After a dip last summer, the stock market rebounded in the fall and has reached record highs in the new year. As a result, many donors may feel more confident in the state of the economy and in their own financial circumstances. Indeed, net household wealth reached a record level in 2006, approaching $54 trillion. But how will this greater sense of security translate to the charitable giving world? The best guess as to what can be expected in the next few months might be gathered by looking at the past.

The Roaring ’90s

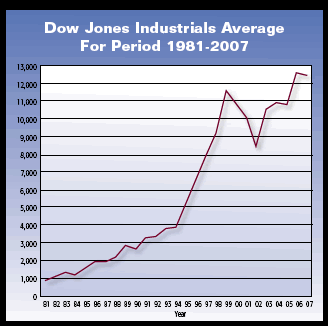

In the mid-1990s, investment markets were growing rapidly as the economy recovered from the recession that clouded the early 1990s. In a landmark moment, the Dow Jones Industrial Average closed above 5,000 for the first time in November 1995, and the Dow was predicted to reach 10,000 by the year 2000.

A growing number of individuals felt jubilant about the surge in stock prices. But that optimism was tempered by lingering doubts about whether those levels could be maintained. Many felt that a stock market correction was not merely a possibility on the distant horizon but a certainty for the near future.

A correction and recovery

Despite a number of overvalued stocks, the market continued to march upward in the 1990s. Exceeding most experts’ predictions, the Dow first closed above the 10,000 mark on March 29, 1999, and reached its highest point of 11,722 on January 14, 2000.

The market upswing of the second half of the 1990s resulted in a positive effect on charitable giving. When the Dow was at its highest, gifts of appreciated securities, in particular, became increasingly popular for a broad group of donors. As a consequence, many development officers took it upon themselves to become more familiar with a variety of gift planning strategies that feature special benefits when funded with appreciated, low-yielding securities.

But things soon changed. After reaching its peak, the Dow experienced a significant correction, eventually falling below 7,300 in October 2002.

After the stock market retreated from its high point, the number of gifts of securities from living donors dropped off dramatically in 2003. Soon bequest receipts began to show slower growth or declines as well in large part due to lower investment asset values weighing on the size of residuary estates.

Last fall, the Dow and other stock indexes began trading at the highest level seen in years and soon may be reaching new highs in addition to the Dow trading above the 12,500 level in January 2007. In this environment, many charitable organizations may see renewed interest from donors in gifts funded with appreciated securities. Unfortunately, some fund-raising executives, particularly those new to the field, may be “rusty” or completely unfamiliar with both basic and more advanced planning strategies utilizing securities.

Why donors appreciate gifts of securities

The combined tax savings of the charitable deduction and avoidance of capital gains tax may attract donors to gifts of appreciated securities. Gifts of publicly-held stocks and bonds that have been held for more than a year (long-term) offer the greatest benefits.

Some have speculated that the lower income and capital gains tax rates brought about by tax law changes might reduce the attractiveness of gifts of appreciated assets. While it is true that donors will not receive the same level of savings that were available during the last period of record high market valuations, consider the situation of tax-payers planning gifts under the current rules. For them, the additional capital gains saved by “giving a paper profit” that has never been taxed continues to hold great appeal. In fact, some major donors may be surprised to discover that they may be able to give more today at a lower after-tax cost!

A case in point

Consider a donor who gave a $10,000 check to charity in the past when he or she was subject to the highest ordinary income tax rate of 39.6%. The after-tax cost of making the gift was $6,040 ($10,000 – $3,960), assuming it could all be deducted in the year of the gift. Under current tax rates given the highest marginal tax bracket of 35%, the after-tax cost of the cash gift has increased by $460 to $6,500 ($10,000 – $3,500).

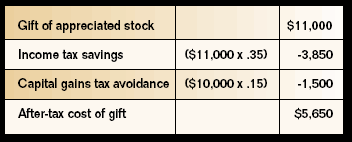

Suppose the donor identifies a highly appreciated stock that had been purchased for $1,000 and is currently valued at $11,000. The after-tax cost of the gift is determined by subtracting the tax savings from the charitable deduction and the capital gains tax that is avoided. Here’s how the numbers work:

From an accounting standpoint, the cost of this $11,000 gift is lower than a $10,000 cash gift. Obviously, the exact savings will depend on the donor’s tax bracket, basis in the security, and other factors. State taxes can in some cases affect the after-tax cost of cash and property gifts as well. This example serves as an illustration of the attractiveness of gifts of appropriate appreciated assets as compared to cash. Our current environment may thus lead an even broader group of donors to consider gifts of appreciated assets.

Beyond outright gifts

In addition to their appeal for funding outright gifts, appreciated securities can also be an attractive choice for funding a variety of deferred gifts such as gift annuities and charitable remainder trusts. While income tax deductions are based on a percentage of the full value of the assets contributed, capital gains tax on long-term appreciated property is partially avoided and/or delayed at the time of the gift. On the other hand, distributions from these arrangements that are categorized as long-term capital gain or qualified dividends are likely to be taxed at 15% rather than at rates as high as 35% on other sources of income.

Some planned giving donors who had previously established a bequest or other simple remainder gift may wish to consider a life income gift in addition to or in place of the original charitable bequest. Those who already have charitable remainder unitrusts may want to add them or fund additional gift annuities as the case may be.

With reduced estate taxes for most individuals, current tax and income planning may be increasingly important. For example, donors who had previously included a charity in their wills for $25,000 may find that a charitable gift annuity funded with appreciated securities can provide attractive payments for life and create current income and capital gains tax savings as well.

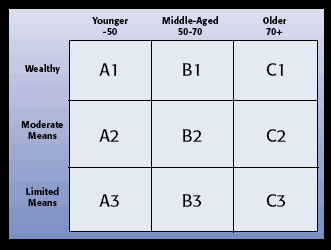

A number of other planning strategies exist that help meet personal and philanthropic goals using gifts of appreciated assets, but charities must inform the donor and advisors about them or this opportunity may be lost. The Sharpe Gift Planning Matrix™ (at right) can be of assistance in identifying those potential donors.

Generally speaking, prospects for outright gifts of securities will tend to fall across the top of the Matrix, as such gifts are tied to wealth and not necessarily to the age of a donor. While most prospects for gift annuities and charitable remainder trusts for life will be found in the C1 and C2 boxes, younger persons of means may wish to fund a trust for a term-of-years or for the life of an older loved one. Charitable gift annuities for the life of the donor and/or spouse will primarily be funded with appreciated assets by those in the C1, C2, and C3 boxes. Gift annuities funded for persons other than the donor or spouse will not normally be funded with appreciated assets, as doing so would result in immediate realization of a portion of the capital gain.

Communicating the benefits of giving appreciated assets at this time will be a key component of successful programs. Consider providing your constituents information that explains the opportunities available to them through a gift of appreciated securities.