Has the fuse been lit for the Great Wealth Transfer?

Has the fuse been lit for the Great Wealth Transfer?

Remember all the talk about the looming great transfer of wealth? In the 1990s, it was predicted that at least $41 trillion in personal wealth would be transferred from one generation to another between 1998 and 2052. Now, two decades after that initial prediction, when can we expect the wealth transfer to really take hold?

The answer rests on population statistics. Figure 1 shows the actual number of deaths in America from 1900 through 2017 followed by the latest Census Bureau projections for 2018 to 2050. Together, they provide a glimpse of the likely timeline for the long-predicted and anxiously awaited charitable bequest boom.

Of particular note is the relatively flat period between 2000 and 2010 during which the number of deaths per year remained fairly steady in the 2.4 million range, resulting in little or no real growth in reported charitable bequest income during that time frame. The lowest number of deaths during that decade was in 2007. Since then, the number of annual deaths has begun to gradually increase again.

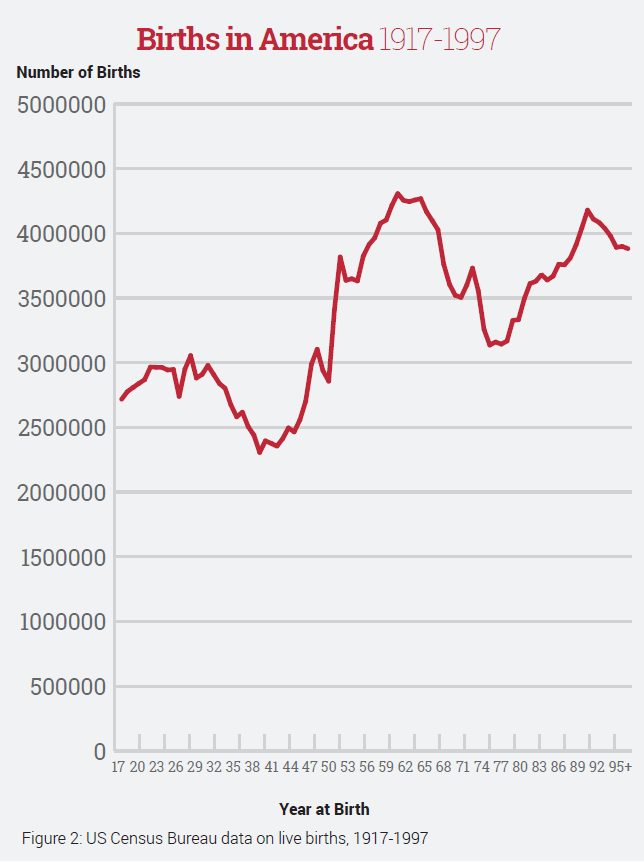

The following chart (Figure 2) shows the number of births in America from 1917 to 1997. As with the death rates shown above, birth rates can be closely tied to historic events. The dip during the 1930s coincides with the Great Depression, while the spike in the mid-1940s and 1950s can be attributed to the Baby Boom after the end of World War II. Those Baby Boomers are the source of the much-anticipated wealth transfer that is just beginning to take shape.

When will Baby Boomers yield “ground-breaking” results?

To understand when to anticipate the transfer and how it will affect the nonprofit world, it’s important to understand who is most likely to make a charitable bequest. SHARPE newkirk and IRS research indicates more than 75% of the estates that include a charitable provision are from decedents who pass away at age 80 or older. Professor Russell James underscored that fact in his article “What’s Wrong With Focusing on Bequest Intentions From 40-Year-Olds?” published in the December 2013 edition of Give & Take. The average age at death has been shown to be early 80s by a number of studies of some of the nation’s largest gift planning programs. This may largely explain the relatively flat bequest income reported by Giving USA in recent years. For example, people who were not born in 1933 did not pass away 84 years later in 2017. The upturn in birth rates after 1933 may, on the other hand, be a precursor of increased estate activity in coming years.

Based on mortality projections, it appears we are just now entering the period during which the leading edge of the Baby Boomer decedents will gradually begin adding charitable gifts to prior estate plans. A small number will pass away and augment the estate gifts of the remaining members of the older, but much smaller, Silent Generation and the few surviving members of the GI Generation. As the Boomers gradually age into their late 70s and 80s, their gifts will begin to supply a greater portion of charitable bequest revenue.

By the mid-2020s, the rapid growth of the 80+ decedent population will begin to accelerate the bequest income boom, and it should grow apace from that point before

reaching its peak in the mid-2040s. Keep in mind, however, that these predictions are for the sheer volume of bequests, not dollars received. It is more difficult to predict the amounts that will actually be received as a number of other factors come into play, including the value of decedents’ estates, the percentage of childlessness and the percentage of estates that include charitable provisions.

Beginning in the late 2040s, fundraisers will experience the results of the late 1990s and early 2000s all over again as the death rate, and therefore the number of bequests, will again begin to fall. The smaller Generation X, following the Baby Boomers, will cause another slowdown in bequest growth similar to the first decade of this century.

Practical implications

For the moment, Baby Boomers are still relatively young and, in many cases, haven’t yet entered their prime for current gifts. The oldest Boomers will turn 73 this year while the vast majority are still in their late 50s and 60s. According to many reports, the heart of the Baby Boom Generation now comprises the greatest number of donor households and collectively gives more than any other generation.

While most Baby Boomers are currently in their prime charitable years for regular and special gifts, it is important to keep in mind from a strategic planning perspective that they are still nearly a decade away—at the soonest—from making operative bequest and other ultimate gift decisions.

In the meantime, nonprofits wanting to increase the amount of funds received from estates over the next 10 to 15 years will have to influence those individuals who will

both make their final wills (the ones that are operative for actual receipt of funds) and pass away over that period of time. This means focusing attention on those who are now roughly in the 75-to 90 age range. This group is almost entirely made up of the 23 million surviving Silent Generation members as only approximately 2% of the GI Generation is alive, and all of them are beyond the age of 90.

The Boomer generation certainly shouldn’t be ignored from a gift planning perspective until they reach the prime age for charitable estate planning. It’s vital to maintain good relationships with these donors both now and later.

While focusing the bulk of attention on those who will fund bequest growth over the coming decade, it is important to make plans to help Baby Boomers eventually transition from current to deferred gifts and plant the seeds that will result in the full flowering of the largest transfer of wealth in history in coming decades. ■