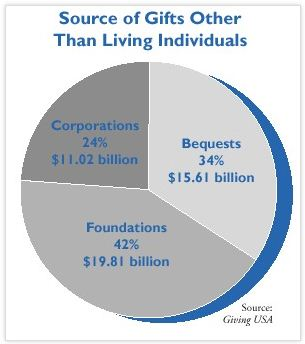

Two recently released reports show that planned giving income continues to grow at a rapid rate. According to Giving USA, bequests grew to $15.6 billion, up more than 14% from 1998 figures. Bequests grew at double the rate of increase in lifetime giving from individuals, which saw 7% growth. Income from bequests was some 37% more than giving by corporations and amounts to nearly 80% of the total distributed by foundations. See the chart at right for a breakdown of sources of gifts from other than living individuals.

Preliminary annual estimates of charitable giving in America were released by the AAFRC Trust for Philanthropy in late May and will be published later this year.

Gifts from all sources were cited at more than $190 billion, a rise of 6.7% over 1998 giving figures. Bequests thus grew at more than twice the growth of overall giving.

The Giving USA figures indicate that the transfer of wealth predicted to occur in the early part of the 21st century continues to accelerate with charities enjoying the benefits in the form of increased bequests. Life income gifts are not reported separately in the Giving USA statistics and they are not part of the reported bequest totals. (See page 5 for indications of trends in trusts and other deferred gifts in the field of higher education.)

Bequests are widespread

The Internal Revenue Service recently released data indicating that some 17.3% of persons who died with taxable estates (currently estates over $675,000) made use of the charitable deduction. This amounted to some 15,000 persons. Recent studies of local probate records as part of local Leave A Legacy TM programs indicate that in the range of 5% to 10% of all persons who die include charitable dispositions in their wills and other plans. Approximately 2.5 million persons die each year. This would suggest that somewhere in the range of 200,000 persons leave bequests to charity each year. Thus, indications are that 90% or more of those who leave assets to charity via their wills and similar plans receive no tax benefits for doing so. As there is also no income tax deduction, income stream, or other financial benefit associated with bequests, experienced gift planners have found over the years that the best indicators of those who will leave estate gifts has been a history of contribution of time, money, or other resources to a particular cause.

It is important to note, however, that the relatively few persons who traditionally leave assets to charity from taxable estates account for a disproportionately large total percentage of the total amount left to charities.

Final thoughts

The Giving USA report is further indication of the importance of active planned gift development efforts. Early indications are that the rapid growth in planned gift income is not across the board but is concentrating in those organizations that have actively and effectively pursued this source of funding. For more information on Giving USA, contact AAFRC at 1-888-5-GIVING or visit their Web site at www.aafrc.org.