The Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) made a number of significant changes in the way that estate and gift taxes are applied. Until the recent changes were enacted, federal tax law had, since 1976, approached gift and estate taxes on a ‘unified’ basis. This meant that the same rates of tax applied whether gifts were made during lifetime or at death. For the year 2001, for example, a person can give away up to $675,000 during life, or as part of distributions from an estate, completely free of federal estate or gift tax.

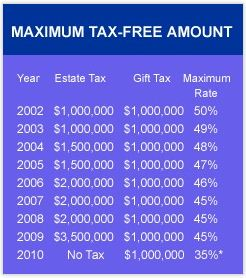

Under the terms of EGTRRA, however, the system will soon be changing. Beginning in 2002, the amount that can be given away during lifetime will be raised to $1 million. Amounts that can be left at death will also increase to this level and will increase further in 2004, 2006, and 2009. The federal estate tax is set to be completely repealed in 2010. The gift tax exemption will, however, remain frozen at the 2002 level of $1 million, even after repeal of the estate tax. For the years 2010 and beyond, the federal gift tax is scheduled to be the same as the highest individual income tax rate, currently slated to be 35% in 2010 and beyond. Gift taxes will thus continue to be levied on amounts given to non-charitable recipients that are not otherwise exempt from tax due to annual exclusions, marital deductions or other exemptions that may apply.

Note the chart located at the top of the next column that depicts the differences in the exempt amounts for gift and estate tax purposes in coming years.

This phenomenon may result in even greater amounts of property accumulating over time in the estates of older, wealthy individuals who may be able to leave property tax-free at death, but will have to pay relatively high rates of gift tax on amounts given to others prior to death. This will undoubtedly have an impact on major current and deferred gift development beginning very soon.

Impact on planning

From a practical standpoint, even more attention may now be placed on ways to transfer assets to loved ones during lifetime. There are a number of ways that this can be accomplished using well-proven charitable planning techniques. Charitable lead trusts that delay inheritances, and term of years trusts that are designed to provide an “inheritance” in the form of an income stream over time, are two ways to make gifts to others during life. Another example would be a gift annuity for the benefit of a parent or other older loved one.

In the early stages of the phase-ins provided for under the terms of EGTRRA, there will be opportunities for gift planners to point out the advantages of charitable planning to help maximize tax benefits for donors under the new law. On January 1, 2002, for example, all taxpayers who have previously transferred the entire $675,000 they could give to others under the terms of prior law will have an additional $325,000 available that they can give to others to round out their new $1 million estate and gift tax exemption. There are a number of ways to use charitable gifts to maximize the amount that donors can give others under the new exemption schedule.

For example, Mary G. has been told that in 2002 she will be able to give her grandchildren an additional $325,000 tax free as a result of increased gift tax exemption amounts taking effect on January 1, 2002. While she is pleased with this added benefit, she would like to give even more to family and also make substantial gifts to her charitable interests. She is not sure, however, that she would like her grandchildren to have access right away to any additional amount she might choose to give them. Her advisors suggest that she create a charitable lead trust. The trust will make payments of 8.9% to the charity for 10 years, after which time her grandchildren will receive the assets in the trust free of gift or estate tax. Mary finds that instead of an additional $325,000, she is able to transfer $1 million in this way, more than three times the additional amount she could give outright to her family on a tax-free basis today. In the meantime, she is also able to use the lead trust to guarantee the payment of an $890,000 pledge over a ten-year period.

Other options include a $580,000 charitable gift annuity for an 80-year-old parent or a charitable remainder annuity trust funded with $540,000 that pays 8% per year to a loved one for 10 years. In both of these cases, the reportable gift is $325,000, the same as the additional amount someone can give to another free of tax beginning in 2002. Keep in mind the donor also enjoys a sizeable current income tax deduction in the case of gift annuities and charitable remainder trusts.

Future trends

For persons who are not sure whether their estates will be subject to federal estate tax in future years, the use of charitable lead trusts, remainder trusts, and other planning tools that are contingent to a greater or lesser extent on taxes being applicable to an estate will be increasingly common. Likewise, the use of charitable gift planning techniques to “lock in” the expanded estate and gift tax exemptions while increasing their value and/or increasing income for loved ones will become widespread.

This is the type of planning that cutting edge charitable gift planners can help their donors engage in. Charities that inform their staff and their donors of the exciting possibilities under the new law can expect to see unprecedented numbers of valuable planned gifts in future years!

Editor’s note: The Mary G. example is extracted from the Sharpe booklet, “Charitable Giving After the 2001 Tax Act.” These examples, along with additional information on this subject, are included in session four of the upcoming seminar, “Charitable Giving After the 2001 Tax Act.”