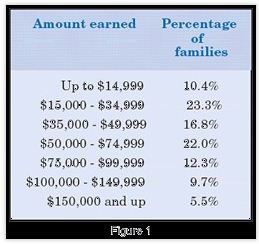

Recently released information and statistics about American citizens may be of special interest to gift planners this fall season. First, a U.S. Census Bureau 2000 Supplementary Survey reports that the average American family earned $63,410 over the previous 12-month period studied. More families earned over $100,000 than those earning less than $15,000. See Figure 1 for a complete look at yearly earnings for American families. Note that in many cases these figures include the earnings of two persons.

According to the latest figures from the Internal Revenue Service, more taxpayers are itemizing their deductions. Perhaps reflecting record levels of home ownership, income tax returns for individuals in 1999 indicate that approximately one in three returns included itemized deductions, such as mortgage interest, taxes, and charitable gifts.

Estimates from the Joint Committee on Taxation reveal that the top 1% of taxpayers pay almost one quarter—23%—of federal income, payroll, and excise taxes. The top 5% and 10% of taxpayers provide an estimated 41% and 53% of tax income respectively.

What this means for gift planners

In spite of economic uncertainty, family income levels remain strong and the number of persons who itemize deductions for income tax purposes has been increasing in recent years. It would be no surprise that up to 50% of many charities’ donors itemize their charitable deductions. This fall is an ideal time to remind donors that charitable gifts made this year may provide welcome savings when their 2001 tax returns are filed. Make sure donors understand that this not only includes current gifts, but also deferred gifts such as gift annuities, charitable remainder trusts, and pooled income funds. With income tax rates projected to fall in future years, such gifts may never save more in taxes than those completed this year.