By Barlow Mann

Did you know that, according to the latest figures from the Internal Revenue Service, the average amount of a charitable gift of corporate stock is $63,779? Read on to learn more about the importance of noncash contributions from individuals—especially from older donors—each year.

Stock gifts up 20 percent

The most recent IRS figures available from 2011 reveal that the 22.5 million individual taxpayers who itemized deductions reported a total of nearly $44 billion in noncash charitable contributions. This category includes, among other property, gifts of real estate, securities, artwork and personal property. Some 7.5 million of these taxpayers reported $38.7 billion on IRS Form 8283, which is required for noncash contributions exceeding $500. Contributions of corporate stock traditionally account for the largest share of noncash charitable contributions each year. This was true even during the Great Recession. In 2011, 41 percent of all noncash gifts reported to the IRS were gifts of stock, up about 20 percent from the previous year. Over 112,000 individual returns reported over 250,000 contributions of corporate stock averaging nearly $64,000.

Who makes noncash gifts?

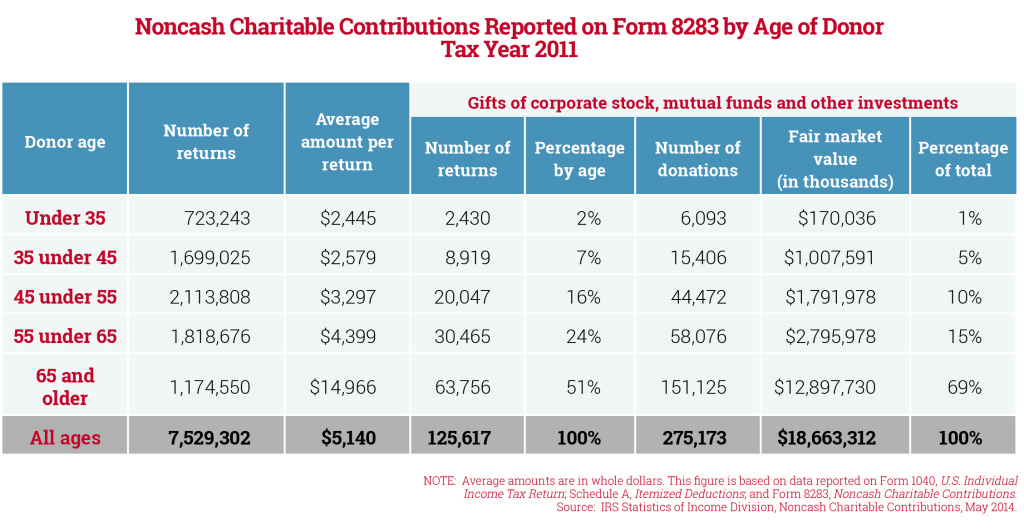

Taxpayers with incomes of $200,000 or more were responsible for almost two-thirds of the dollar value of noncash contributions. Those with incomes between $100,000 and $200,000 were responsible for another 14.3 percent, meaning that just under 80 percent of the value of all noncash contributions came from taxpayers with annual incomes of more than $100,000. Taxpayers in the 65-and-older age category who reported noncash contributions on IRS Form 8283 were the most generous donors of noncash gifts, accounting for some 45 percent of noncash contributions. Of the $18.7 billion of stock, mutual funds and other investments donated in 2011, the 65-and-older category was responsible for $12.9 billion. That’s nearly 70 percent of all gifts of securities! (See chart below.)

Looking ahead

Looking ahead

Since 2011, the broader stock market has continued to recover, and in 2014 many popular stock indexes have reached record levels. In addition, the Federal Reserve recently reported that household wealth in America has reached an all-time high, driven to a large extent by recovery in real estate values and investment markets.With wealth levels increasing, now is the time to make sure your donors, especially those over age 65, are aware they can make tax-advantaged charitable gifts using appreciated securities. By doing so, you may find that many of your donors are able to make more meaningful gifts than they had ever thought possible.

If you are unsure how to motivate your best prospects for these types of gifts in 2014, Sharpe Group can help. Sharpe provides advice and assistance both in helping to identify the right people in your file and in communicating information about the gift planning techniques and strategies that might best suit their needs. Visit www.SHARPEnet.com or call 901.680.5300 for information about accessing Sharpe services.