According to various industry studies, charitable gift annuities are the second-most popular planned giving strategy after bequests. Although very popular due to their relative ease of use with donors and planned giving professionals, the economics of gift annuities and their attractiveness when compared to traditional investment alternatives can some-times be a mystery.

Defining the gift annuity

In a nutshell, a gift annuity is a gift planning alternative that provides regular, fixed payments to a donor as part of a gift exchange. Payments from gift annuities are normally structured for the life-time of the donor and, in some cases, another beneficiary.

Typically, the gift is one of cash or securities, but due to the tremendous increase in value of real estate there has been a growing interest in funding gift annuities with real estate. Following recent legislation in the state of New York, all states now permit the use of real estate to fund a charitable gift annuity.

While gift annuities are usually marketed to donors as a practical way to make a larger gift, donors are sometimes encouraged to look to a gift annuity as an alternative source of higher income rather than a commercially available fixed-income investment such as tax-exempt bonds, corporate bonds, Treasury bonds, or a commercially issued lifetime annuity. Unfortunately, this may not be the wisest way to communicate the benefits of gift annuities. Let’s see why.

The features of a commercial annuity

The gift annuity is perhaps most akin to commercially available annuities issued by insurance companies. When comparing commercial annuities to gift annuities, commercial annuities will almost always pay higher rates. It is important to know that there are a number of variations on the structure of commercial annuities, and it is vital to compare “apples to apples.”

The following is a summary of the most common options available for commercial annuities:

Straight Life Annuity: Provides a guaranteed income for the balance of the annuitant’s life. This option provides the highest income to the annuitant(s). At the death of the annuitant(s), the insurance company retains any balance remaining of the original investment. The risk of ‘running out of money’ due to longevity has been transferred to the insurance company. Conversely, in the event of earlier than normal death, the insurance company enjoys a windfall. This option can be for a single life, or for a Joint and Survivor, meaning that as long as one of the annuitants is alive the insurance company will continue to pay an income until the survivor dies.

Life Income-Installment Refund Option: Like the straight life option, the installment re-fund annuity will pay an income for the balance of the life/lives of the annuitant(s). However, if the annuitant(s) dies before receiving the original investment back, a named beneficiary(ies) will continue to receive payments until such time as the entire amount transferred to fund the annuity has been recouped.

Life Income with Period Certain: The annuity will pay an income for the life of the annuitant, but in the event of the death of the annuitant before the ‘period certain’ number of years expires, payments will continue to another named beneficiary(ies) for the balance of any guaranteed time period. The longer the ‘period certain’ years, the lower the income will be.

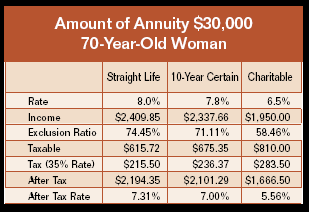

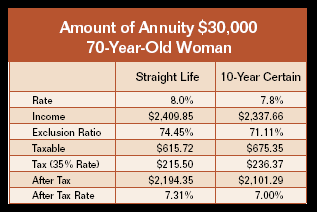

The chart to the right compares the payments to a 70-year-old woman from a straight life annuity to a 10-year certain annuity payout option, assuming a $30,000 annuity.

Note that, as might be expected, the straight life commercial annuity that pays only for the life of the annuitant pays more than the 10-year certain annuity that guarantees payments will last for at least 10 years regardless of when the person passes away.

How is a charitable annuity different?

Immediate payment charitable annuities, on the other hand, come in just one form: the “straight life” annuity. The donor transfers funds to a charity that agrees to make fixed payments for however long that person might live. If the donor dies earlier than his or her life expectancy, the charity receives more than would otherwise be expected. Conversely, if the donor lives past normal life expectancy, payments continue. Payments are structured so that, on aver-age, approximately 50% of the amount funding the gift annuity remains as the “residuum” at the death of the annuitant(s).

In the case of the 70-year-old above, under the gift annuity rates recommended by the American Council on Gift Annuities (ACGA), the donor would receive 6.5% for life. That is substantially less than the 8% she would receive from a straight life commercial gift annuity. As the chart on the right illustrates, her after-tax income from the gift annuity is less than what would be received from either of the two types of commercial annuities illustrated above.