In response to the pressure many fundraisers are under to acquire new donors, much has been communicated about the need to introduce charitable gift planning concepts—including bequests—to baby boomers and others as young as their 40s.

While donors of all ages should be encouraged to include bequests as part of their long-range estate plans, we must not lose sight of the fact that today’s seniors are more active than ever and that many are making revisions to their plans well into their 70s and 80s and beyond.

Fundraisers would be wise to review the latest information on charitable giving to ensure they are spending budget dollars in the most fruitful ways.

A case in point

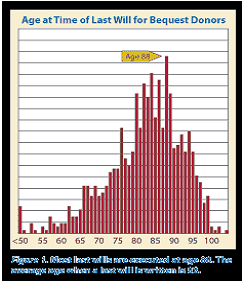

Consultants at the Sharpe Group recently studied more than 1,000 estates received by a large international organization with one of the oldest and most successful planned giving programs in the country. The average age when the will that actually left funds was executed is 82, while 88 is the most common age for such wills to be executed (see Fig. 1).

Later rather than sooner

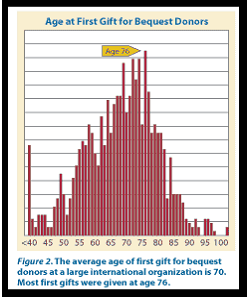

That is not to say that all bequests appear for the first time in the final will. It is undoubtedly true in some cases that the charitable bequest included in the final will was not a new addition to that will but instead had been included in prior versions. This is especially likely in organizations that tend to foster lifelong relationships. For many nonprofits, however, bequest donors don’t even make their first gift of any kind until they are past the age of 70. For example, the average age at first gift for the bequest donors to the organization mentioned earlier is 70 (see Fig. 2).

Studies of other organizations have yielded similar results. Even in the case of colleges and universities, which have a built-in donor pool of alumni, many of those who leave bequests are donors who don’t begin giving at all until their mid- to late 50s and beyond.

This may be due, in part, to the fact that many people do not engage in serious philanthropy, including the consideration of bequests, until their families are grown and their economic fortunes are secure and determined. And the latest economic reports have indicated that elusive moment of economic security is increasingly arriving at an older age.

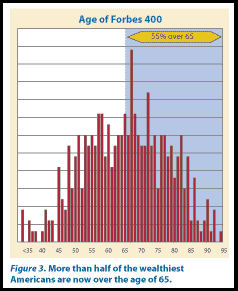

Recently released Forbes 400 figures show that more than half of the wealthiest Americans are now over the age of 65 (see Fig. 3).

In the case of the Forbes list, as well as the broader universe of donors, it can be a real mistake to assume that those in their 70s and older are beyond the age at which they make philanthropic decisions. As noted earlier, nothing could be further from the truth.

If you are in doubt about whether your organization’s donors are making important planning decisions late in life, consider pulling the files on your last 50 estates and checking the donor’s age at first gift, last gift, at the time the will or other plan was executed, and at death. In many cases you will undoubtedly find that these special donors were acquired relatively late in life and that your organization may have been named for the first time in the final will.

Beyond bequests

Studies now show that much of the behavior we seek to influence is taking place between the ages of 70 and 90. According to the American Council on Gift Annuities, for instance, the average age gift annuities are established is 79, about the same age as the average age at which final wills are executed.

If 70 is the new 50, and the average 70-year-old has a life expectancy of 15 years, the most successful programs will recognize the fact that 70-year-olds are actually on the younger end of the planned gift donor spectrum and will prepare to steward relationships with the growing group of 70+ donors that will last for 20 to 25 years or longer.

Excerpted from Session 9 of the popular Sharpe seminar “Gift Planning Fundamentals.” For more information or to register for an upcoming seminar, visit www.sharpenet.com/seminars.