It is common for charitable organizations and institutions that rely on charitable gifts for a substantial portion of their funding to have guidelines in place regarding the types of gifts that will be accepted—and for what purposes they may be restricted. But in order for such policies to be effective, they must be appropriate for both the particular organization and the current economic environment. Well-thought-out gift acceptance policies are especially important for programs that actively encourage gifts through bequests and other long-term gift planning opportunities such as gifts of real estate and other non-cash property.

Special attention to property gifts

In recent years, as investment markets have fluctuated and real estate values have fallen in many areas, a number of programs have had donors express increased interest in gifts of real estate in lieu of cash and other property. Now more than ever it is important to have policies in place that can make it easier to quickly distinguish between desirable gifts of homes and other real estate and those that may be problematic. For that reason, many organizations are taking a fresh look at real estate gift acceptance guidelines. In times when organizations are receiving gifts such as a single baseball card worth over $200,000 (see the February 2011 issue of Give & Take), it can be wise to have policies in place to ensure an organization is prepared to accept such gifts where appropriate.

How much is enough?

Lower interest rates and yields on other investments have led some programs to review their policies on the maximum payout rates allowed for charitable remainder trusts and lead trusts. These and other plans can suffer unacceptable levels of encroachment on principal if payment rates are too high. Many donors choose their own trustees to administer these trusts, thus shifting the burden of managing assets in a way that meets payment requirements away from the charitable party. Even in such cases, however, it is still important to determine acceptable payout rates since they can have a bearing on the amount of recognition donors will receive in the context of capital campaigns and other development initiatives.

Who can propose what?

It may also be necessary to alter default values in software used to project benefits for donors so that they reflect lower total return assumptions. More and more organizations are restricting who is authorized to set investment return assumptions in gift illustrations. Failure to do so can result in the embarrassing situation where a gift acceptance committee rejects a gift offered in response to a development officer’s proposal!

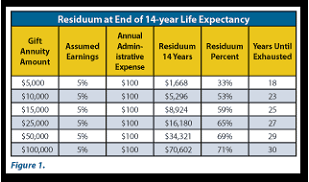

Administrative expenses may also necessitate adjustments to the minimum amounts necessary to fund a particular gift. For example, assume that the fixed cost of administering each gift annuity for a particular organization is determined to be $100 per year. For a $10,000 gift annuity, that amounts to 1% of the initial gift annuity amount. For a $5,000 gift annuity, however, that is 2%.

The organization also believes it can earn a net total return of 5% on the annuity reserve funds. If the organization pays the 6.4% rate recommended by the American Council on Gift Annuities (ACGA) for a 75-year-old, then a $10,000 gift annuity that costs $100 per year to administer should result in a residuum amount of just under $5,300, or 53% of the amount transferred, assuming the donor lives 14 years. ACGA rates are designed to yield an average residuum of 50%, so this is in keeping with the desired outcome.

Suppose, however, that the organization accepts a gift annuity in the amount of $5,000. As we can see from Fig. 1, because the assumed expense of $100 per annuity is fixed and applies to gift annuities regardless of their amount, the residuum for a $5,000 gift annuity would be significantly less than the target amount and the annuity funds are exhausted if the donor lives just four years past the 14-year life expectancy. Considerations such as these should come into play when deciding minimum gift annuity amounts.

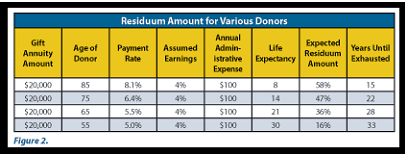

Future earnings assumptions must be taken into account as well when  setting minimum ages for gift annuities and similar plans. Note that as long as earnings assumptions of 5% are met and administrative expense is maintained at $100 per gift annuity, there is no problem achieving or exceeding a 50% residuum amount for older donors. If investment returns were to fall to a net of 4%, however, just 1% short of expectations, residuum percentages remain in acceptable ranges for older donors but may fall into negative territory for younger persons (see Fig. 2).

setting minimum ages for gift annuities and similar plans. Note that as long as earnings assumptions of 5% are met and administrative expense is maintained at $100 per gift annuity, there is no problem achieving or exceeding a 50% residuum amount for older donors. If investment returns were to fall to a net of 4%, however, just 1% short of expectations, residuum percentages remain in acceptable ranges for older donors but may fall into negative territory for younger persons (see Fig. 2).

Note that under these circumstances an 85-year-old can live to nearly twice his life expectancy without exhausting the underlying funds. In the case of a 55-year-old, the gift annuity residuum will be just 16% and the funds underlying that gift annuity will be exhausted should the donor live just three years beyond the 30-year life expectancy.

Gift acceptance policies should thus take into account a number of factors including earnings assumptions, administrative expense levels, the expected time period until receipt of the gift, and others when setting minimum gift amounts and ages for various gifts. Some programs may need to adjust policies that were set at a time when different assumptions were appropriate.

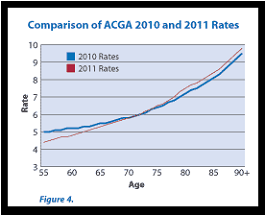

In the case of gift annuities, recent changes in ACGA recommended rates to take effect July 1, 2011, take into account the greater level of risk over time for younger gift annuitants as well as the impact on present value of the residuum for younger donors (see Fig. 3).

Note that the rates represent little or no change for donors in the 70 to 74 age range. Rates are lowered somewhat for persons under 70 and raised for those over age 74 (see Fig. 4). The largest rate increases are in the 79 to 82 age ranges where the bulk of gift annuity activity takes place. In fact, an ACGA study reveals that 81% of gift annuitants are over the age of 75.

These changes should be helpful to those who wish to limit gift annuities issued to younger donors, as the rates are now skewed in ways that make those gifts less attractive.

Examining restrictions

Experienced fundraisers know that donors will often give more when they are involved in deciding how the funds will be used. Organizations that do not allow donors significant input in how their gifts are used can find it difficult to raise large amounts from relatively sophisticated donors.

But just as the economic landscape changes over time, so do organizational needs. In prosperous economic times when an organization is experiencing steady increases in funding, it may be possible to allow a broader range of restrictions on gift dollars than is possible in more challenging economic times. For this reason, sections of gift acceptance policies that address permissible restrictions and minimum amounts required to place restrictions on gifts may also need to be examined periodically.

It can be helpful to take a proactive approach. Rather than overly limiting restrictions on gifts, a better strategy may be to “carve out” a number of areas of interest to broad groups of donors. Based on various mission components, areas of geographic emphasis, or other discreet “thought sectors,” such policies can lead donors to an adequate level of comfort regarding the use of their gifts without unduly restricting them.

Also, consider incorporating a statement that enables donors to approve language that would allow the chief executive officer or other appropriate party to alter the use of funds with the approval of the board or other governing body. This will cover instances where a particular program or service for which funds are restricted is either overfunded or is no longer needed.

Keeping the peace

Besides controlling costs and helping to channel funds to appropriate areas of program emphasis, well-considered and current gift acceptance policies can also help maintain harmonious staff relations and foster better relationships between donors and those assigned to steward relationships with them.

By involving staff from development, finance, program administrations, and other areas of organizational management along with volunteer leadership from the board in the process of creating and reviewing gift acceptance policies, a spirit of teamwork and mutual understanding can be created and maintained over time. Those who are not involved in the day-to-day activities of fundraising can gain a greater understanding of what drives the development process before the gift is completed. Likewise, those who work directly with donors can gain a different perspective on the issues faced by those who must meet the expectations of donors after the funds are actually received.

Policies that are rooted in consensus of management and voluntary leadership and reduced to written form can also be very beneficial in helping to preserve relationships with donors when a gift must for one reason or another be rejected. If the donor can be furnished with written policies, it is much easier for the fundraiser “on the ground” to handle any negative reactions. Written policies remove focus or blame from the contact person and make it clear that the rejection of their particular gift is the result of policies that had been considered and determined in the past. A donor may even gain a greater respect for the professionalism of an organization that is prepared to quickly respond to an offer to make an unusual gift.

Finally, gift acceptance policies can be an excellent tool for training new and existing staff. After updating policies each year, consider holding a series of staff training sessions to explain any changes. New staff will gain confidence, and veterans will feel reassured that their management is in tune with the times. All staff will feel that your organization has taken all steps possible to assure that they can relate to donors in a way that communicates a commitment to the highest levels of service and excellence.

Editor’s note: Learn more about gift acceptance policies and other important issues in Sharpe’s popular seminar “Integrating Major and Planned Gifts.” See Page 7 or www.sharpenet.com/seminars for details on this seminar and a listing of all Sharpe seminars in 2011.