The Rates Committee of the American Council on Gift Annuities (ACGA) recently announced an increase in the suggested maximum rates payable for charitable gift annuities at the 33rd ACGA Conference in Seattle April 25-27, 2018.

The Rates Committee of the American Council on Gift Annuities (ACGA) recently announced an increase in the suggested maximum rates payable for charitable gift annuities at the 33rd ACGA Conference in Seattle April 25-27, 2018.

The new rate table was subsequently released with a suggested July 1, 2018, effective date. According to ACGA surveys, 97% of charitable organizations offering charitable gift annuities usually or always follow the recommended rates, which are designed to result in approximately 50% of the initial gift remaining at the death of the payment recipient(s). Recent ACGA surveys found the actual residuum for terminated annuities to be in the 62% to 64% range over the past ten years. This underscores the conservative assumptions underlying the rates.

The suggested rate changes are based on an earnings assumption of 4.75% (up from 4.25%) assuming the ACGA allocation of cash, equities and fixed income investments and a 50/50 age distribution between men and women and quarterly payments at the end of the period.

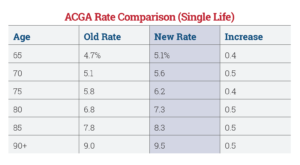

The suggested rate change will be in the 0.3% to 0.5% range depending on the annuitant’s age and is expectedto have a positive impact on charitable gift annuity activity nationwide. See the rate chart below for representative changes.

A chart with additional rates and a comparison to older rates is available here.

All Sharpe marketing materials have been updated with the new suggested rates and are available for use by July 1, 2018. Brochures, booklets and newsletter content are also available with the new ACGA rates or may be customized based on a client’s needs. For more information or to order updated gift annuity brochures or booklets, click here. ■