Editor’s note: In this issue we introduce “Planning Matters,” a new monthly Give & Take column. This new column will feature a broad range of gift and estate planning topics, including ideas, developments, and tax issues that affect all those involved in charitable gift planning efforts. We trust you will find this and upcoming “Planning Matters” columns informative and useful.

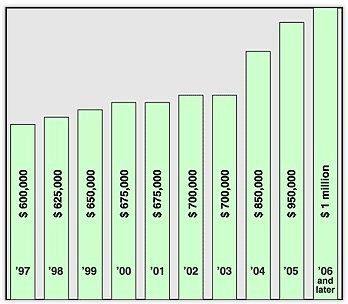

The next step in the planned phase-in of gift and estate relief provided for in the 1997 Tax Act will be ushered in with the New Year. The 1997 Taxpayer Relief Act provided for the expansion of the unified gift and estate tax over a nine-year period of time from a $600,000 exemption equivalent to $1 million for individuals and from $1,200,000 to $2 million for couples.

For the year 2000, the amount increases from $650,000 from $675,000. The estate tax exemption gradual phase-in is scheduled to be completed by 2006. The chart below details the amount that can be given tax-free or at death to family and friends each year.

In addition to the above amounts, remember there is also an unlimited deduction for qualified gifts to spouses or charities at death. Apart from the unified credit provisions, up to $10,000 (known as the “annual exclusion amount”) may be given to any number of persons each year. The 1997 Act provided that this amount would be indexed for inflation to the nearest $1,000. No adjustments have yet been made in the $10,000 amount, as inflation has been relatively low since 1997.

From a charitable gift planning point of view, this gradual phase-in provides a number of opportunities to encourage donors to review and revise their gift and estate plans in light of changes in the nation’s tax laws.