In 1999 the IRS conducted the first of what will be annual studies of charitable remainder trusts (CRTs). The information, contained in the winter issue of Statistics of Income Bulletin, focused on data from the 1998 reporting year.

For 1998, a total of 85,060 information returns were filed by charitable remainder trusts. It should be noted that these returns represent all CRT filings for the year, not just new charitable trusts.

Charitable remainder unitrusts (CRUTs) outnumbered charitable remainder annuity trusts (CRATs) by a ratio of three to one. These figures tend to confirm the results of surveys conducted by the National Committee on Planned Giving and others.

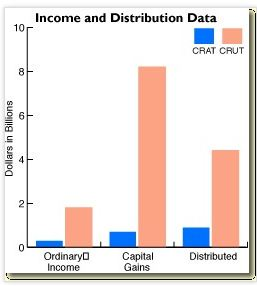

These returns contained additional information concerning the size, income, distribution, and accumulations of charitable remainder trusts. See the chart at right for additional income and distribution data. It would appear from these figures that a significant portion of the payments from CRTs came in the form of distributed capital gains.

These returns contained additional information concerning the size, income, distribution, and accumulations of charitable remainder trusts. See the chart at right for additional income and distribution data. It would appear from these figures that a significant portion of the payments from CRTs came in the form of distributed capital gains.

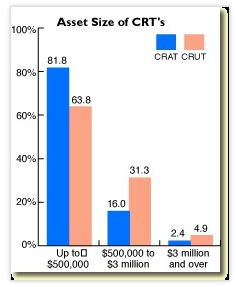

The most important data was related to the size of CRATs and CRUTs. Trust statistics were divided into three categories: small, medium-size, and large. Over two-thirds of all trusts reporting had assets less than $500,000. Less than 5%, or 3,641, had assets greater than $3 million. Slightly over one-quarter, or 23,530, of the trusts were in the size range between $500,000 and $3 million.

Final analysis

Based on the results of the recent NCPG survey, we know that the largest number of CRTs are initiated by the donors’ advisors, that most are not administered by the charity they benefit, and that seven out of ten CRT donors retain the right to change the charitable beneficiary of their trust. Increasingly from a charitable recipient’s perspective, the receipt of the remainder from a CRT is becoming little more certain than a gift by charitable bequest. For this reason, it is increasingly important to engage in marketing efforts designed to discover bequest expectancies and include a way for donors to inform you that they have included you in their wills or “other long-range plans.” This is the only way many will be able to discover the fact that they may have been included as a remainder beneficiary where a donor has retained the right to revoke the gift in the future. Gift planners may thus be well advised to identify, cultivate, and steward CRT expectancies in much the same manner as potential bequest donors. Keep in mind also that campaign crediting guidelines that govern bequest expectancies may need to be modified to include charitable remainder trusts where the remainder interest is revocable.