The Giving USA Foundation, which tracks contributions to nonprofit organizations, recently released its estimate for giving in America in 2006. According to its 52nd annual report, Giving USA 2007, total giving in 2006 is estimated at $295.02 billion. This figure represents a 4.2% increase over giving in 2005.

When adjusted for inflation, total giving in 2006 grew 1% over 2005. While gifts from living individuals increased 4.4% and foundation gifts rose 12.6% over 2005 figures, corporate giving saw a 7.6% decline. Bequest giving totaled $22.91 billion, a 2.1% decline over the revised 2005 total of $23.4 billion.

Behind the dip in bequests

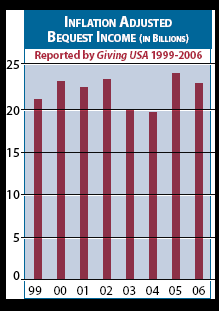

Giving USA attributes the drop in bequest income for 2006 to an unusual increase in 2005 as reported by the IRS and to the fact that, overall, the U.S. is seeing slowing death rates and longer life expectancies that are compelling more people to expend assets for long-term health care and other expenses later in life. In fact, since 1999, bequest revenue received by America’s charities has been relatively flat when adjusted for inflation (See chart at right).

In a widely discussed 1999 report, Boston College professors John J. Havens and Paul G. Schervish predicted a $41 trillion wealth transfer beginning in 1998 and ending 55 years later in 2053. In order to focus their findings, the predictions were divided into two periods. They estimated that charities would receive as much as $2.7 trillion during an initial 20-year period beginning in 1998. The bequest amount estimated for that period was $1.7 trillion.

They used historical patterns and wealth-growth rates that were supported by a long-term historical record. In fact, wealth did not increase as estimated. Other changes in demographics and giving behavior have also meant that the predictions made in 1999 have not been realized.

Between 1998 and 2006, Giving USA reports that a total of $174 billion has actually been bequeathed to charity, which is just one-tenth of the estimated $1.7 trillion predicted by 2018. Therefore, in order to achieve the minimum 20-year wealth transfer projection of $1.7 trillion in bequests to charity by 2017, over $1.5 trillion in charitable bequest income would have to be received over the next 11 years. The annual average would need to be over $140 billion each year, some six times the amount received in 2005, which, at $23.4 billion, was the record year so far for charitable bequests.

It now seems highly unlikely that nonprofits will realize even one-third of the amount of bequests projected for the initial 20-year period.

Good news

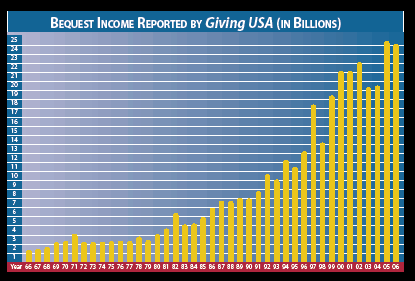

There is, however, some good news regarding bequests to charity. Note the longer-term trend in bequest income as reported by Giving USA for the period 1966 through the present (See chart below). While there has been little inflation-adjusted growth in bequests in recent years, note that bequest receipts more than doubled between 1985 and 1995, and nearly doubled again between 1995 and 2005.

The surprising news

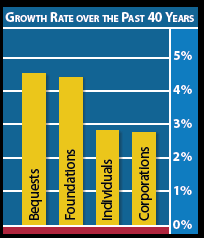

According to Giving USA, income from bequests has actually been the fastest growing source of gift income over the past 40 years. Adjusted for inflation, bequests have grown by an average of 4.5% each year since 1966. By comparison, gifts from living individuals grew at a rate of just 2.8% per year over the same time period, while gifts from corporations and foundations grew at 2.7% and 4.4% respectively.

There is currently no reason to believe that the minimum Schervish and Havens wealth transfer numbers for bequest revenue between now and 2017 will be achieved. That would require a compounded growth rate of 47% per year over the next 11 years—some 10 times the historical growth rate. It appears, however, that various demographic and economic trends should result in at least a doubling of bequest income over that time period, perhaps continuing the 40-year trend of bequests being the fastest growing source of philanthropic support.

New expectations

When it comes to setting your organization’s expectations in regard to future bequest income, we feel the latest data as well as the 20-year and 40-year bequest statistics bode well for future growth. This should be viewed as a “the glass is half full” opportunity.

With the smaller “Silent Generation” (those born between 1925 and 1942) now moving into the age range where final estate plans are most often made, bequest income during the remainder of the first phase of the wealth transfer will depend on how well nonprofits are able to make their cases for support through estates of this age cohort, a group that is smaller than the G.I. Generation that preceded them and the Baby Boomers who will follow them as bequest donors.

Now is the time to return to the basics of planned gift marketing. Since other data reveals that less than half of adults have a valid will or other estate plans in place, now is the time to encourage constituents in the relevant age range to make the final estate plans that will be the operative ones where their charitable dispositions are concerned. For those who have already made their plans, communications should focus to a large extent on the need to review those plans and keep them up to date in light of changing life events.

Development professionals may want to pay particular attention to existing bequest expectancies as well as those who have in the past indicated they would consider including a charitable organization in their estate plans. When donor relationships are effectively stewarded and properly maintained, such donors may fund other planned gifts as well as make increased current gifts over the remainder of their lifetime.

Editor’s note: Robert Sharpe serves on the board of the Giving USA Foundation and is a member of Giving USA’s Advisory Council on Methodology.