contributing to the most favorable environment for the creation of charitable remainder trusts in more than a decade. Fundraisers who understand the fundamentals will be able to show prospective donors how establishing a charitable remainder trust can help them meet their personal, financial and charitable goals.