Did you know that each year gifts of publicly traded securities make up the largest portion of individual non-cash contributions reported to the IRS by itemizing taxpayers? Or that these gifts in some years provide more benefit to charitable entities than bequests?

According to IRS reports, gifts of corporate stocks, mutual funds and other investments accounted for nearly 50 percent of all individual non-cash contributions reported on Form 8283 in 2010. In 2006 and 2007, corporate stock donations totaled more than $23 billion each year, exceeding Giving USA bequest income estimates for those years.

Perhaps most surprising is that many donors and prospective donors fail to understand even the most basic benefits of giving securities rather than cash. A Fidelity Investments study at the height of market values in 2007 reported that 68 percent of those who were capable of making gifts of appreciated securities were unaware of the advantages of giving this way.

Unfortunately, this may be even truer today than it was then. After the Great Recession began and stock market indexes fell, gifts of stock declined dramatically. Between 2007 and 2008, charitable gifts of securities fell 48 percent, followed by another 21.2 percent drop the following year. This decline tracked the precipitous drop in the Dow from just over 14,000 points to under 7,000.

After the Great Recession ended in 2009, the economy began to experience a modest recovery that was also reflected in the stock market. In turn, charitable gifts of stock led the rebound in giving in 2010 as they increased 37 percent while gifts of cash rose less than 4 percent. Although hard data is not yet available, our experience leads us to conclude that this upward trend in giving continued in 2011 and 2012, though Giving USA estimates stock giving has not yet recovered to 2007 levels.

Why give stock?

There are many reasons well-informed donors give stock. They may wish to preserve cash for other purposes, rebalance their portfolios or “share the wealth” in good times. But there are also significant tax benefits available to those who give appreciated stock held longer than a year.

Donors are generally entitled to a tax deduction based on the full fair market value of the stock at the time the gift is made, not just their original cost. Additionally, they do not incur any capital gains tax when stock is given away rather than sold. The higher their regular and capital gains tax rates, the greater the total tax savings:

Who gives stock?

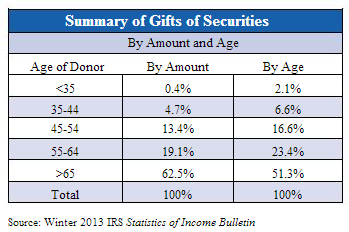

Over 90 percent of the dollar volume of stock gifts comes from persons with incomes over $200,000. Over 90 percent of the gifts also come from persons over the age of 45. Note that the likelihood for gifts of securities increases with both income and age with over half of these gifts coming from taxpayers age 65 and older who are in the highest income ranges.

At a minimum, consider marketing stock gifts to affluent donors age 65 and older. Inform appropriate donors of the benefits of using gifts of securities to fund charitable trusts and gift annuities that provide additional cash flow. It will be especially important to keep these ideas front and center as aging baby boomers rapidly swell the ranks of those over 65.

Recent surges in stock market values alone make now a good time to encourage gifts of stock. When combined with new higher income tax rates, the capital gains rate, the Medicare tax and an aging donor population, gifts of securities may never be more attractive for wealthier donors. Many other donors may also see the appeal of giving in this way.